Vilas Fund commentary for the second quarter ended June 30, 2019.

Q2 hedge fund letters, conference, scoops etc

Dear Vilas Fund Partner,

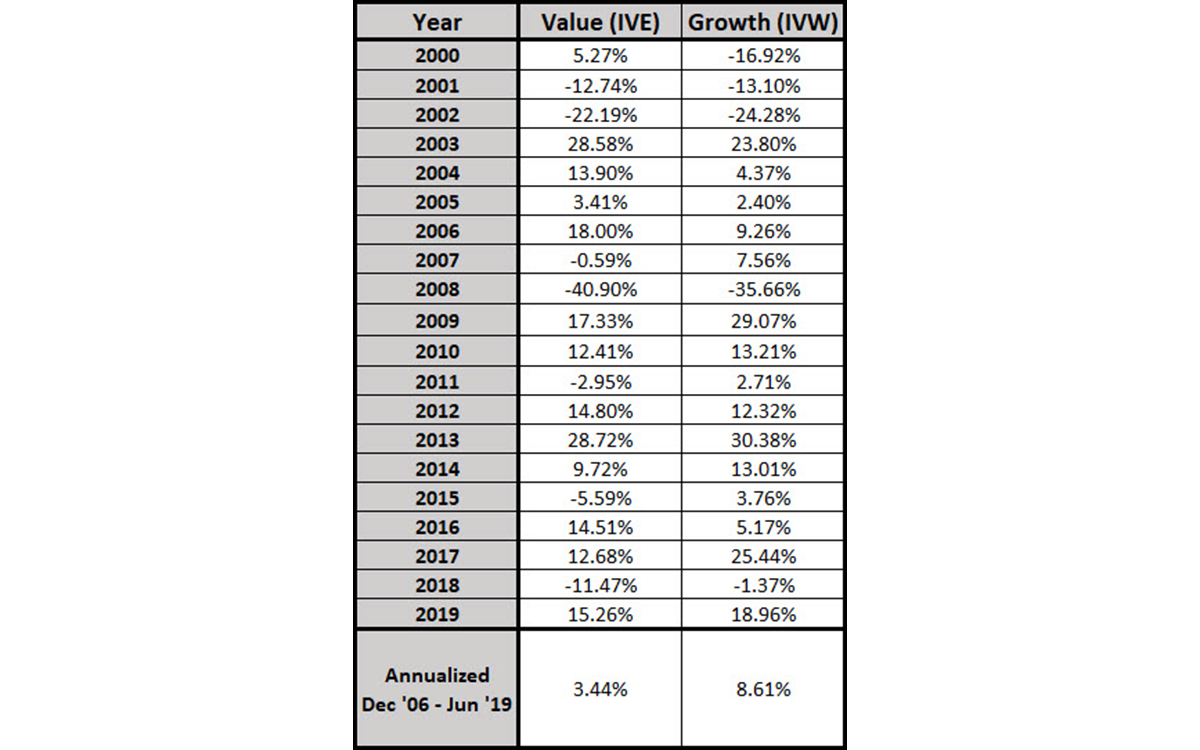

The Vilas Fund, LP rose 7.8% in the second quarter of 2019, bringing the year to date return to 44.8%. The Fund has compounded at 11.5%, net of fees, since it began nearly nine years ago (August 9, 2010). This has turned a $1 investment at inception to $2.64. Relative to other actively managed value-focused hedge funds, the fund ranks as one of the best in the industry as the average fund in our category has compounded at 6% versus our 11.5% and turned $1 into $1.68. However, as you know, the fund’s results have lagged the S&P...