Investor Letters

Here Is What “The World’s Greatest Turkish Equity Analyst” Is Buying: Talas 2020 Letter

Corsair Capital is still winning big with SPACs: Q1 2021 Letter

Mark Leonard: Good Companies Are Not Always Great Stocks

African Markets Bounce Back In January, Only To Reverse The Next 2 Months: Laurium Q1 Letter

The Cheetah Bottleneck

Carlson Capital Thinks The SPAC Boom May Be Over [Q1 Letter]

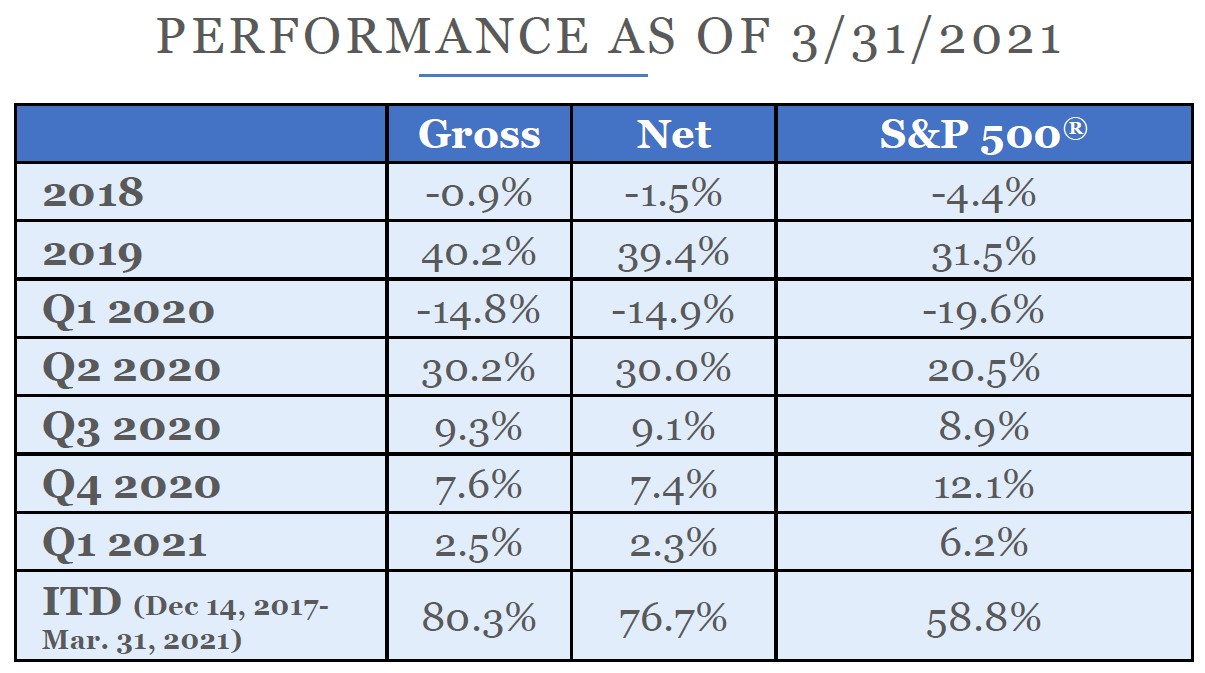

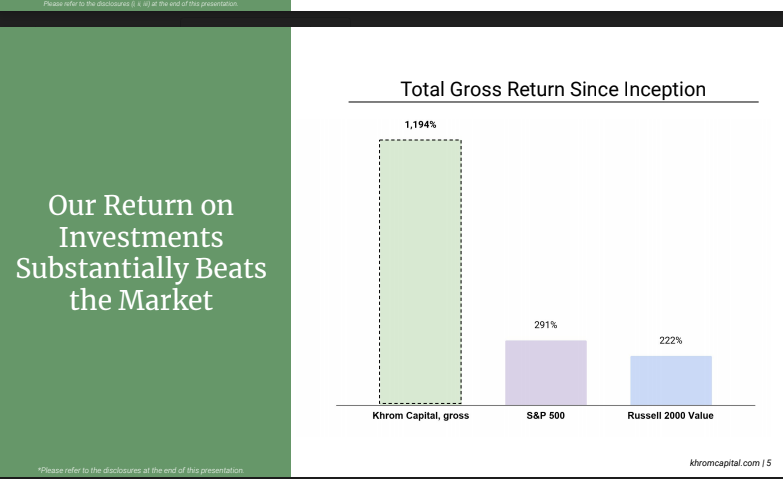

Khrom Capital killed it during the first quarter, continuing its strong track record; here are their favorite stocks

Delbrook Thinks Uranium Miners Could Disappoint

This credit fund was roughly flat for March as negativity continued

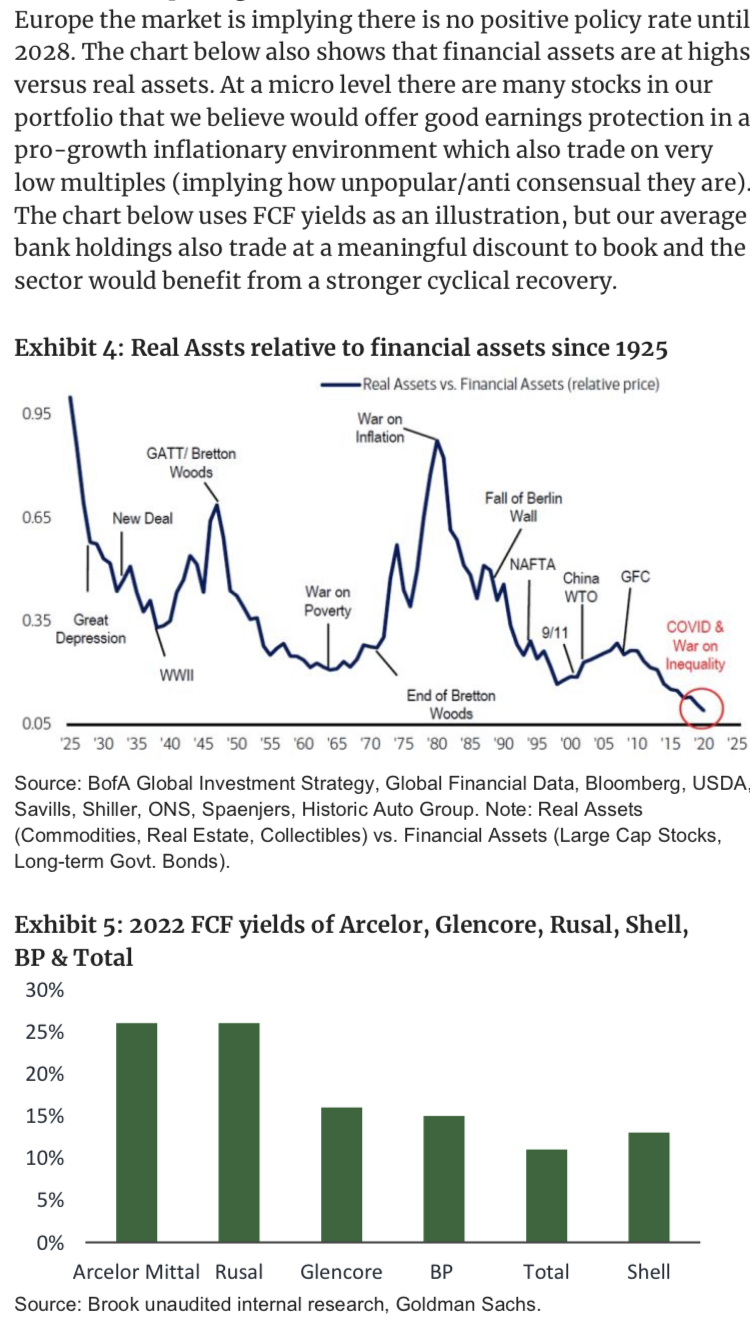

Brook Asset Management had a strong first quarter, is shorting This US education stock [Exclusive]

Despite 60% Loss On Shorts, Yarra Square Up 20% In 2020

David Einhorn: This NJ Deli With One Location And Little Revenue Is Trading At $100M+ Valuation

Arquitos Capital Management March 2021 Performance Update

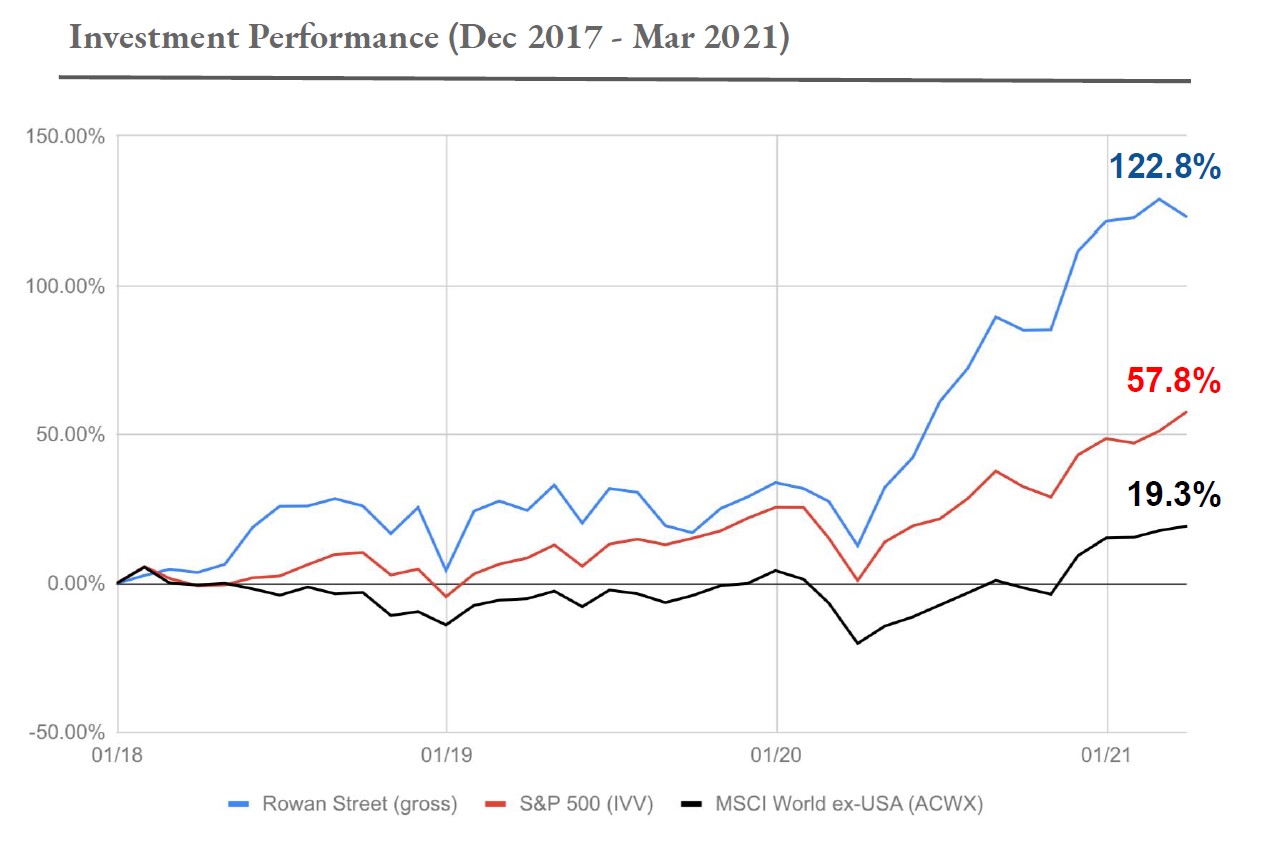

Rowan Street Capital 1Q21 Performance Update

David Einhorn: Has The Tide Turned From Growth to Value?

Michael Mauboussin: MEROI – Bridging Accounting and Valuation

Greenlight breaks even for Q1 after damage to its short book [Full Letter]

The Octopus and The Shark – Broyhill