At the 2025 Value Investing Seminar, Florian Weidinger, CEO and Chief Investment Officer of SLAM, a pan-Asian investment manager overseeing over $1 billion in assets, provided a detailed perspective on investing in Asian markets, with a particular focus on opportunities within China. SLAM is characterized by its "unapologetic value investing" approach, conducting hundreds of meetings annually with Asian corporates, and actively pursuing value creation through engagement with management.

Weidinger brings over two decades of experience in financial services, including founding Hansabay (a Singapore-based investment management business focused on emerging and frontier economies, which later merged into SLAM) and serving as a vice president at Lehman Brothers. His experience spans public and private investments across Europe, Africa, and Asia, encompassing a wide range of strategies from event-driven to distressed investing.

2025 Sohn Hong Kong Conference [100 Page PDF Report]

2025 Value Investing Seminar - SLAM's Florian Weidinger

Weidinger began by discussing common investment pitfalls, specifically highlighting the "time sink" error. This mistake involves not just capital loss but also significant research time spent on positions that fail to deliver returns. He emphasized the importance of knowing when to cease pouring valuable research time into underperforming investments, as research time must ultimately generate a return.

Also our coverage of the 2025 Ben Graham Conference, 2025 Morningstar Investment Conference and the Best Alternative Investment Fund Conferences for 2025.

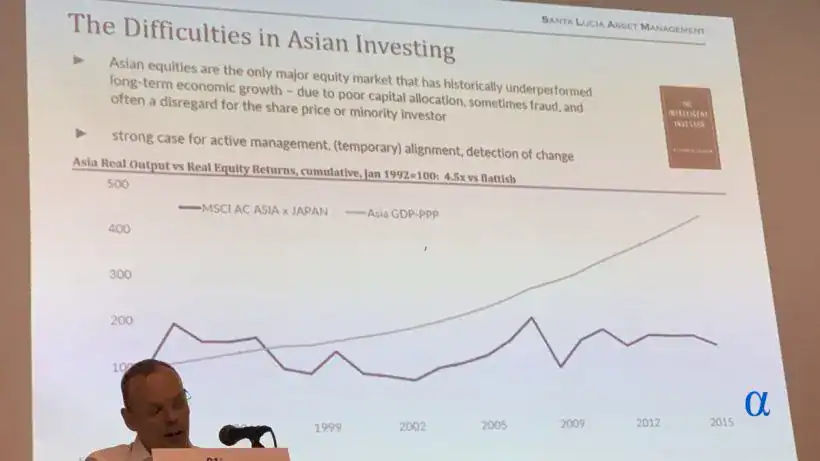

He then addressed the inherent paradox of investing in Asia. In theory, Asia should be a fertile ground for investment returns due to its young, growing population and its centrality to global demographics. However, the reality of investing in Asian ETFs reveals a "roughly flat experience in real terms". Weidinger identifies the core issue as a fundamental "question of alignment". He asserts that many Asian companies fail to maximize value for minority shareholders. To counteract this, SLAM actively seeks companies where the interests of minority shareholders are aligned with those of the majority owners.

SLAM's investment strategy focuses on three key criteria: value, dividends, and the opportunity for productive dialogue with management regarding value sharing and alignment. Dividends are seen as a particularly strong indicator of alignment because the annual board decision on dividend payout forces a clear choice on how value is distributed, making it a "marker of potential alignment". This also provides financial discipline and allows investors to be "paid to wait" for value to materialize. The strategy is to invest in cheap situations, where dividend yields provide ongoing returns, and where the dividend itself signals good alignment with controlling shareholders.

Weidinger briefly touched upon an investment idea from the previous year's seminar, JB Financial Group Co Ltd (KRX:175330), a Korean opportunity. He stated that it remains a "good live opportunity," noting that the "Korean Value Up Program" has gained momentum, with some stocks beginning to reflect this positive development.