Flexible capital providers who are looking past Europe might be overlooking some massive opportunities. The Davidson Kempner team wrote a white paper on opportunities in Europe because they were excited about the deals and opportunities they were seeing there. Meanwhile, pessimism about Europe remains high and priced into the markets via valuation discounts.

In an interview with Hedge Fund Alpha, Suzanne Gibbons, partner and head of research at Davidson Kempner, shared details on what opportunities they're seeing as a flexible capital provider.

The tipping point

Gibbons believes Europe is at a major tipping point right now. She explained that the market has hit peak pessimism on Europe. She noted that while we have hit the 100th percentile of Europe's discount to the U.S. on a sector-neutral basis after accounting for the technology concentration in the U.S., that discount going back to 1990 currently stands at the 95th percentile following a slight rally in Europe.

"There was a lot of pessimism going into the year in terms of comments at Davos, and it was interesting because our teams were actually finding a lot of really interesting opportunities," Gibbons said. "So that's what sparked our decision at Davidson Kempner to write a paper on why we were finding Europe attractive."

Underperformance in Europe

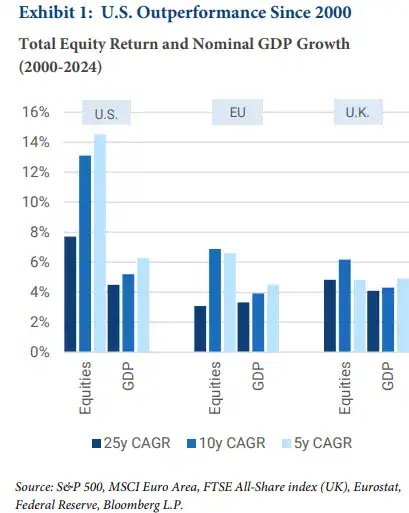

In her presentation at the 2025 Sohn Montreal Conference, Gibbons noted underperformance in Europe in terms of its market and GDP performance versus the U.S. going back to 2000.

Gibbons added that this underperformance has become even more pronounced over the last five years from an equity market return perspective, but at the same time, they were seeing plenty of alpha in Europe.

"One interesting data point was seeing that private equity returns in Europe versus the U.S. have been slightly better over that 25-year period, even as equity with public equity returns were so much lower, and even as GDP was lower. So that struck us as interesting and actually explained why we ourselves were finding a lot of alpha in both public and private markets in Europe," Gibbons told Hedge Fund Alpha.

Upon digging deeper into Europe to determine why the underperformance was happening and why they were uncovering lots of alpha in both the public and private markets there, the Davidson Kempner team concluded that it was because of a lack of institutional capital.

"And on top of that, you also have this marginal bank retrenchment in Europe with the tighter regulations versus the U.S.," Gibbons added. "And so we think that that has led to an interesting opportunity set with less competition."