Kernow Asset Management's performance update for the month ended February 29, 2024.

The strategy declined 0.9% in February on tepid economic data and mixed earnings reports.

The British like to chat about one thing more than the weather: housing. It often defines our status. The default margin for any at-scale construction project should be c.5%. However, the current rate for UK housebuilding is 15-20% because of the status dynamics. Competition should decrease margins back to the lower level, but it doesn't.

So, why do these excess returns last? The planning system makes the competitive moat formidable. If an individual applies to build twenty homes in a field as infill using the exact specifications and contractors as the main housebuilders, they would most likely be rejected. If a big housebuilder with a track record does it, it is likely to be accepted. As with most government power systems, we do not doubt that the planning system will get more extensive and complicated over time. This widening moat suits the housebuilders.

Last month, the Competition and Markets Authority issued a report on the sector. Most importantly for us, it is happy with the profitable operation of builders, and there will be no further action on land banking. It rightly suggested planning reform was required instead and launched a further investigation into price fixing. The findings give us confidence that the sector's high margin returns can be maintained over many years. The political will to not reduce the number of built homes trumps the temptation of additional taxation.

In the sector, we are invested in Berkeley Group Holdings PLC (LON:BKG). It has the best margins and is the highest-quality housebuilder on the listed market. It does this by focusing its development on large, bespoke sites near the highest-paid jobs. The company believes its planning moat is the primary source of sustainable competitive advantage. It is not simply box-building all over the country like most of its peers. It also has an aversion to debt after a big scare in 2008. This makes it an attractive investment proposition that we expect to hold for many years.

In other portfolio news, Hunting plc (LON:HTG) released its FY 2023 results, which were ahead of the guidance it provided in January, Mondi delivered solid FY 2023 results, and CMC Markets announced a significant cost-cutting plan that was well received by the market.

On the short side, we added five new positions after covering our position in Avacta Group Plc (LON:AVCT) for a substantial gain. Avacta is the poster child for a harmful AIM-listed company. It is run by a CEO who has presided over seven failed products in a row - all shut down or sold for a loss. The company is good at one thing - raising money by telling stories backed by questionable facts. It nearly ran out of road this time but pulled off another dilutive fundraise at a 34% discount to its share price. Given the smaller market cap size and new story risk, we chose to exit.

Hot on the heels of CRH PLC (LON:CRH), Ferguson PLC (LON:FERG) and Flutter Entertainment PLC (LON:FLTR), the other interesting change this month was Indivior being rewarded in advance with a c.18% share price rise on the mere announcement of switching its primary listing to the US. Other companies that we now expect to be under extra pressure to examine their US public markets approach include 4imprint Group, Ashtead Group and Experian. Anything under a £1bn market cap or less than 30% of its sales in the US does not make sense.

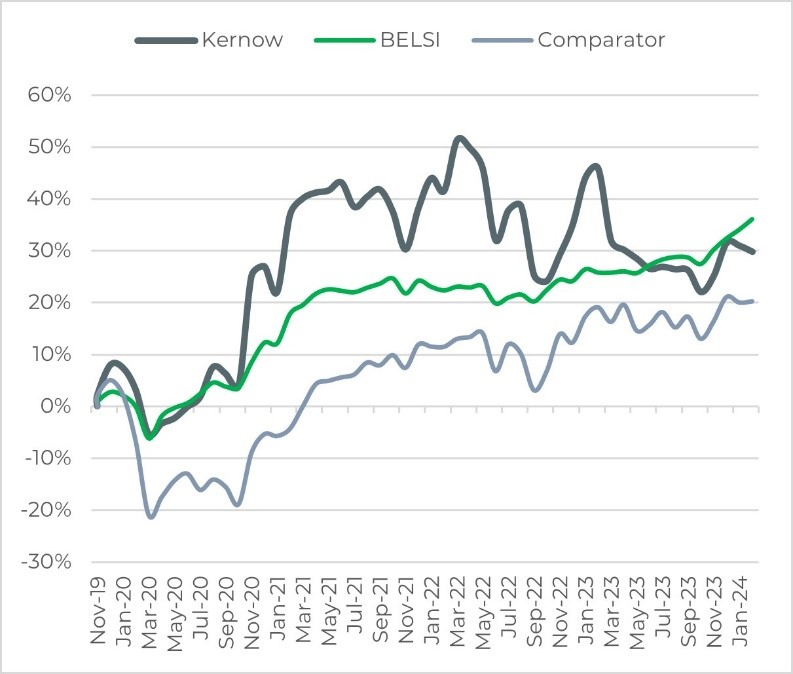

Since its inception in November 2019, the Kernow strategy is up 30%, compared with the prevailing UK equity market, which has increased 20% over the same period. The collective upside in the portfolio is worth more than 227%.

- Book of the Month: Quality Investing: Owning the Best Companies for the Long Term by L Cunningham, P Hargreaves, and T Eide

- Good month for: Wincanton, +44%, on buyout bid

- Bad month for: St James's Place, -22%, following £426m refund provision

In late January, Ed discussed promoting UK financial services post-Brexit with Lord Dominic Johnson CBE, Minister for Investment, at a lunch organized by the Independent Investment Management Initiative. In February, he sat on a panel discussing how AI can benefit capital markets. In both instances, the focus on leveraging technology underscores its significance in addressing these challenges.

Kind regards

Alyx Wood

Chief Investment Officer

Kernow Asset Management

See the tear sheet here.