Noster Capital is a firm founded by Pedro de Noronha in 2008, and Noster Capital Fund represents the flagship of the company. The fund operates on the principles of value investing with a very thorough investment process.

Managers analyze all relevant reports, converse with the management, and all to better understand how the company operates, and to identify potential competitive advantages. Hedge Fund Alpha got a sneak peek at their latest investor letter which is focused on last year's performances, macro updates, and the state of the oil, gold, and crypto markets. If the hedge fund name rings a bell, remember those headlines about a hedge fund manager betting Apple would go bankrupt? Well it seems Pedro got that call very wrong, but is doing well nonetheless.

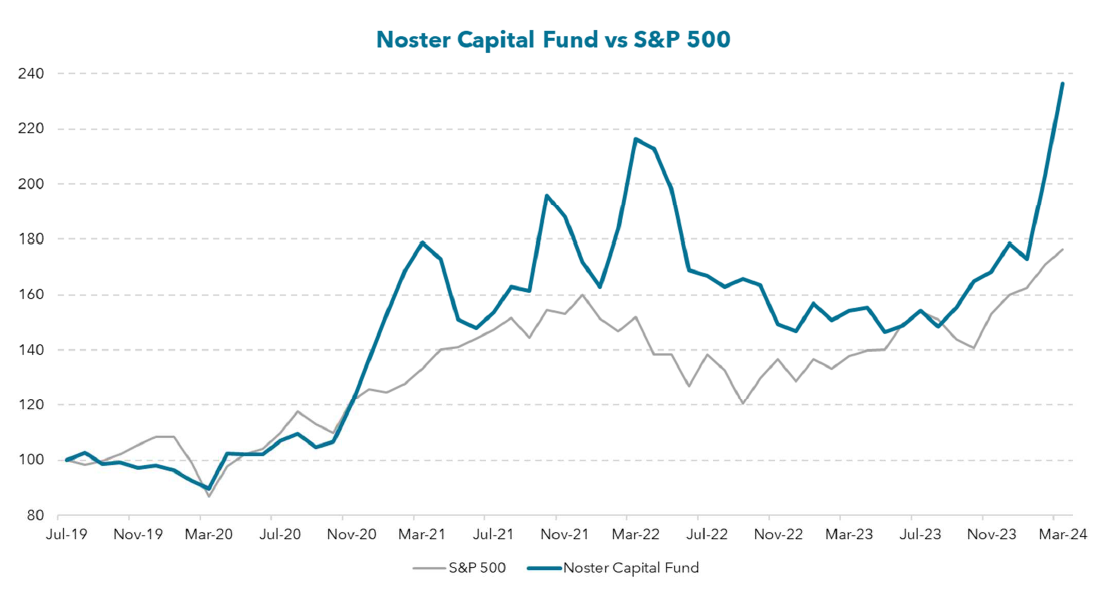

After a period of poor performance between 2015 and 2019 Noronha and his partners decided to restructure the portfolio of the fund. Since the restructuring, the fund generated a gain of 136.3% against the 76.3% gain of the S&P 500 Index in the same time frame. In 2024 the fund delivered a 32.4% gain in contrast to Indexes 10.2%.