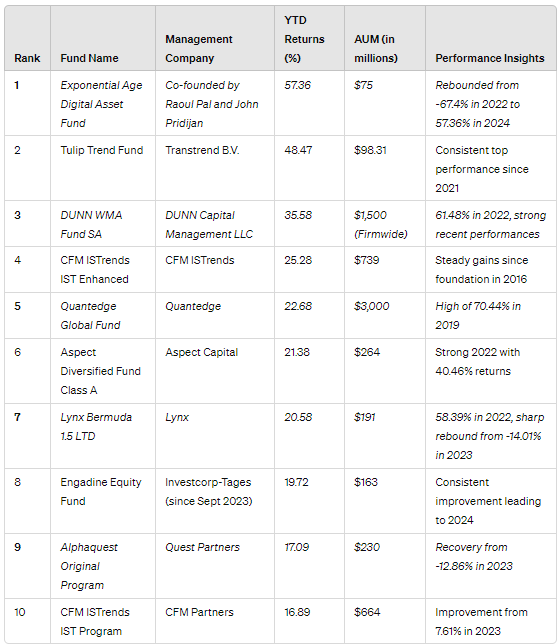

HSBC Alternative Investment Group delivers investment management and advisory services to clients across the globe. The group provides investment advice and manages portfolios. They also track hedge fund returns and publish a regular update on performance numbers for many funds. Insights from their Hedge Weekly Investments Performance Review reveal the ten top performers in 2024.

1. Exponential Age Digital Asset Fund (offshore) - 57.36% YTD returns

Fund was co-founded in November 2021 by Raoul Pal and John Pridijan. The fund provides investors with a single access point to the world-leading digital asset hedge funds. The current asset size of the fund is $75 million. In 2022 they were in the top 20 bottom list with a return of -67.4%, managing to bounce back and deliver a 57.36% YTD return. Raoul Pal is the founder of Real Vision, a popular financial media outlet.

2. Tulip Trend Fund - 48.47% YTD returns

This trend-following fund is managed by Transtrend B.V. Tulip Fund and has a solid track record dating back three decades. They were in the top 20 categories in 2022, with 32.94% returns, which followed after an impressive 2021 with 43.38% returns. Their YTD returns are 48.47% placing them in second place on the HSBC list.

3. DUNN WMA Fund SA - 35.58% YTD returns

The fund is managed by DUNN Capital Management LLC known as one of the world's longest-running Commodity trading advisors. President and owner of the fund is Martin Bergin, and he can brag about the streak of great performances lately. In 2019 the fund generated an 18.75% gain, in 2022 a massive 61.48%, while YTD results are promising 35.58%.

4. CFM ISTrends IST Enhanced - 25.28% YTD returns

CFM ISTrends is a hedge fund founded in 2016. It is a multi-asset, multi-scale, long-term trend-following fund. Its goal is to capitalize on market prices moving in one direction over a period of time. The fund generated 17.17% returns in 2021 and 33.99% returns in 2022. YTD 25.58% returns are also exceptional, placing the fund in 4th place.

5. Quantedge Global Fund - 22.68% YTD returns

Quantedge runs a systematic quantitative investment strategy. It is diversified among multiple asset classes including equities, bonds, commodities, currencies, and insurance-linked securities. In 2019 the fund generated impressive 70.44% returns, in 2020 20.05%, and in 2023 29.71%. Last YTD returns are also solid - 22.68%.

6. Aspect Diversified Fund Class A - 21.38% YTD returns

Managed by Aspect Capital, their pinnacle fund offers a range of systematic investment solutions. They cover three major areas - Trend following, Macro & Currency, and multi-strategy & Combined Solutions. They have an AUM of $264 million and managed to get in the top 20 category for 2022 with a 40.46% return. Their 21.38% YTD returns placed them in the 2024 top 20 category.

7. Lynx Bermuda 1.5 LTD - 20.58% YTD returns

Lynx program is a broadly diversified managed futures strategy. Its goal is to deliver high-risk-adjusted returns uncorrelated to traditional asset classes. The fund was on the 2023 worst 20 list with a return of -14.01%. This came after a phenomenal 2022 and gains of 58.39%. Lynx AUM is $191 million, and their YTD return is 20.58%.

8. Engadine Equity Fund - 19.72% YTD returns

Founded in 2016 Engadine Equity Fund was managed by Engadine Partners until September 2023. The fund was then taken over by Investcorp-Tages, continuing the practice of relying on a long/short equity strategy. They finished 2023 with a gain of 11.66%, while the rise of performance in 2024 recommended them for the place among the top 20 funds.

9. Alphaquest Original Program - 17.09% YTD returns

Alphaquest Original Program is a flagship fund of Quest Partners. The fund’s primary approach is a trend following with a twist that offers a quicker reaction to trend reversals. After a forgettable 2023 with a negative return of -12.86%, Alphaquest started strong in 2024 generating 17.09 returns.

10. CFM ISTrends IST Program - 16.89% YTD returns

Another fund in the top 20 list hailing from CFM Partners is ISTrends IST Program. The fund trades a broad range of most liquid futures and FX forwards while utilizing a trend-following strategy. After a slower 2023 with a return of 7.61%, from the looks of things 2024 has a better potential.