Performance figures for the hedge fund industry in 2018 are starting to trickle out. These numbers suggest that while some managers (such as David Einhorn) suffered immense losses last year, the industry, as a whole, outperformed the broader market.

Q3 hedge fund letters, conference, scoops etc

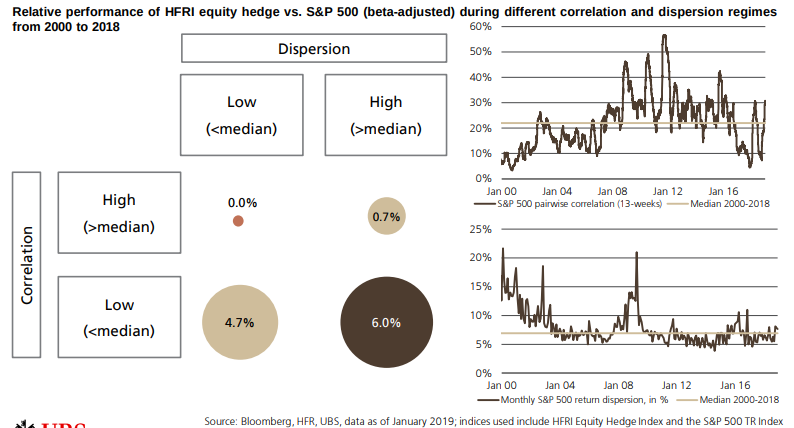

For example, the Eurekahedge Hedge Fund Index was down -3.85% in 2018, outperforming the MSCI AC World Index which declined -10.18% over the year. Meanwhile, the HFRI Fund Weighted Index was down -4.1% for 2018. These early numbers show that while hedge funds lost money on average in 2018, they suffered far less than equities.

If you’re looking for more timely hedge fund insight, ValueWalk’s exclusive newsletter Hidden Value Stocks offers exclusive access to under-the-radar...