As part of Merk's in-house research we regularly evaluate a consistent set of charts covering the economy, equities, fixed income, commodities and currencies. The aim is to keep our eyes open and to look through the noise of the headlines, avoiding the distractions of sensationalized click-bait. In sharing this content, we offer a cross-check to your own thinking and aim to add value to your own process.

[timeless]

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

We invite you to download a copy of the slide deck (PDF); or to view the video:

U.S. Business Cycle Chart Book

Why is the Business Cycle Important?

S&P 500 (log scale) and official National Bureau of Economic Research (NBER) U.S. Recessions

Analysis: Over the 90 years between 1927 and 2017, the average S&P 500 monthly return during expansions was +0.89% (889 months), compared to an average S&P 500 monthly return during recessions of -0.71% (191 months). The business cycle also has important implications for Fed policy. *Note that recessions are not announced by the NBER until well after their start dates*

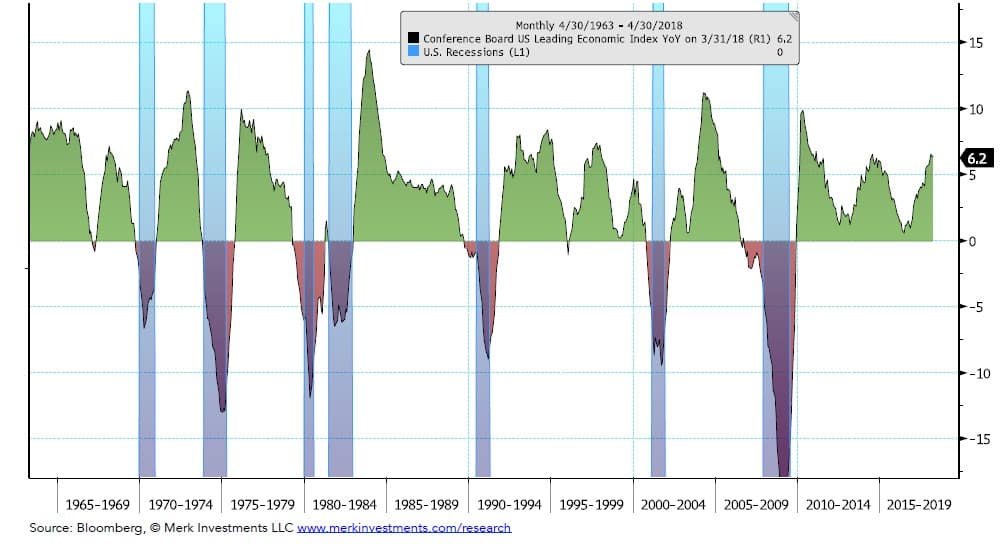

Leading Economic Indicators (LEIs) Index

YoY rate of change of the Conference Board’s LEI Index

Analysis: LEIs have decelerated slightly from +6.5 to +6.2

History suggests recession unlikely in the next six months,

I’d get incrementally negative on the business cycle outlook if the LEIs went negative

U.S. Yield Curve Steepness

(10yr yield – 3yr yield)

Analysis: Yield curve still positively sloped

I’d get incrementally negative on the business cycle outlook if the yield curve inverted (i.e., 3yr yield > 10yr yield)

U.S. PMIs

Manufacturing and Non-manufacturing (aka Services) PMIs (Purchasing Managers Index)

Analysis: Both manufacturing and services PMIs have softened a bit but are still well above 50

I’d get incrementally negative on the business cycle outlook if manufacturing PMIs fell below 50

Global PMIs

Largest global economies’ Manufacturing PMIs (Purchasing Managers Index)

Analysis: All above 50 but momentum has slowed over the past few months

I’d get incrementally negative on the business cycle outlook if China, India, Germany or Japan manufacturing PMIs fell below 50

U.S. Unemployment Momentum

U-3 Rate and U-3 12 month Moving Average

Analysis: Unemployment rate continues to trend down and stay below its 12-month moving average (with labor force participation stable to rising – not shown)

I’d get incrementally negative on the business cycle outlook if the unemployment rate moved above its 12m MA while the labor force participation rate trended lower

SF Fed Leading Unemployment Rate (U-3) Model

Replica of San Francisco Fed Model (grey) and U-3 Unemployment Rate (black)

Analysis: The SF Fed model does not currently suggest cause for concern on the unemployment rate

I’d get incrementally negative on the business cycle outlook if the SF Fed model line trends higher on a YoY basis

Se the full PDF below.

The investing audience should view this content in the context of their individual investment process, time-horizon, and goals.

Article by Axel Merk, Merk Investments

Merk Investments® LLC is an investment advisor registered with the Securities and Exchange Commission ("SEC"). This does not mean that we are sponsored, recommended, or approved by the SEC; or that our abilities or qualifications in any respect have been passed upon by the Commission or any officer of the Commission.