April 15, 2024

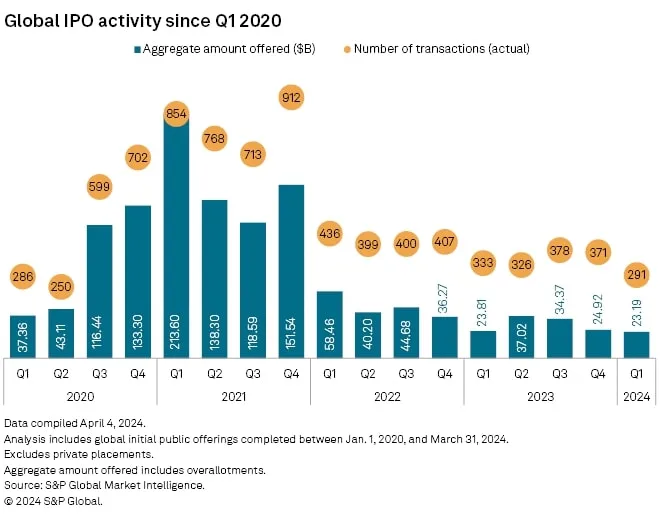

Initial public offering activity slowed in the first quarter of 2024 to the lowest level since the second quarter of 2020.

There were just 291 IPOs launched globally in the first quarter of 2024, down from 371 IPOs launched in the fourth quarter of 2023 and a nearly 70% drop from the fourth quarter of 2021 when 912 IPOs were launched worldwide, according to the latest S&P Global Market Intelligence data and analysis.

Key highlights from the analysis include:

- First-quarter IPOs offered $23.19 billion, down from $24.92 billion in the fourth quarter of 2023 and the lowest amount since the first quarter of 2019, when about $19 billion was offered .

- US companies launched 25 IPOs in the first quarter, up from 23 launched in the same quarter in 2023 but well below the 357 launched in the first quarter of 2021.

- The cumulative worth of the securities sold through IPOs was $5.67 billion in the first quarter of 2024, up from $2.51 billion in the first quarter of 2023 and far below the $132.29 billion in the first quarter of 2021.

- Reddit Inc. was the largest US IPO offered in the first quarter of 2024, with $860.2 million offered in March, followed by Astera Labs Inc., with $819.7 million offered in March, and American Healthcare REIT Inc., with $772.8 million offered in February.

- European IPO activity also continued to slow in the first quarter of 2024, with 29 IPOs offered throughout the quarter, the lowest level since the first quarter of 2023 when just 27 were offered. European activity peaked in the fourth quarter of 2021, when 204 IPOs were offered.

A link to the full analysis can be found here: IPO activity slowdown stretches through Q1 2024 | S&P Global Market Intelligence (spglobal.com)

Thank you in advance for citing S&P Global Market Intelligence, should you choose to use any of this information in your reporting.

Kate Smith

Public Relations Director

S&P Global Market Intelligence