According to the latest research from PivotalPath, hedge funds stay the course, but in a reversal from the norm, larger funds outperformed in August.

Q2 2021 hedge fund letters, conferences and more

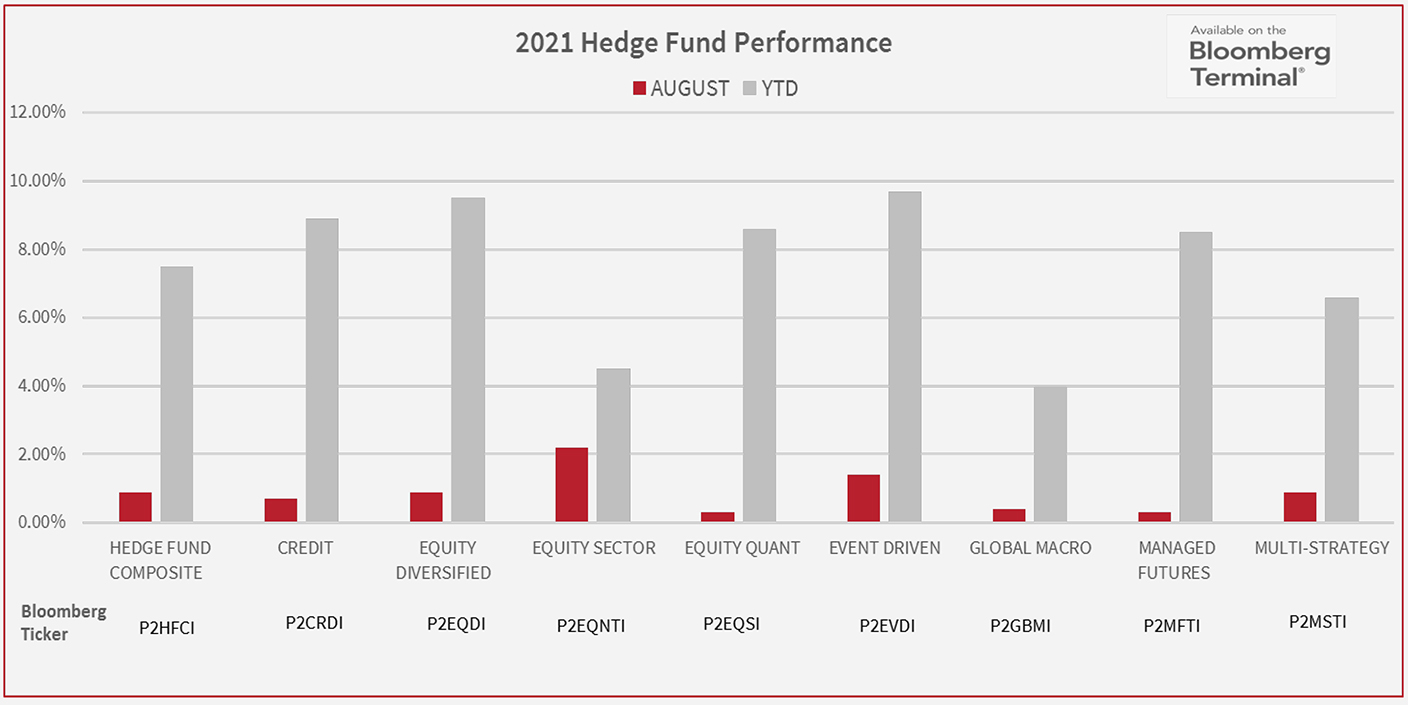

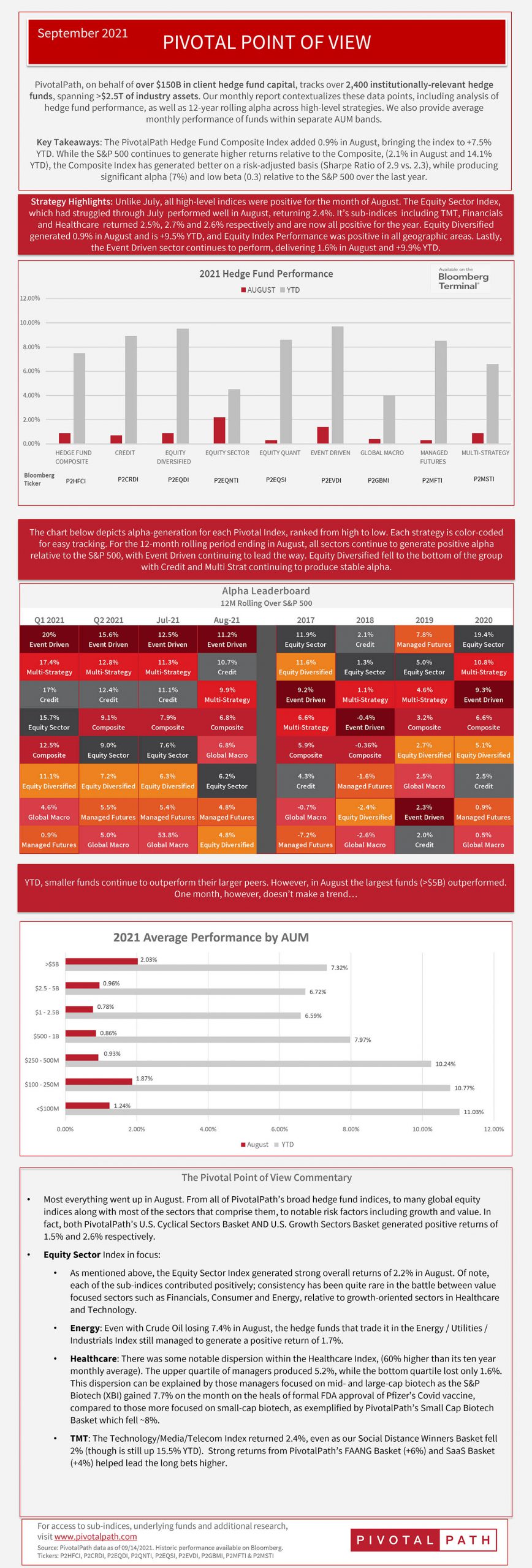

PivotalPath has released their monthly report, the Pivotal Point Of View, which measures performance among more than 2,400 institutionally-relevant hedge funds, as well as 40+ different hedge fund strategies and $2.5T in total industry assets. What were some of the big findings this month? For one, hedge funds continued to do well – especially on a risk-adjusted basis – and some of the largest funds were the best performing.

A Few Quick Highlights

- Everything went up in August – including both the U.S. Cyclical Sectors Basket AND the U.S. Growth Sectors Basket, which generated positive returns of 1.5% and 2.6% respectively.

- Within equity sector, of the sub-indices contributed positively, which has been quite rare in the battle between value focused sectors such as Financials, Consumer and Energy, relative to growth-oriented sectors in Healthcare and Technology.

- TMT returned 2.4%, even as our Social Distance Winners Basket fell 2% (though is still up 15.5% YTD). Strong returns from PivotalPath’s FAANG Basket (+6%) and SaaS Basket (+4%) helped lead the long bets higher.