Investor Letters

Wondering what the smart money is up to? These hedge fund investor letters will point you in the right direction. We’ve got investor letters from leading and emerging managers around the globe, so you’ll always be up to date on what the smart money is doing. Some of the top hedge managers whose investor letters we cover include big name funds such as Dan Loeb, David Einhorn, “The Big Short” Greg Lippmann, Jeffrey Ubben’s ValueAct Capital, Marc Azer’s Two Sigma; as well as top emerging managers such as Alluvial Fund, Grey Owl Capital, Arquitos Capital, L1 Capital, Khrom Capital, Black Bear Value Fund, Kernow Asset Management, Gator Capital.

NOTE: We are not affiliated with nor do we endorse any funds listed. Stay on top of the latest in hedge fund commentary below. If you would like to see your fund covered please email us at info(@)hedgefundalpha.com. All inquires are confidential. We do not charge any money to cover funds nor do we accept compensation to be listed. We only cover those funds who we think are interesting or enhance the data (although we do not endorse any fund or investing they do). All emails are confidential and your investors will not know you sent us your letter. While we prefer prominent fund managers and top emerging fund managers we will accept other genres. However, your vehicle must be legally registered with FINRA (and if applicable the SEC) or your local equivalent (like the FCA in the UK_ to be considered. Also see our hedge fund database tool here.

This tech-heavy hedge fund is in the green for 2020 despite March selloff

This African hedge fund is outperforming its benchmark

Q1 2020 Hedge Fund Letters Coverage: Singer, Loeb, Carlson, Russo, Lakewood, Maverick, Paul Tudor And Much More [UPDATED 6/25 11:03 EST]

Value Briefs

Value Briefs

Bonhoeffer Fund 1Q20 Commentary: Case Study On This South African Auto Stock

Greenhaven Road Capital 1Q20 Commentary

Hazelton Capital Partners 1Q20 Commentary

New Hedge Fund Launch Blue Eagle Up 7.5% In Its First Ever Quarter Thanks To Short Bets

This top value fund presents theses for Pinterest and Fiverr

Value Briefs

Value Briefs

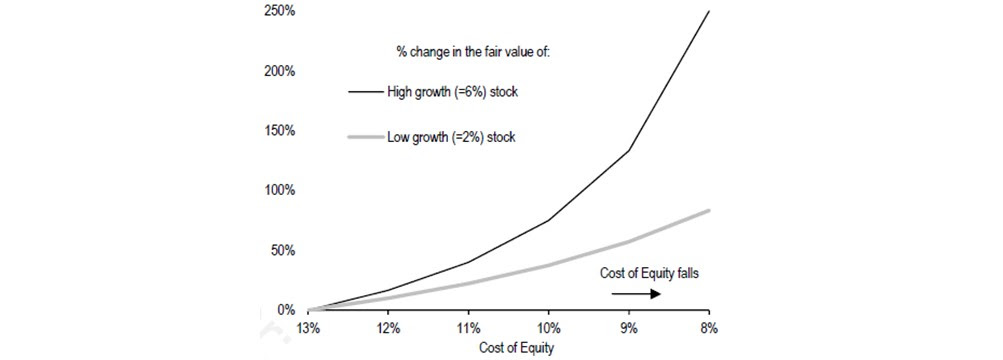

Berkshire Hathaway – Shrinking Its Way To Profitability

Odey suggests government could confiscate gold if this happens

Hedge Fund 13F Round-Up For Q1 2020: Notable Positions And Changes

Value Briefs

Value Briefs

Hedge Funds: Gross Leverage Rose While Net Leverage Fell

Nantahala Capital Management Buys Timeshare Companies To Profit From Market Slump

March was the worst month ever, but April was the best in 9 years says legendary credit fund manager Mitch Julis

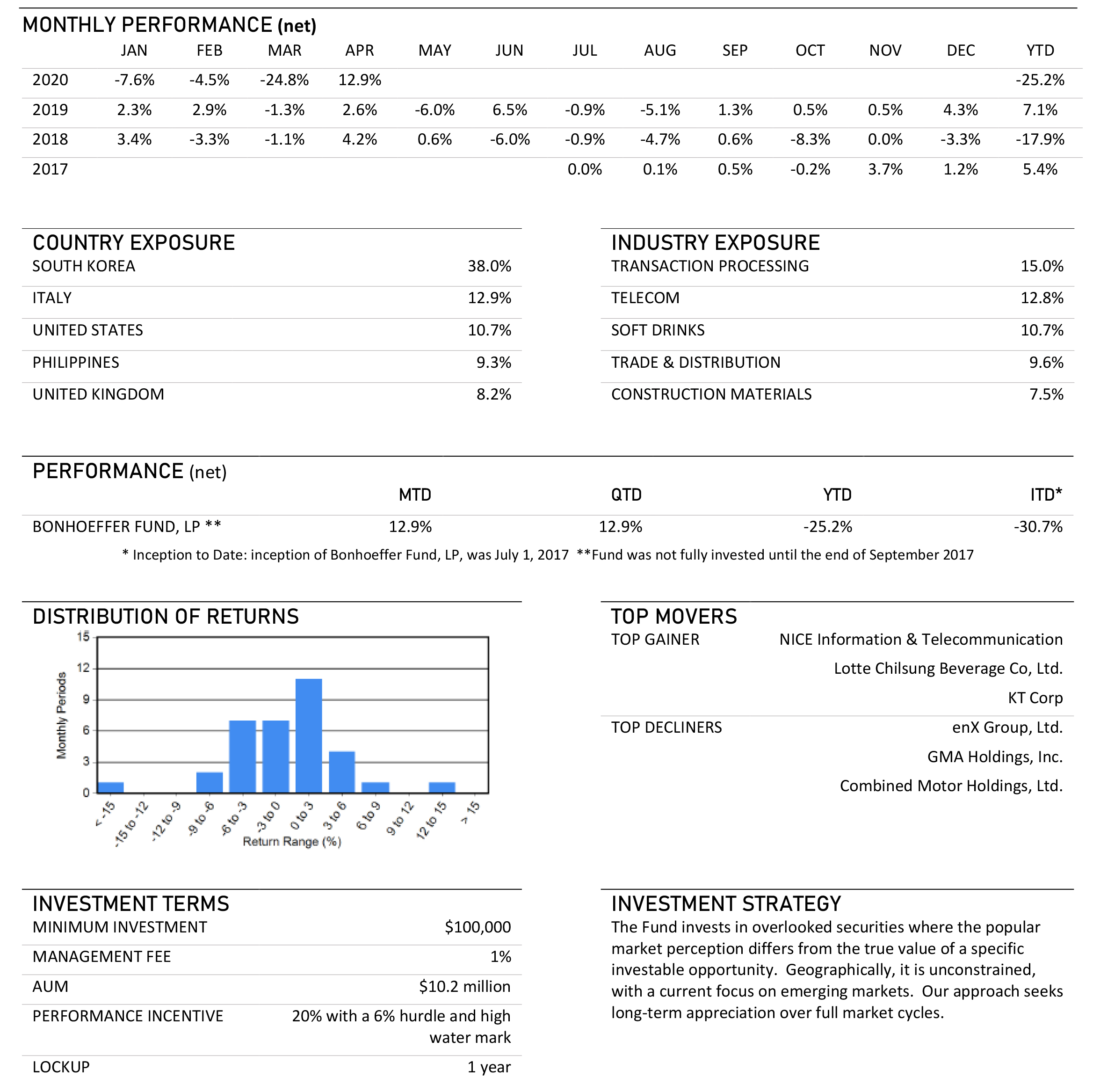

Bonhoeffer Fund April 2020 Performance Update

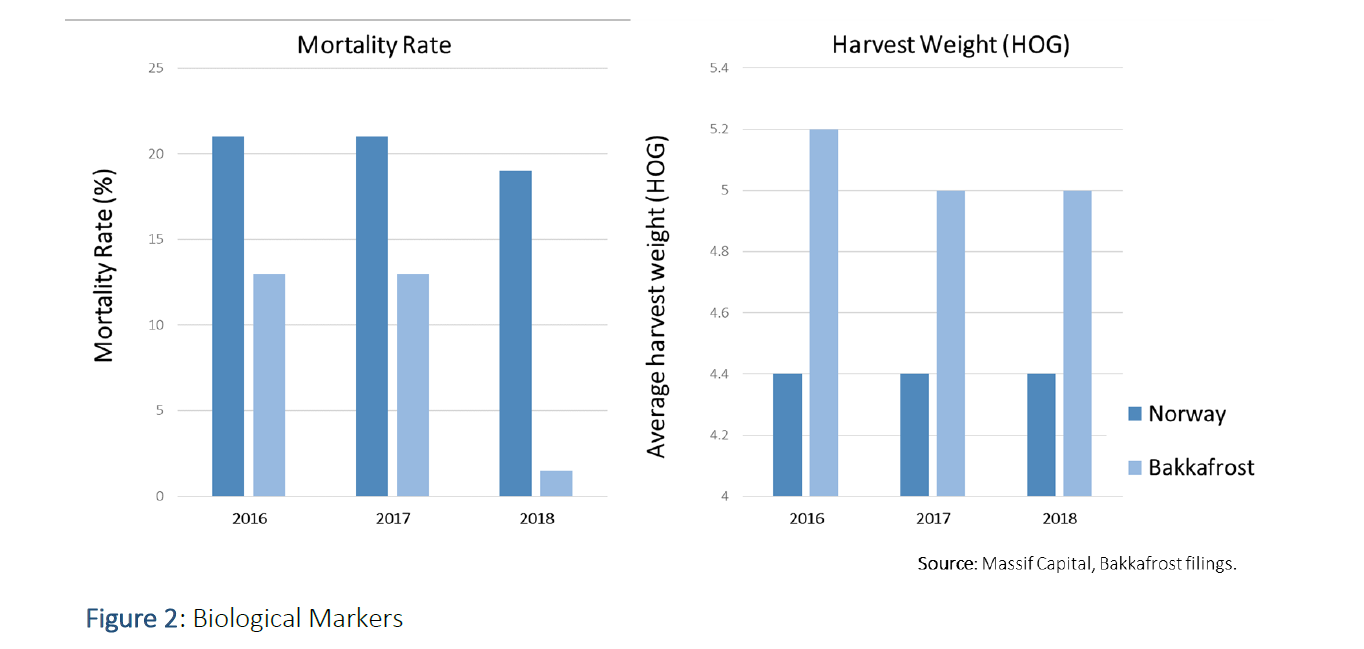

Massif Capital: Long Position In Bakkafrost P/F (BAKKA)

Value Briefs

Value Briefs

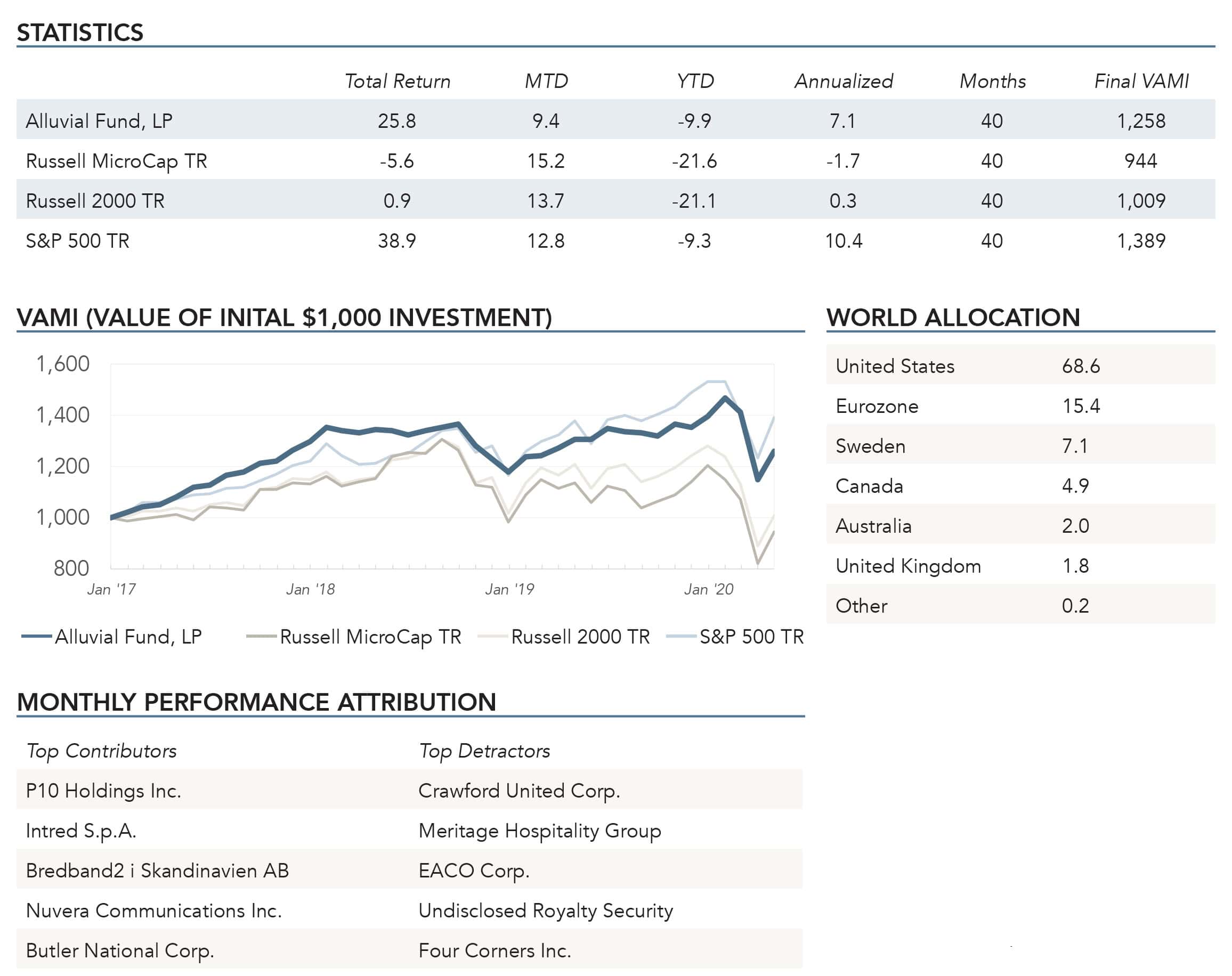

Alluvial Fund April 2020 Commentary: Long this Microcap Apartment Stock

Exclusive: David Einhorn’s fund of funds got killed in Q1