The Securities and Exchange Commission has proposed raising the reporting threshold for 13F filings from $100 million to $3.5 billion. If that proposal becomes reality, it would mean a significant reduction in the number of companies that are required to file 13Fs. It would also increase the importance of sites like ValueWalk that report on what companies are doing.

Q2 2020 hedge fund letters, conferences and more

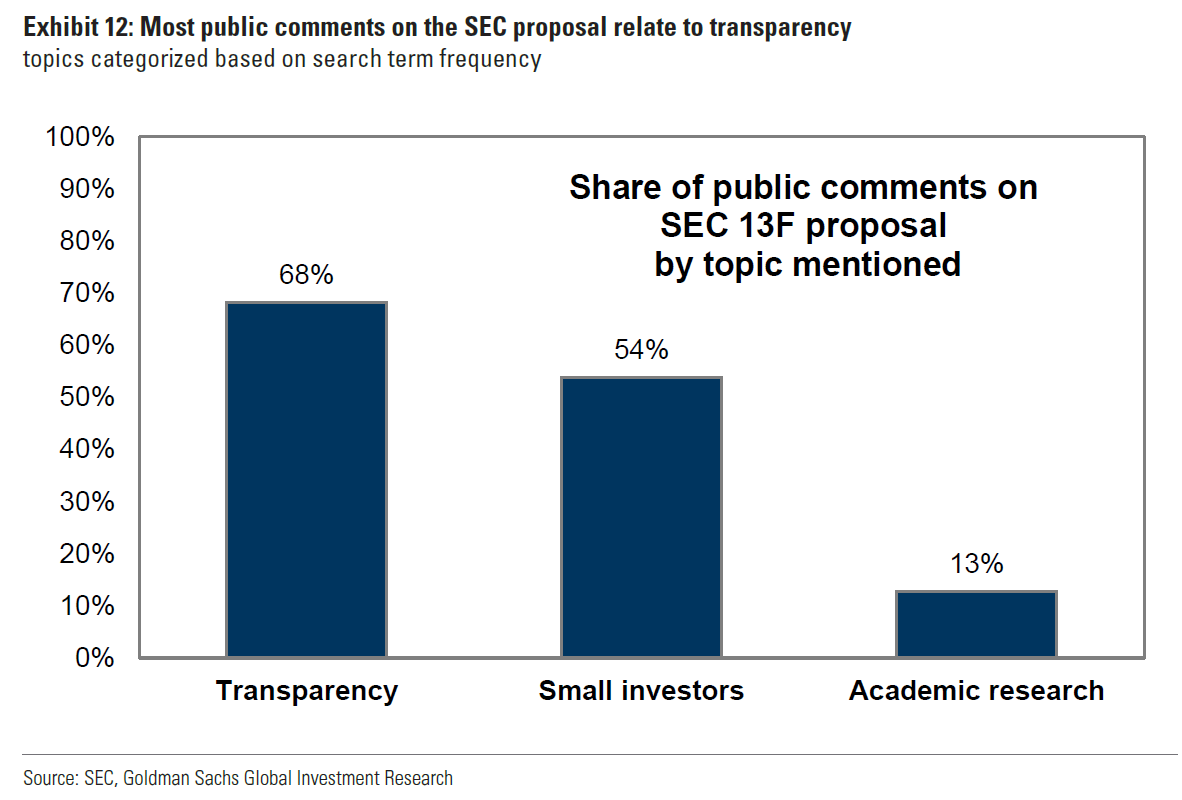

New SEC proposal about 13F filings

In their latest "Hedge Fund Trend Monitor," Goldman Sachs said investment firms with over $100 million in equity assets under management have been...

This content is exclusively for paying members of Hedge Fund Alpha

Insider Strategies and Letters to Shareholders from the Top Hedge Funds and Maximize Your Portfolio Growth with Hedge Fund Alpha

Don’t have an account?

Subscribe now and get 7 days free!

This article is only available for Premium Members

Subscribe today and get :

Insider Strategies and Letters to Shareholders from the Top Hedge Funds

Exclusive Access to coverage of Private, Closed-Door Investor Conferences

Hedge Fund Manager Research Currently Producing 21% – 40% Returns Annually

Don’t have an account?

Subscribe now and get 7 days free!