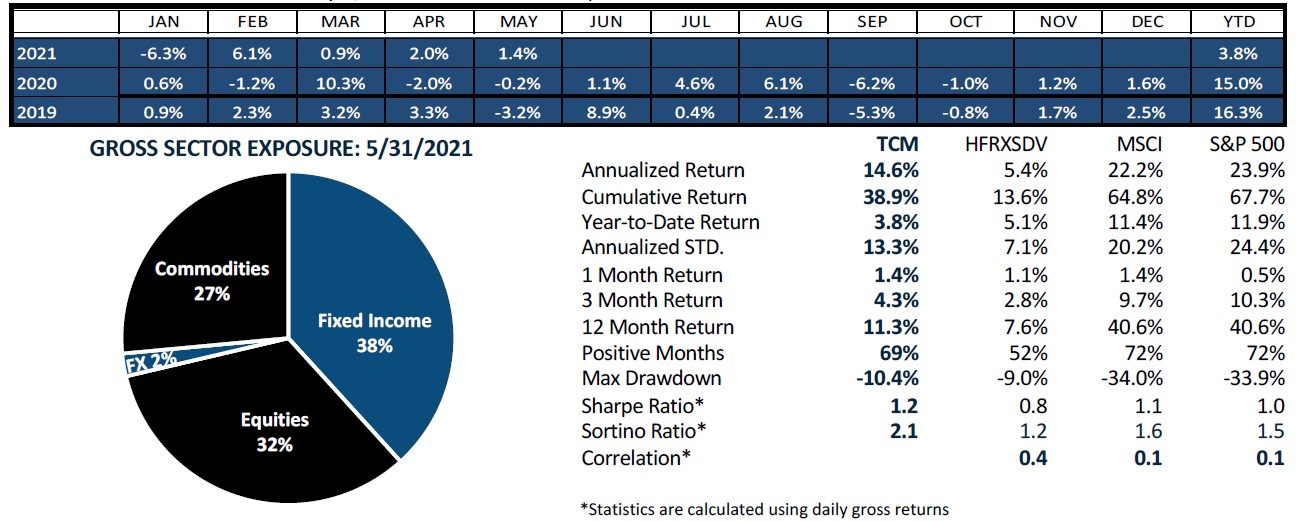

The Trident Fund LP returned +1.4 percent in May, and the fund is +3.8 percent net for 2021.

Q1 2021 hedge fund letters, conferences and more

Trident unearthed a unique source of return in May when it exploited market reaction to an aggressive Fed rather than merely following the trends. Through the Risk Regime model, Trident profited from the steep rally in short-term Treasuries that followed Fed Chairman Powell’s mid-month comments in front of Congress in which he pledged to keep rates at zero despite any short-term inflation.

The yield curve trade was the main source of return for the Risk Regime model, which earned +1.0 percent for the month. Meanwhile,...