*This analysis was produced by S&P Global Market Intelligence, not S&P Global Ratings, which is a separately managed division of S&P Global.

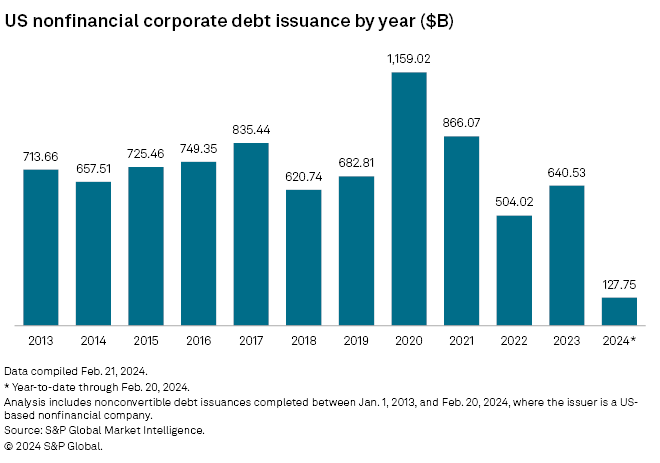

US corporate bond issuance got off to a sluggish start in 2024, a possible sign that higher-for-longer interest rates are denting companies' willingness to take on new debt.

Nonfinancial companies issued $127.75 billion in new debt from Jan. 1 to Feb. 20, a roughly 16% fall from the same period in 2023, according to the latest S&P Global Market Intelligence data.

Key highlights from the analysis include:

- The year-to-date total is nearly double the comparable amount in 2022, though issuance fell off a cliff that year following a two-year dash for cash during a period of lower borrowing costs in 2020–21.

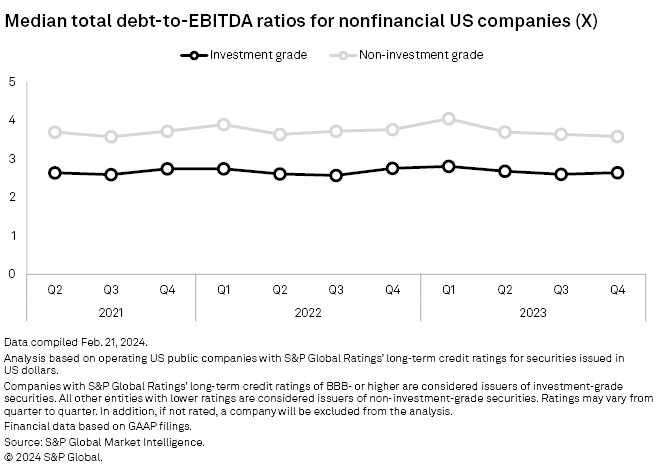

- The median debt-to-EBITDA ratio for companies rated investment-grade by S&P Global Ratings grew slightly to 2.64 in the 2023 fourth quarter from a revised 2.60 a quarter earlier, according to S&P Global Market Intelligence.

- Non-investment-grade companies recorded a decline in their median debt-to-EBITDA ratio, at 3.58 from 3.64.

- Eight of 10 investment-grade sectors tracked by S&P Global Ratings recorded an uptick in their median debt-to-EBITDA ratio.

- For non-investment-grade sectors, median debt-to-EBITDA rose in the consumer discretionary, healthcare and industrials sectors while falling in all others.

Read the full article here by S&P Global Market Intelligence