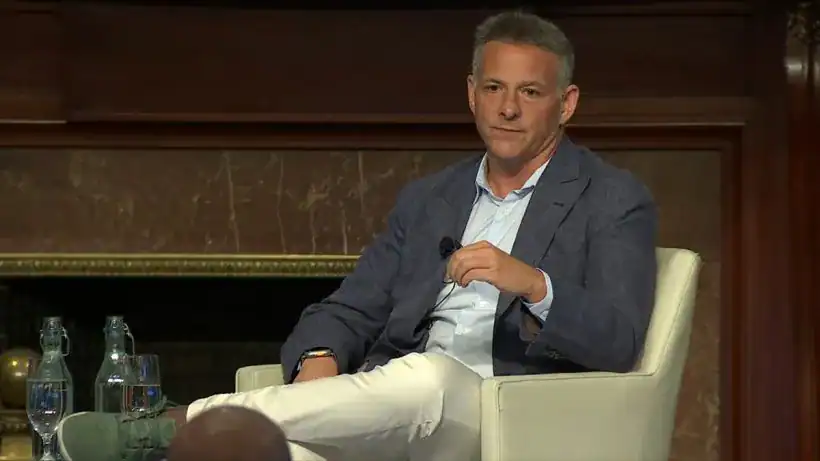

David Einhorn, President of Greenlight Capital, spoke on September 25, 2025 at Simplify Asset Management’s “Entering the Fall 2025” conference, a gathering of investors and economists to discuss markets, the economy, stock picking and more. Below is an in-depth analysis of his one-hour fireside chat at the conference.

A simple question with a hard answer

Is the market still broken? Einhorn does not hesitate.

“Oh, very much so,” he says. Then he draws a line that frames everything else. It depends what you think a market is for.

If the purpose is to “allocate capital, fund reward things that have good returns on capital, punish things that have bad returns on capital,” and by doing so push companies to be efficient, then “it’s ever more broken.” If the real purpose now is entertainment and short-term scorekeeping, to let people “amuse themselves, enrich themselves, trading… trying to solve the puzzle of what the stock is going to do an hour from now, two hours from now, three nanoseconds from now,” then the market works great.

That second purpose, he argues, has swallowed the first. The result is a place where traditional valuation talk has little bite. He laughs at the idea that pointing out a cycle-high multiple will change minds. Comparing today’s Shiller PE to history is like “shouting the emperor has no clothes at a nude beach.” “Everybody already knows this,” he says. “Nobody cares.”

That last phrase is the spine of his current process. If the market will not care, build your return so you do not need it to.

Also see: Steve Mandel On “The Home Depot” Test, How To Use AI In Equity Research & Shortselling Today

What changed: the convergers left and the short-timers took over

Einhorn says the key shift is who sets prices day to day.

Twenty years ago the dominant players were big long-only mutual funds. They hired analysts, did fundamental work, bought slowly, and held for years. “There were serious people that were analyzing all these companies,” he says. Their capital “led to make stocks generally converge towards value.” He calls this group the “convergers.”