We just released our 6-minute mid-year 2022 review, going over 17 charts discussing macroeconomic indicators, asset classes and sector returns, transcript trends, and more.

Q2 2022 hedge fund letters, conferences and more

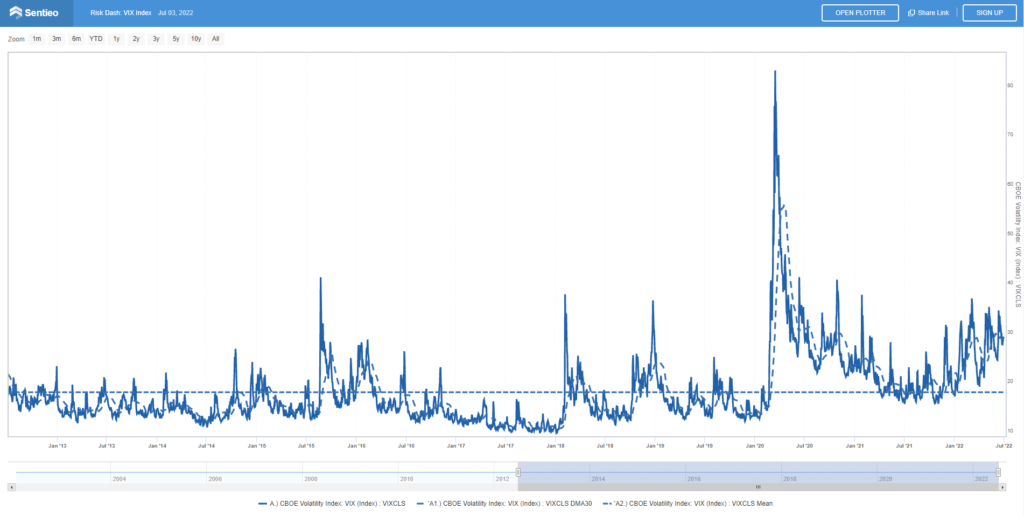

1. VIX Index: We have entered a high-volatility market regime

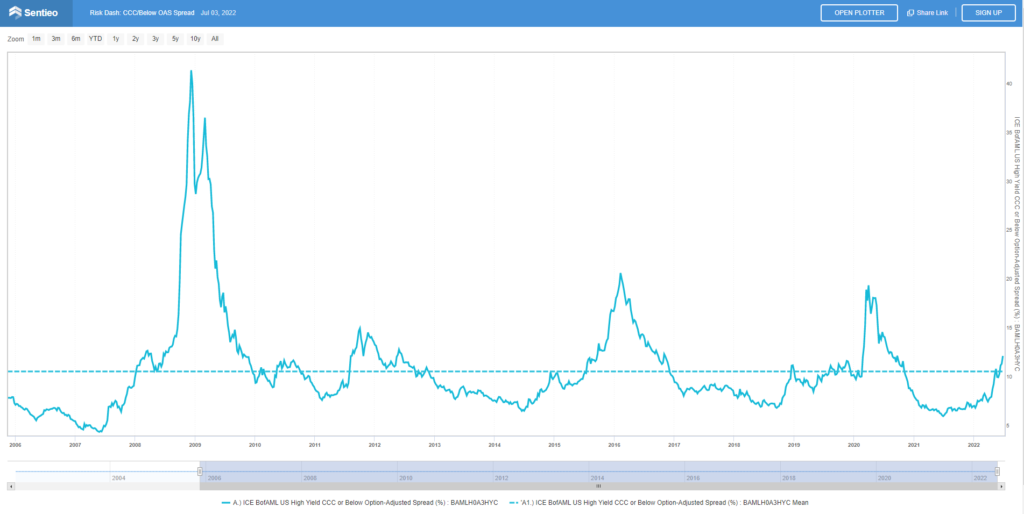

2. Credit spreads are shooting up

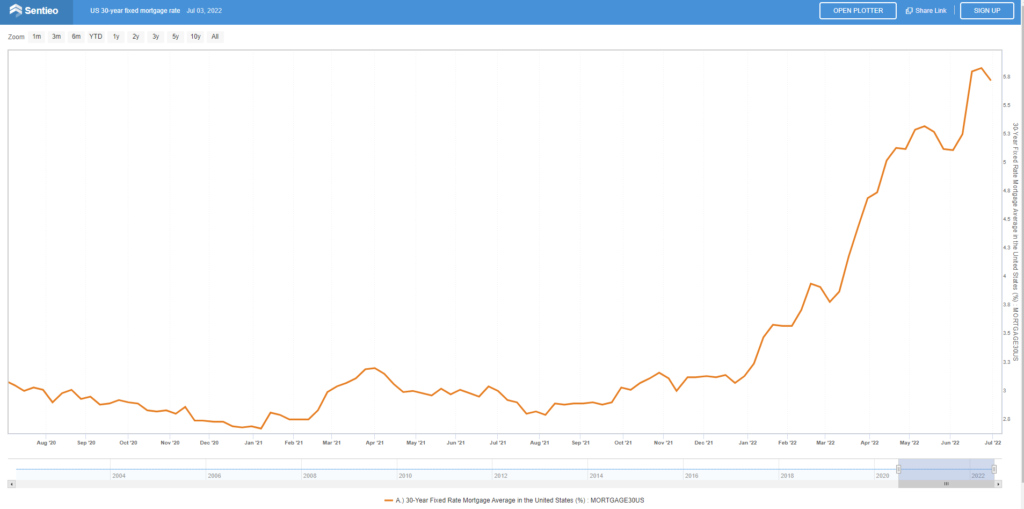

3. Mortgage rates have increased considerably in the last 6-12 months, affecting several sectors (showing US 30-year fixed rate mortgage)

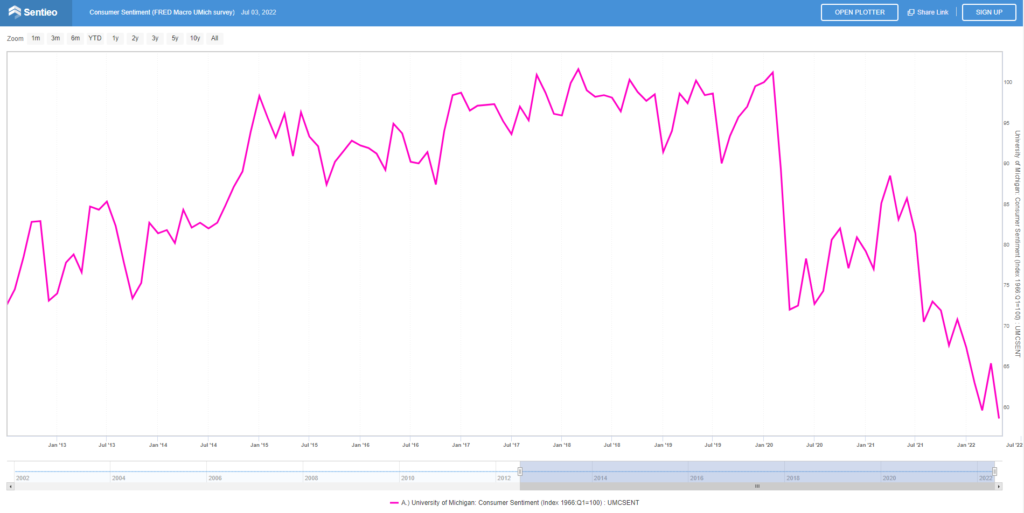

4. US consumer sentiment is extremely poor

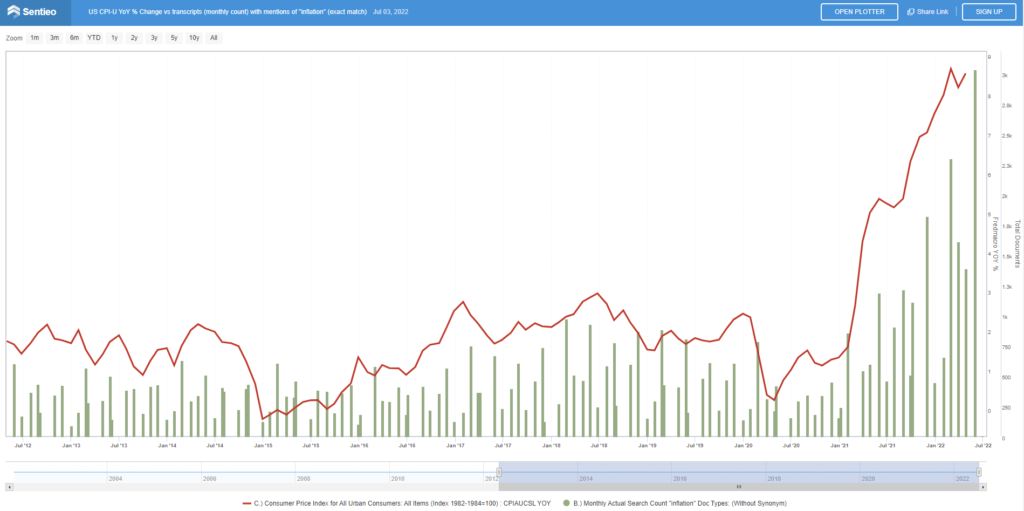

5. Inflation (and transcripts with mentions of inflation) are at very high levels

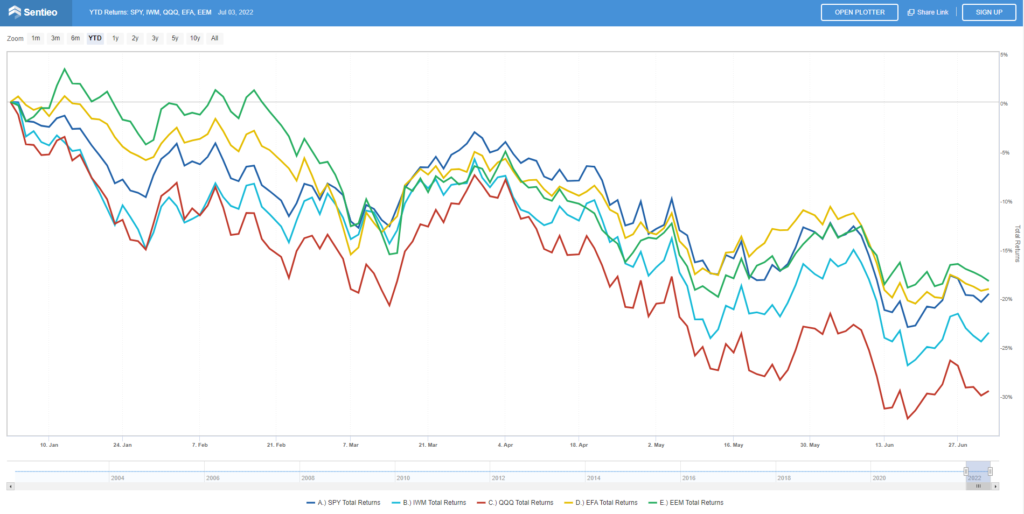

6. All broad equity indices are down double-digits YTD: SPY, EFA, EEM, QQQ

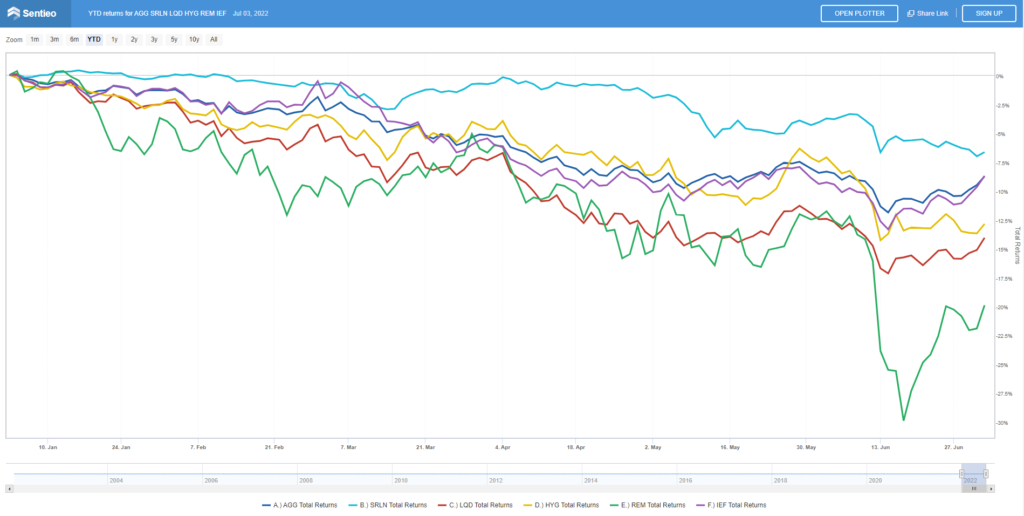

7. Unusual, given the move in equities, fixed income is down across instruments: AGG, LQD, HYG, SRLN and more

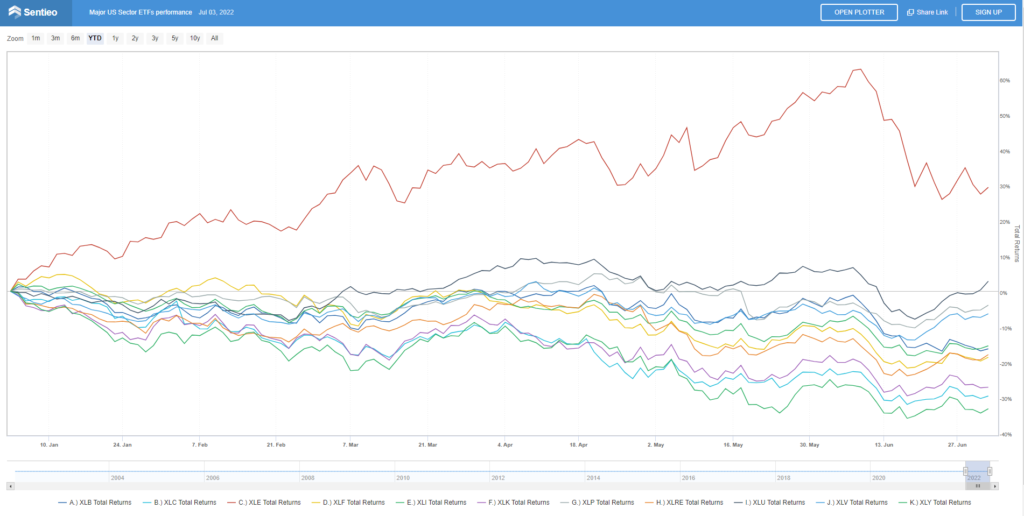

8. Within the US equity sectors, XLE trounces all YTD

9. “High-duration” sectors like $XBI Biotechs, FINX Fintech, SPAK SPACs have done much worse than the broad indices YTD

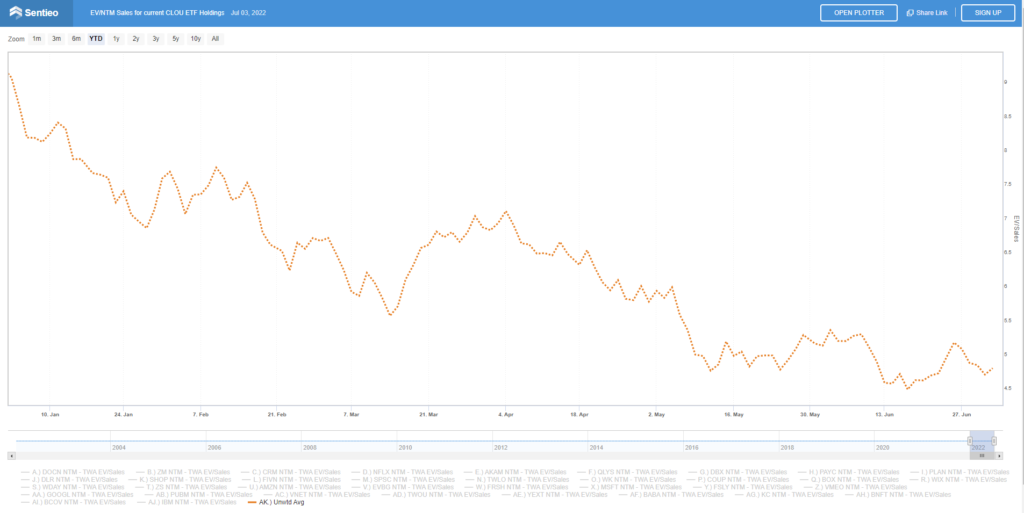

10. SaaS valuations (looking at the average CLOU holding EV/NTM Sales) have been cut in half YTD

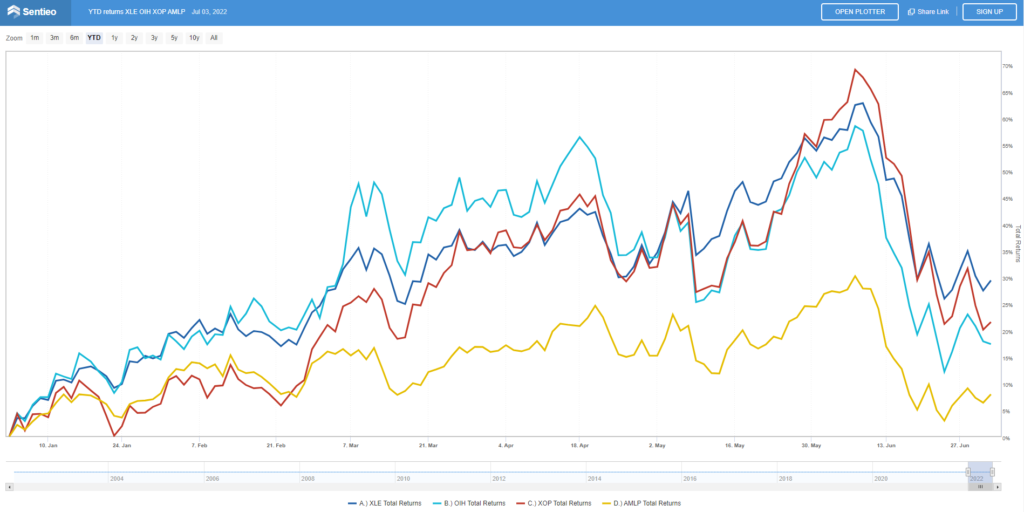

11. Within energy, AMLP midstream has done worse versus the large-caps XLE, services OIH and E&P XOP

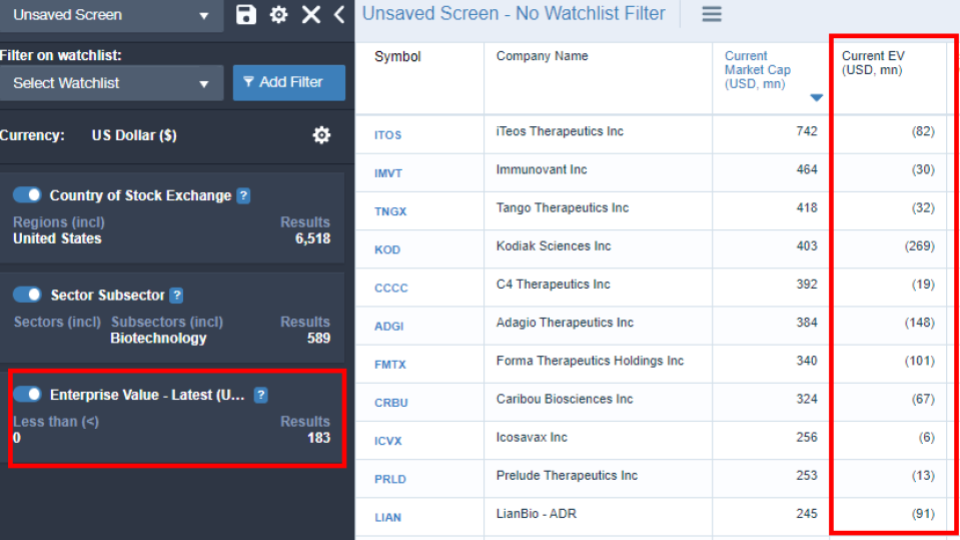

12. 183 US-listed Biotechs trade at negative enterprise value, in contrast to just 13 a year ago (XBI)

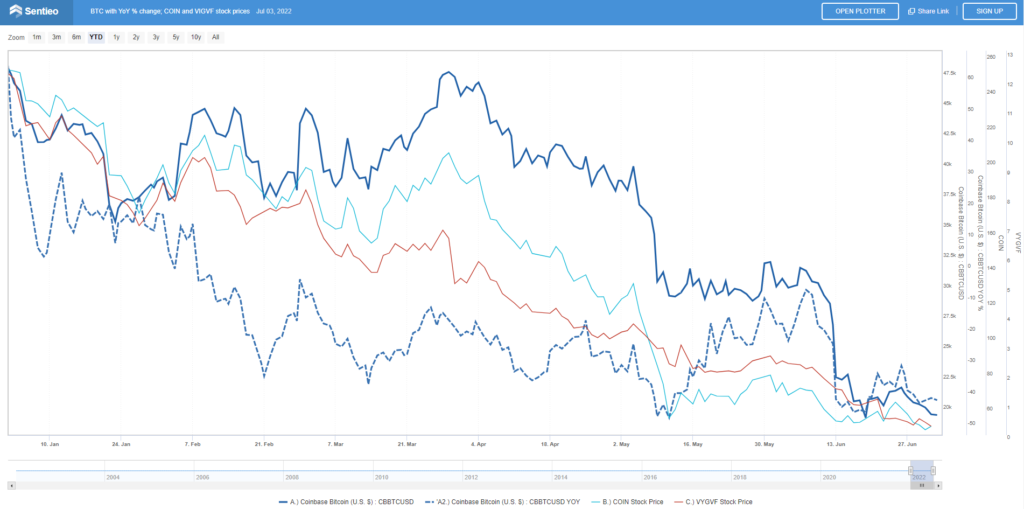

13. The crypto winter is here, with large declines for Bitcoin and crypto-related equities

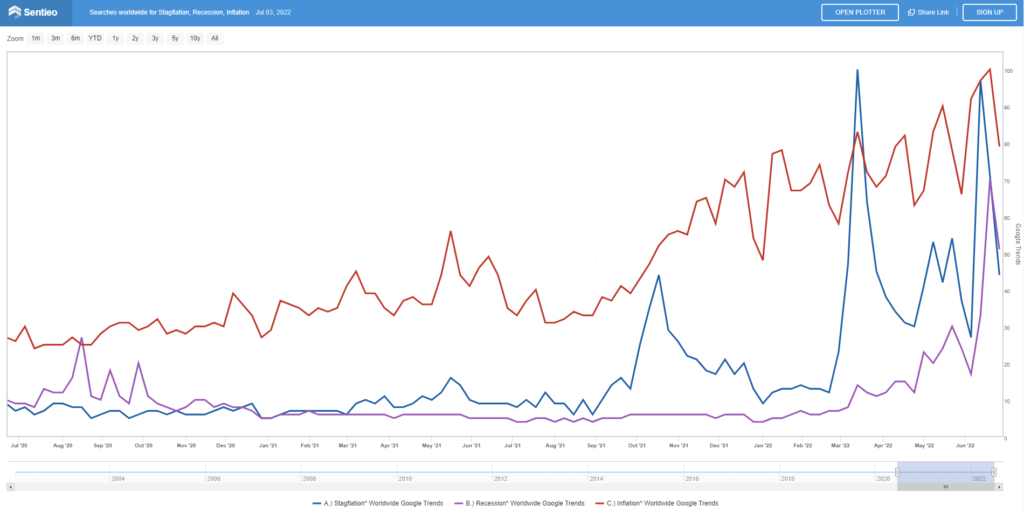

14. Searches for stagflation, recession, and inflation have been moving up considerably

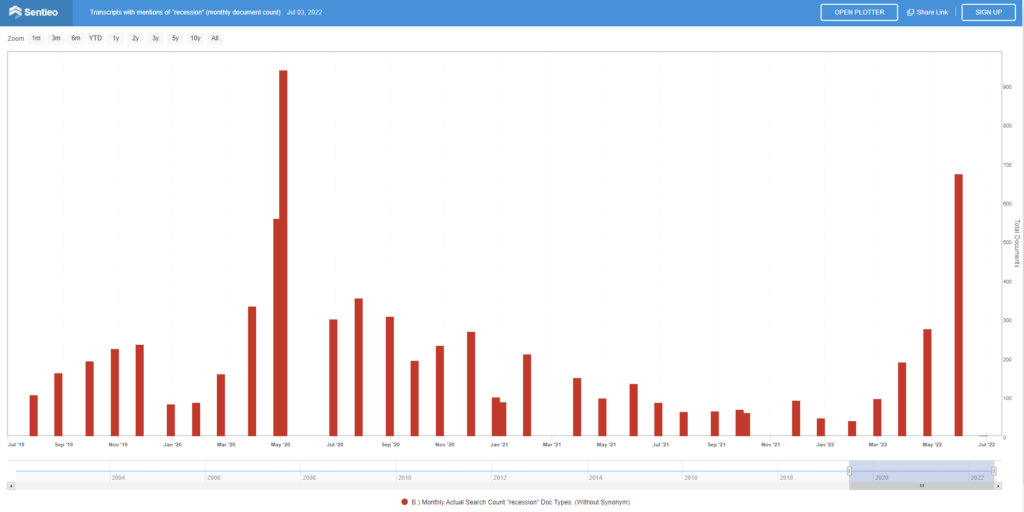

15. May 2022 had the second highest number of call transcripts mentioning “recession” in recent year, after May 2020

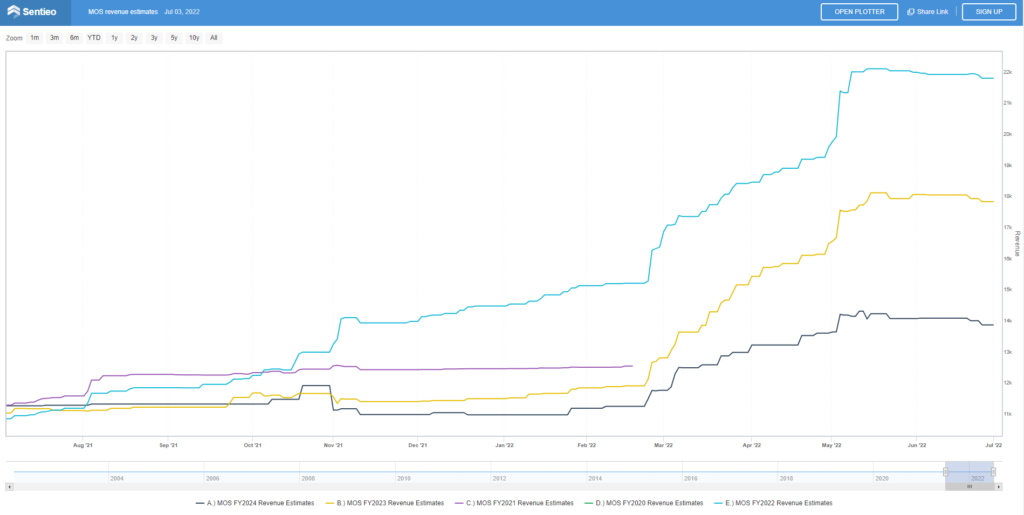

16. Perhaps some green shoots regarding inflation, current estimates for the revenues of the fertilizer companies point to 2022 being the high point, as we can see with the MOS revenue estimates by year

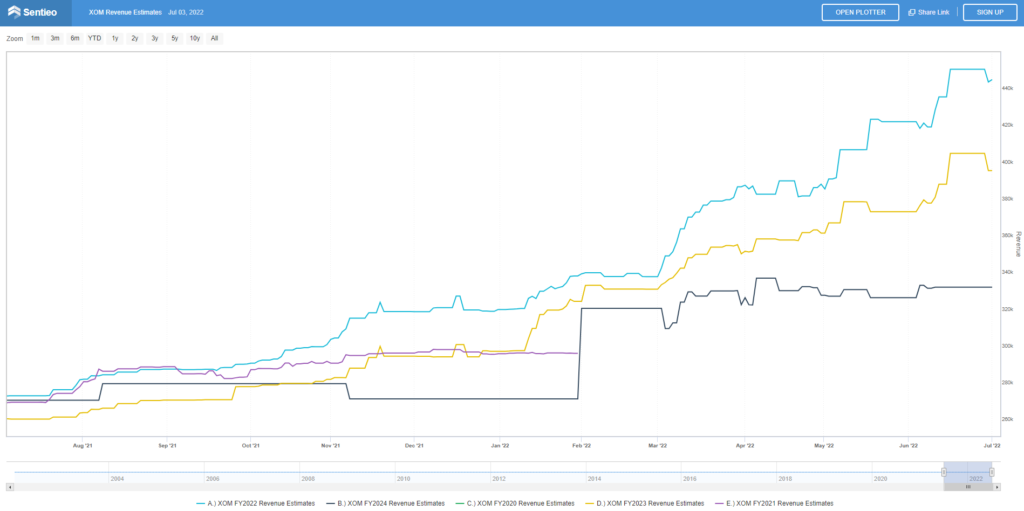

17. Similarly, the trend in XOM’s revenue estimates could indicate longer-term moderation in commodity prices