Trojan Fund from Troy Asset Management is a multi-asset fund that employs a long-term long-only approach. The portfolio is made of carefully selected high-quality companies acquired at fair valuations. Preferred investments include equities from developed markets, bonds, and gold-related assets.

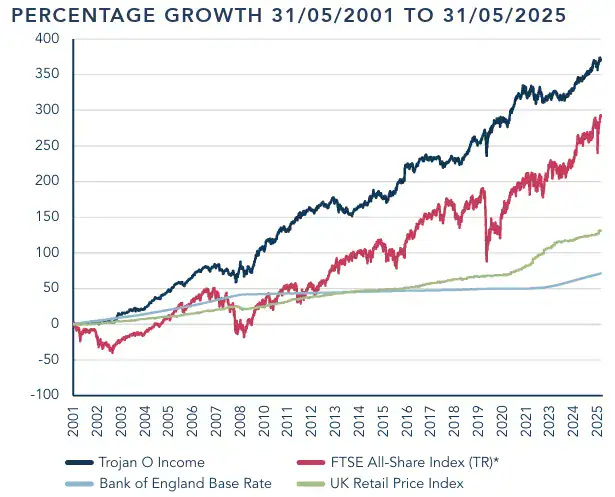

The Fund has $6.8 billion in assets under management (AUM) and has disclosed 0.7% gains for May, while the FTSE All Share Index generated 4.1%. Total year-to-date returns are 3.4%.

Capital is predominantly invested in equities (39%), U.S. treasury inflation-protected securities (26%), followed by gold-related investments (11%). Also, there are noted investments in short-dated gilts (9%) and Japanese government bonds (8%).

May Commentary

At the end of the month, the fund's employees attended...