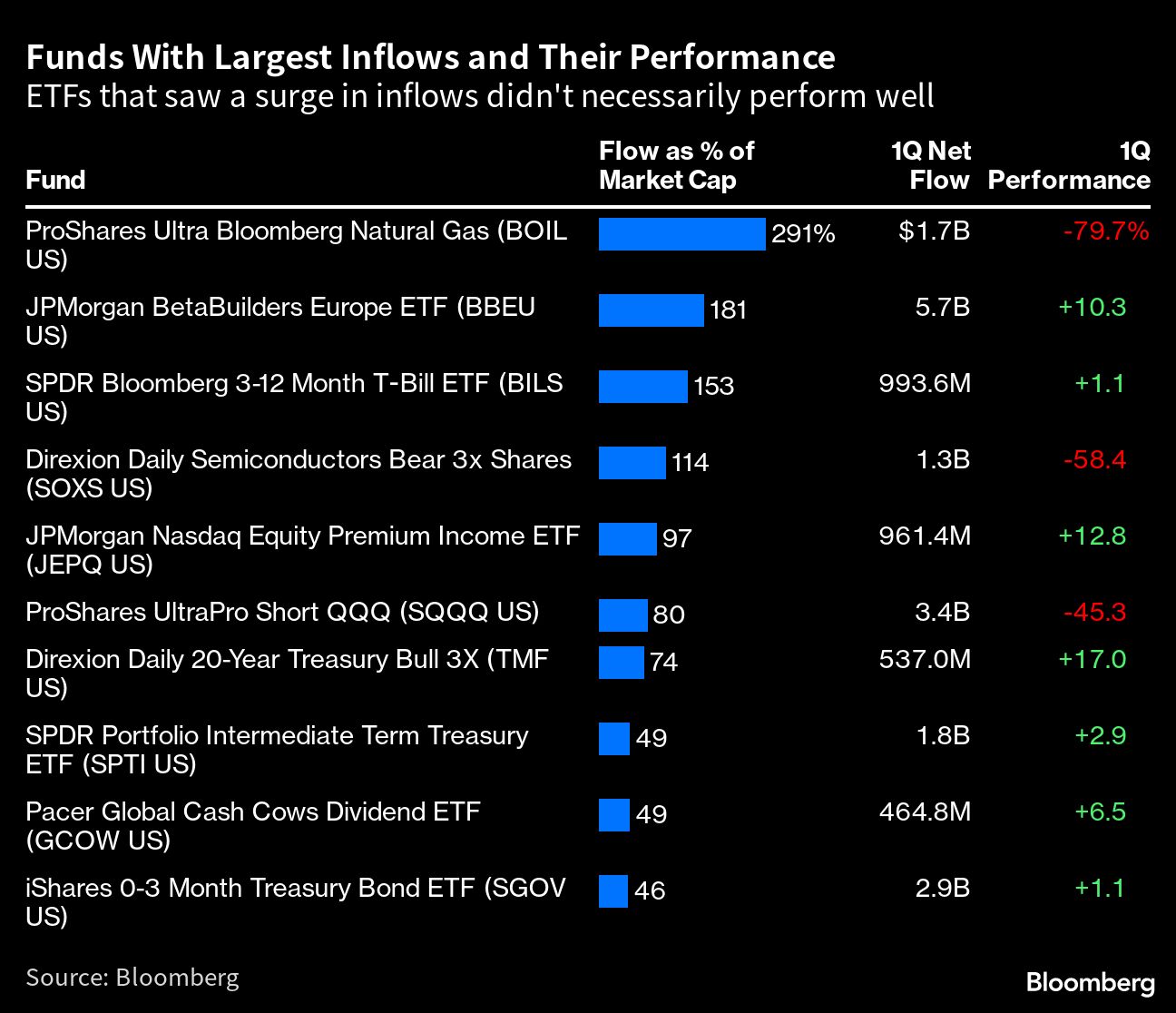

Add this to the long list of market surprises in the first quarter of 2023: The worst-performing exchange-traded funds still managed to attract massive amounts of cash.

US ETFs tracking the sinking natural gas market and ones making magnified bets against the again booming tech sector have, unsurprisingly, seen their prices tumble. Yet these funds ranked near the top of the leader board for inflows.

Q1 2023 hedge fund letters, conferences and more

“It has not paid to be bearish on semis and technology,” said Jane Edmondson, chief executive officer of EQM Capital. “Many investors have clearly been positioned wrong this quarter, not expecting a rebound in big tech in January, again surprised in February that the Fed was not going to back down on interest rates, only to be rewarded with another tech rebound in March thanks to the Fed-induced banking crisis.”

To be sure, there’s only so much you can read from flows in a period in which investors were buffeted by shifting rate expectations, a banking crisis, confusing inflationary signals and more. Against that backdrop, the most dependable trend was a flood of cash into the safety of government bond ETFs.

In addition, a calendar-based read of flows can offer a misleading picture. For instance, activity can be affected by periodic tax concerns or end-of-year portfolio adjustments. And big flows to or from leveraged products can reverse fast, since they aren’t intended to be held for long.

Read the full article here by Angel Adegbesan, Advisor Perspectives.