At the 2024 Value Investing Seminar, Thomas Gelati of Studio Over provided a thorough analysis of a leading land development and home construction company. Gelati's detailed breakdown of Lennar highlighted its financial performance, strategic initiatives, and overall investment potential, making a compelling case for its consideration by value investors.

![Thomas Gelati Of Studio Over Likes This Construction Stock [Value Investing Seminar] 1 Thomas Gelati - Buying the Whole Company](https://hedgefundalpha.com/wp-content/uploads/2024/07/Thomas-Gelati-Buying-the-Whole-Company.jpg)

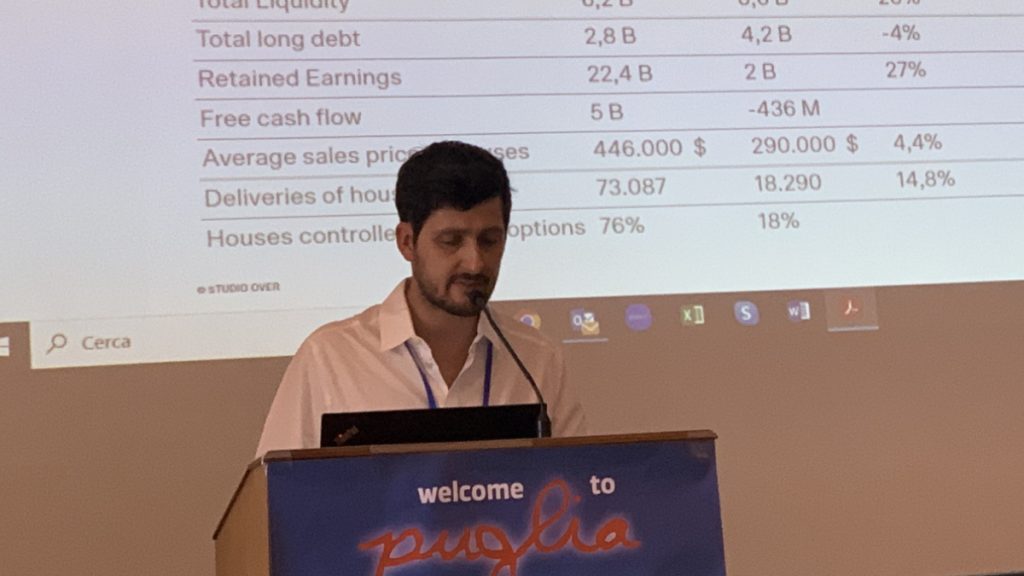

Financial Performance Over the Last Decade

Gelati began by examining the company's impressive financial growth over the past ten years. He noted that Lennar Corp (NYSE:LEN)'s earnings before taxes (EBT) had grown by an average of 24% annually. This robust growth was accompanied by significant improvements in the company's liquidity, which increased from $1 billion to $6 billion between 2018 and 2023. Additionally, Lennar successfully reduced its debt from $8.5 billion to a much more manageable level.