The Two Sigma fund from Schroder utilizes sophisticated computer systems for the implementation of a model-driven investment approach. Strategy cornerstones include U.S.-based market-neutral equities and global macrotrading strategies.

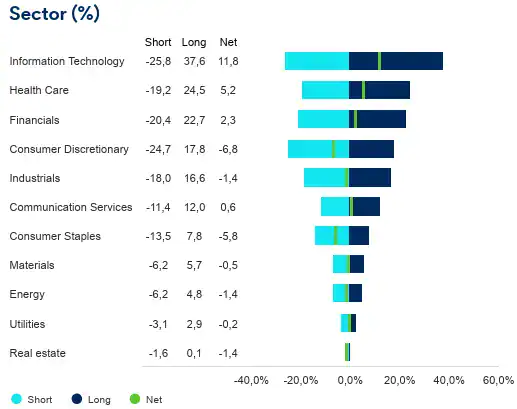

The equity market strategy seeks profit generation through investing in synthetic longs and shorts in undervalued and overvalued stocks. The global macro strategy mixes fundamental and technical models that are poised to reap the benefits of changes in global asset prices.

Marc Azer is the fund manager, and he oversees $480 million in assets under management (AUM). From the May report, the manager reported a 1.3% gain compared to a benchmark 0.4% return. June was slower with negative -0.2% returns, bringing the fund's year-to-date performance to 6.5% while the benchmark is trailing at 1.8%.