Hedge funds recorded their strongest return in over a decade lead by the long/short equities

Q3 2020 hedge fund letters, conferences and more

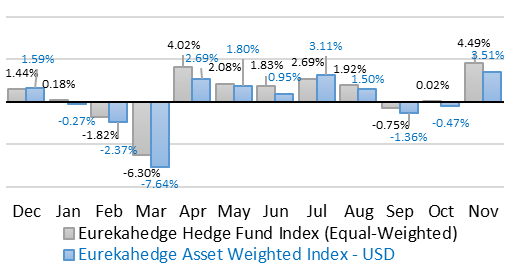

Equal-weighted and asset-weighted hedge fund performance

Hedge fund managers the ended month of November up 4.49% on an equal-weighted basis, and 3.51% return on an asset-weighted basis. The better-than-expected efficacy of the COVID-19 vaccines and optimism on the new US administration boosted the performance of the global equity market during the month. On a year-to-date basis, global hedge funds were up 8.17% over the first 11 months of 2020.

Over the month of November, US$8.8 billion of investor inflows on top of US$26.3 billion of performance-driven gains were recorded by the global hedge fund industry.

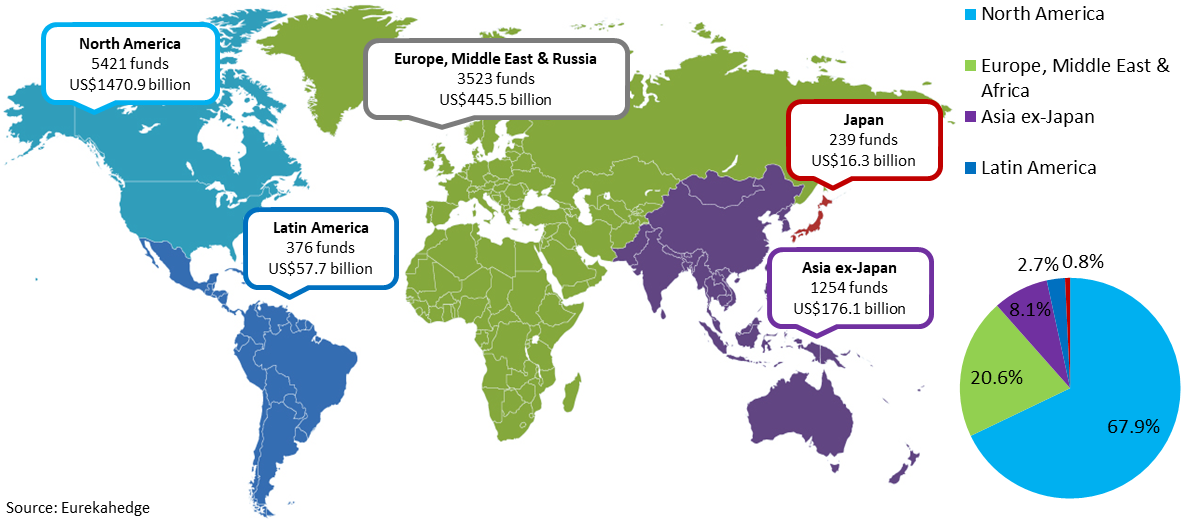

Hedge fund performance by region (2020 YTD)

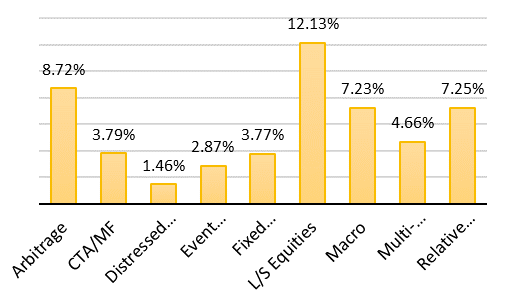

Hedge fund performance by strategy (2020 YTD)

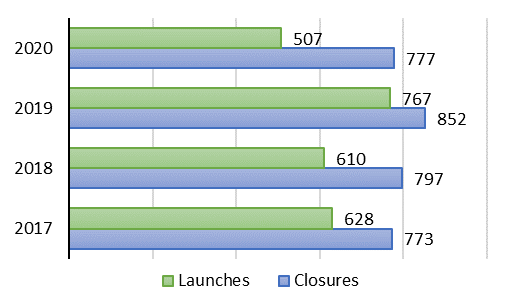

Annual launches and closures of global hedge funds

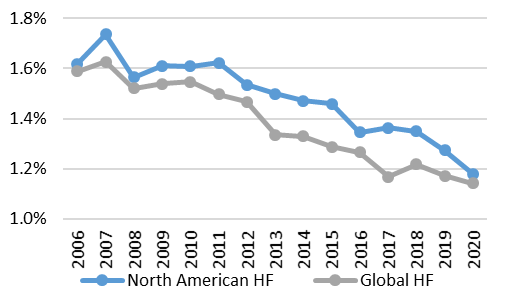

Average management fees of North American and global hedge funds by launch year

Launched in 2001, Eurekahedge has a proven track record spanning over 16 years as the world's largest independent data provider and alternative research firm specialising in global hedge fund databases and research. The global expertise of our research team constantly adapts to industry changes and needs, allowing Eurekahedge to develop and offer a wide array of products and services coveted by institutional investors, family offices, accredited investors, qualified purchasers, financial institutions and media sources. In addition to market-leading hedge fund databases, Eurekahedge's other business functions include hedge fund research publications, due diligence services, investor services, analytical platforms and risk management tools.