Spruce Point Capital Management is short shares of Super Group Ltd (NYSE:SGHC).

After conducting a forensic review of Super Group (SGHC) Ltd (NYSE: SGHC) ("SGHC“, “Super Group” or the "Company"), an online sports betting and gaming company and 2022 vintage SPAC transaction domiciled in Guernsey, we identified what we believe are serious issues with the integrity of its financial reporting and transactions with a closely connected shareholder. Our work points to a material omission of a minority ownership interest in its crown‑jewel South African subsidiary, Raging River Trading (Pty) Ltd (“Raging River”). SGHC states that it owns 100% of the subsidiary but our documentary evidence contradicts this claim.

Here Are The Key Points Why We Believe Super Group’s EBITDA Is Materially Overstated:

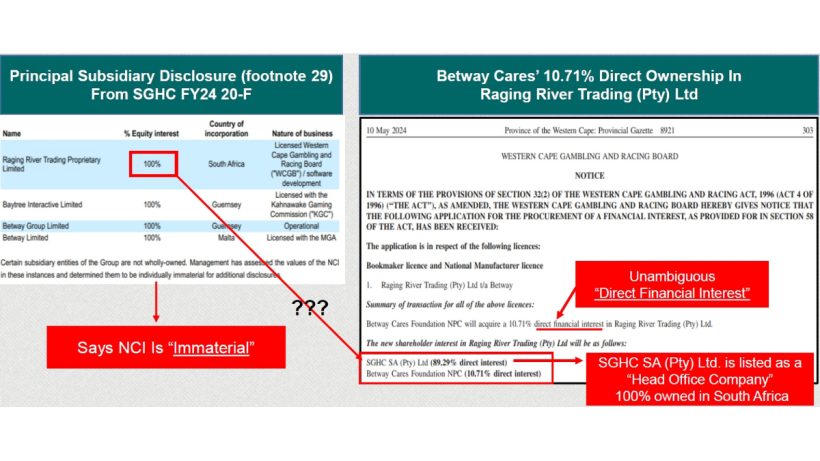

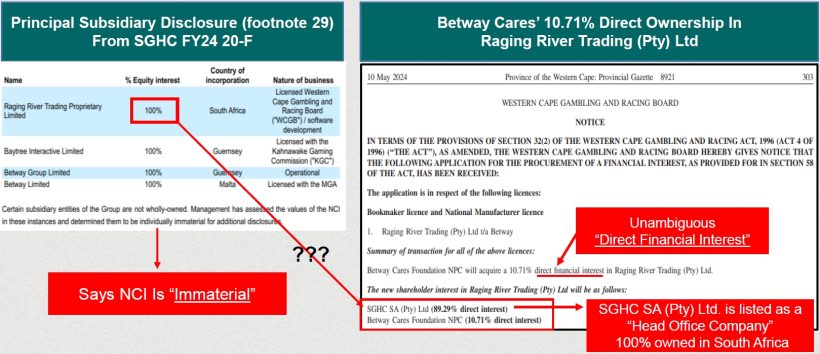

- SGHC designates Raging River as a "principal subsidiary“ and its 20-F filed in 2025 claims it owns 100% as of year end 2024.

- Why is it material? We believe the subsidiary’s 2025E EBITDA is approximately $287 million or ~52% of SGHC’s total 2025E EBITDA. SGHC’s financials show that Raging River has produced a very attractive 36.5% EBITDA margin. SGHC’s financial reporting, as currently presented, captures 100% of the subsidiary’s extremely strong economics.

- A public notice from May 2024 at South Africa’s Western Cape Gambling and Racing Board discloses that Betway Cares Foundation NPC will acquire a 10.71% direct financial interest in Raging River, reducing SGHC's ownership to 89.29%. However, no formal notification that the transaction actually closed has been fully advertised.

- Spruce Point obtained a copy of a public record request in November 2024 of a B-BBEE verification certificate issued by SANAS-accredited agency EmpowerLogic which confirms that Raging River has 10.71% Black ownership, with a measurement period ending December 31, 2023, potentially proving this ownership structure existed more than a year before SGHC's December 31, 2024, fiscal year-end.

If SGHC is improperly consolidating 100% of Raging River’s financial results rather than 89.29%, we estimate it may be overstating 2025E EBITDA by approximately $30.7 million which represents the 10.71% non-controlling (minority) interest. This would represent a material misstatement that strikes at the heart of SGHC's reported profitability and raises fundamental questions why the Company recently changed auditors and whether past material weaknesses of internal controls have been remediated as claimed. In addition to disruption from prediction markets, we believe investors should also be concerned by its complex corporate structure, transactions with its largest connected shareholder, and exposure to rising regulatory and tax costs. If we adjust SGHC’s EBITDA for the minority interest and value the Company at 4.0x –6.0x EBITDA, consistent with its valuation range in 2024 when it started missing financial projections, we estimate approximately 20% – 50% downside risk to $4.25 – $6.80 per share and expect the share price to significantly underperform the equity market and the gaming industry.

Read the full report here by Spruce Point Capital Management