From McIntyre Partnerships see their Q1 letter here

Hello. The fund recently initiated a position in SMTA. Our thesis is highlighted below.

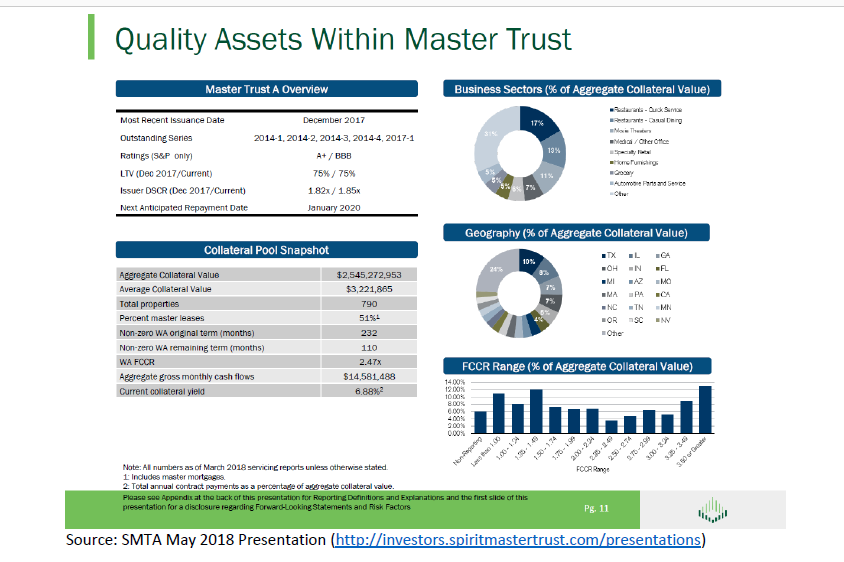

Spirit MTA REIT (SMTA) is a classic “bad bank” recently spun from Spirit Realty. The market views SMTA as an overlevered, “too difficult” stock, but when properly analyzed, we believe SMTA is a simple story: a portfolio of real estate assets, with minimal recourse leverage, that is likely to be liquidated and the cash returned to shareholders in the next three years at price near $30/share, a 200% return. We believe the recent spin dynamics, combined with a lack of investor familiarity with the ABS structure of SMTA’s largest asset, create a favorable entry point. Further, compensation...