An obscure investment product used to finance risky real estate projects is facing unprecedented stress as borrowers struggle to repay loans tied to commercial property ventures.

Known as commercial real estate collateralized loan obligations, or CRE CLOs, they bundle debt that would usually be seen as too speculative for conventional mortgage-backed securities into bonds of varying risk and return.

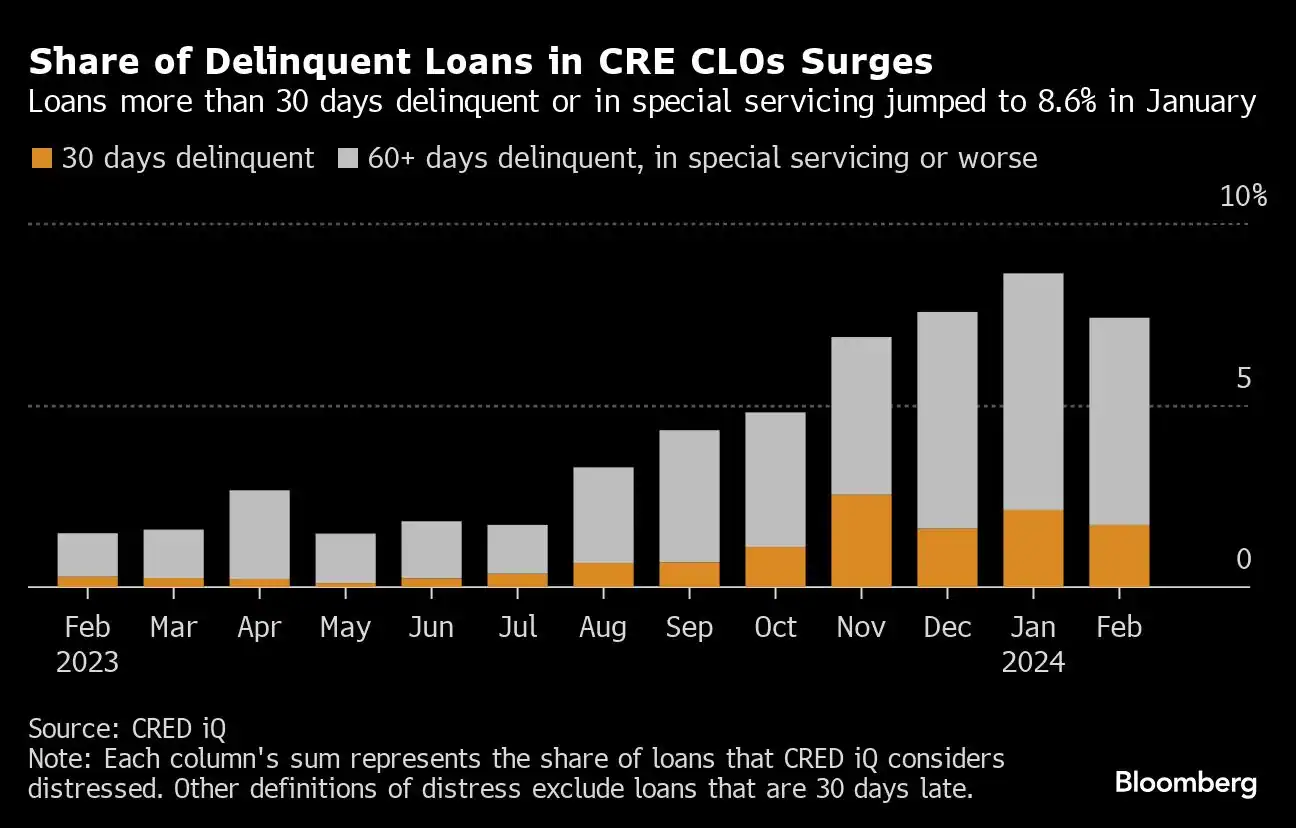

In just the last seven months the share of troubled assets held by these niche products has surged four-fold, by one measure, to more than 7.4%. For the hardest hit, delinquency rates are in the double digits. That’s left major players in the $80 billion market rushing to rework loans, while short sellers are ramping up attacks on publicly-traded issuers they say may be so beset by missed payments that they have little to no equity value.

The pain is part of a broader shakeout in the $20 trillion US commercial real estate market, which nearly brought down New York Community Bancorp and has elicited warnings from Treasury Secretary Janet Yellen and Federal Reserve Chair Jerome Powell. Yet industry observers say few products are more exposed than CRE CLOs.

That’s because they’re primarily stuffed full of short-term, floating-rate loans for properties undergoing renovations or expansions, the type of risky debt that banks or CMBS often don’t want to hold. With rising interest rates eroding resale prices for refurbished multifamily dwellings and demand for office space still tepid, many borrowers are starting to struggle to meet their obligations. That’s left a number of CRE CLO issuers — which finance the riskiest part of the structures themselves and sell off the safer pieces — already absorbing losses.

Some say the pain could eventually spread to those invested in less risky portions, too.

“The CRE CLO market is the first shoe to drop in terms of defaults in the CRE debt markets,” said Mark Neely, director of alternative investments at GenTrust, a money manager. “The loans inside CRE CLOs tend to be for transitional properties, so the borrowers are counting on reselling them before the loan matures. But today many borrowers can’t sell properties for anywhere near where they bought them.”

To be sure, the highest rated debt issued by CRE CLOs benefit from ample protection built into the structure of the securities, and analysts across the board expect those bonds to be just fine. At the bottom of the capital stack, however, it’s a different story.

Issuers have been buying time by extending maturities, letting developers pay interest with additional debt, and making other changes to loans to encourage borrowers to keep current.

Modifications often take the form of two- to three-year extensions, in exchange for which borrowers typically are required to inject more capital.

Increasingly, CRE CLO issuers are also buying out delinquent loans via cash reserves, allowing them to avoid tripping asset-coverage tests which causes cash-flow streams to certain investors to get turned off — a mechanism designed to protect those who purchase less risky portions of the structures.

Firms bought back a record $1.3 billion of delinquent loans last year, according to JPMorgan Chase & Co. estimates.

“Increased stress in this market has forced managers to take unprecedented steps to protect the integrity of their CRE CLO structures,” strategists led by Chong Sin wrote in a report last month.

Market watchers say that may partly explain why the share of loans in CRE CLOs with payments more than 30 days overdue fell to 7.4% last month, based on data from analytics firm CRED iQ, after peaking at more than 8.5% in January. Another measure of CRE CLO loan stress from Citigroup Inc. that uses different criteria touched 4.8% in January, the highest in data going back to 2014.

“Incentives in these structures are substantially aligned with bondholders, and there’s a strong motivation for sponsors to buy troubled loans out of the trusts,” said Liza Crawford, co-head of global securitized at TCW Group Inc. Still, she added, “I don’t think everyone is going to have enough money or financing to do that. It’s a ticking clock.”

The origins of CRE CLOs date back to before the financial crisis, when commercial real estate collateralized debt obligations, or CRE CDOs, were a routine financing tool. Demand all but disappeared in 2008 as real estate prices plunged and the downfall of Bear Stearns and Lehman Brothers Holdings Inc. prompted money managers to shun riskier structured credit products.

Read the full article here by Scott Carpenter of Bloomberg News, Advisor Perspectives