Tyler here with this week’s Macro Musings.

The May Macro Intelligence Report (MIR) is coming out near the closing bell today. In it we’ll have our latest thoughts on the US dollar, China’s macro deleveraging, and how all this relates to stock markets around the world. If you want to stay plugged into the macro narrative and keep tabs on the trades we’re taking to capitalize on it, get yourself a copy. We have a 60-day money-back guarantee, so there’s literally no risk for you to check out how we’re positioning for the summer months. Click here and scroll to the bottom of the page to sign up for the MIR.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital

A Developing Soros Style Boom-Bust – Alex explains reflexivity and how the market is always wrong. These are the exact principles George Soros used to extract billions from the global markets.

Ed Seykota’s “Fundamentals” And A Massive Pain Trade – Alex dissects the budding dollar bull trend in the context of reflexivity and market positioning.

Shorting Gold — AK covers our short gold thesis.

Black Swans — AK explains Nassim Taleb’s black swan theory and how to protect your portfolio against these events.

Article I’m reading —

Bloomberg has been killing it with some newly released content. (Probably as a function of moving to a paid subscription model instead of an ad supported one.)

Here’s my favorite one of the week.

The Gambler Who Cracked The Horse Racing Code – A mini bio on race track sharp Bill Benter. Benter got his start in Vegas counting cards based on Ed Thorp’s system in Beat the Dealer. He then transitioned into betting on horse racing at the Hong Kong Jockey Club. Benter created a quantitative system that could accurately predict what horses were going to win. He created this decades before quant analysis became commonplace in professional racetrack wagering.

Long story short, he pulled a billion dollars out of the track over the course of his career. This article details the entire crazy story from start to finish. And it’s stuff that Benter has never before released to the public. If you liked Ed Thorp’s come up story from Vegas to Wall Street you’ll love this one too.

Podcast I’m listening to —

If Aaron Brown goes on a show then I’m listening. His latest appearance is on the Better System Trader podcast. (link here)

Aaron’s a veteran quant who actually knows Bill Benter from the article above. He’s a poker player, trader, and the ex-risk manager for AQR — a multibillion dollar hedge fund.

On the podcast Aaron talks about the biggest misconception regarding risk and how traders should approach drawdown management. He also makes a great point on how low volatility environments can be riskier than high volatility environments.

Aaron is the authority on risk management. So if you need help cutting losses, then give this episode a listen.

Video I’m watching —

Alex told me the other day that he was enrolling in an online course on Algorithmic Information Dynamics from the Santa Fe Institute. It’s only $50 and you can take it from the comfort of your home. What piqued my interest was the course trailer. You can check that out by clicking here. And here’s a link to the course sign up page.

The instructors are out to teach us how to tackle causality in non-linear systems from a model-driven approach that does not use traditional statistics and classical probability theory.

The class may help with understanding and modeling complex systems, like economic ones. Give the intro video a quick watch and if you have some down time this summer consider enrolling alongside Alex.

Chart I’m looking at —

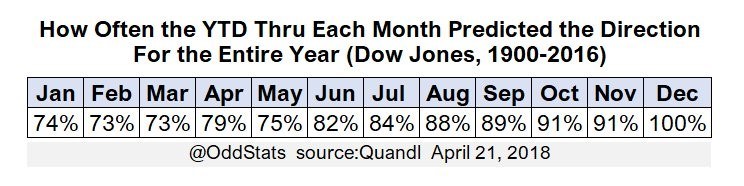

I found this table on @OddStats Twitter this week. It shows positive performance begets positive performance and negative performance begets negative performance in stocks. Obviously each year has many other nuances and subtleties that affect eventual performance. But we can at least use this to start tempering expectations for returns in 2018.

Quote I’m pondering —

When I saw that screen light up that day in the Merrill Lynch offices, I lost any residual doubt that Bloomberg could make it. We had picked just the right project. It was big enough to be useful, small enough to be possible. Start with a small piece, fulfill one goal at a time, on time. Do it with all things in life. Sit down and learn to read one-syllable words. If you try to read Chaucer in elementary school, you’ll never accomplish anything. You can’t jump to the end game right away, in computers, politics, love, or any other aspect of life. ~ Mike Bloomberg

Whenever I’m struggling or frustrated with something I try to chop it up into smaller pieces. Like Bloomberg, I’ve found that breaking up macro goals into micro goals helps to keep things moving forward. And as an added benefit I get a significant mood improvement from having a sense of accomplishment.

If your defined task is overwhelming it’s easy to feel beaten down and burned out because you haven’t been able to cross something off the mental checklist. Completing smaller subtasks helps you stay motivated and moving forward.

That’s it for this week’s Macro Musings.

If you’re not already, be sure to follow us on Twitter: @MacroOps and on Stocktwits: @MacroOps. Alex posts his mindless drivel there daily.

Here’s a link to our latest global macro research. And here’s another to our updated macro trading strategy and education.

Article by Alex, Macro Ops