AZO and ORLY: Both auto parts retailers are uncorrelated to S&P 500, but which one is a better buy?

By Price Earnings Ratio Tracker Team

Q4 2019 hedge fund letters, conferences and more

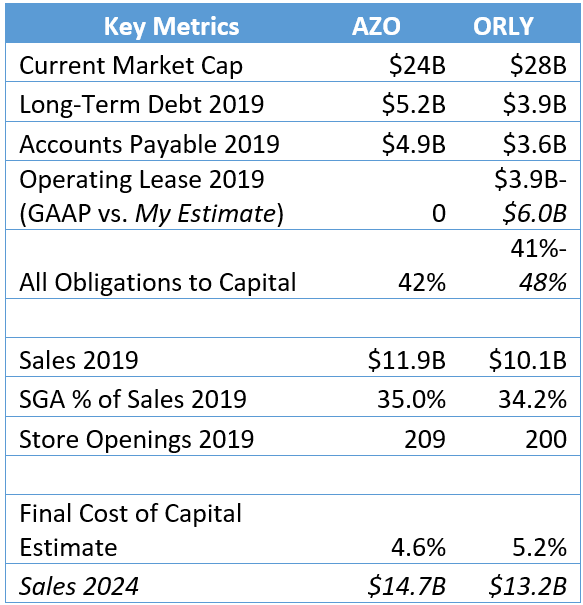

Over recent months I have created valuation models for the two main competitors in the auto parts retail business – AutoZone, the leader on the coasts with a $26 billion market capitalization at time of writing, and the somewhat smaller in terms of sales, more Midwest oriented O’Reilly with a $28 billion market cap. My model was inspired by Aswath Damodaran’s corporate finance course. So if you had to choose the equity of just one of these companies to invest in, which would you buy?