LONDON — January 27, 2023 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that assets invested in the global ETFs industry extended its lead over the global hedge fund industry by US$4.57 trillion at the end of Q3 2022, based on data from ETFGI and HFR. (All dollar values in USD unless otherwise noted.)

Q4 2022 hedge fund letters, conferences and more

Highlights

- Assets invested in global ETFs industry extended lead over assets in global hedge fund industry to $4.57 trillion at the end of Q3 2022.

- The global hedge fund industry suffered net outflows of $26 billion during Q3 2022 while global ETFs industry gathered net inflows of $129.9 billion.

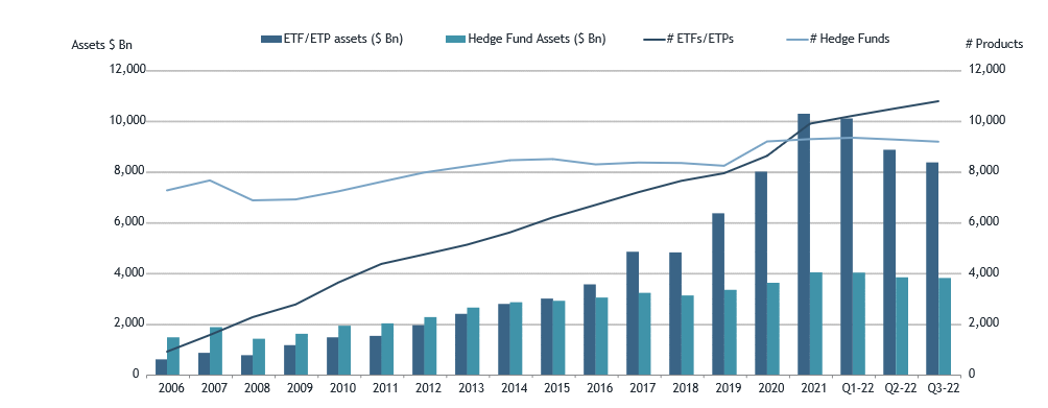

Assets invested in the global ETFs industry first surpassed those invested in the global hedge fund industry at the end of Q2 2015, as ETFGI had forecasted. Growth in assets in the ETFs industry has outpaced growth in the hedge fund industry since the financial crisis in 2008. According to ETFGI’s analysis there was $8.35 trillion invested in 10,763 products listed globally at the end of Q3 2022 while assets invested in hedge funds globally was $3.78 trillion invested 9,163 hedge funds, according to a report by HFR..

During the third quarter of 2022, global ETFs industry gathered $129.9 billion in net inflows, according to ETFGI’s Global ETF and ETP industry insights report. In contrast, HFR reported that hedge fund saw net outflows of $26 billion in Q3 2022.

Growth in global ETF/ETP and global hedge fund assets, as at end of September 2022