Investor Letters

This Fund Smashed The S&P 500 In 2020

Bill Gurley: The Absurdity Of Today’s Valuations

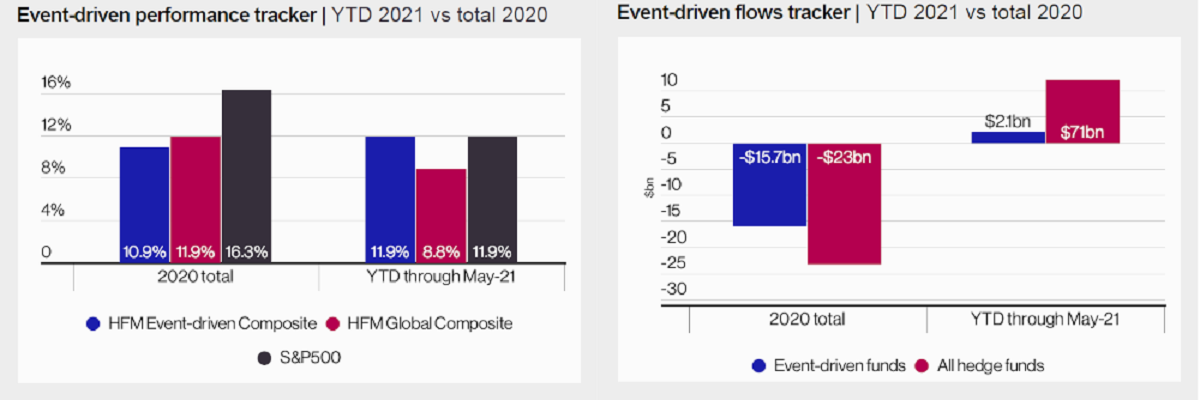

HFM Event-Driven Composite Index Up 11.9% YTD

Carlson Capital Sees Return Of “Goldilocks” Market

Lee Ainslie’s Top 10 Holdings (Q1 2021) – Big Bet On Coupang Inc

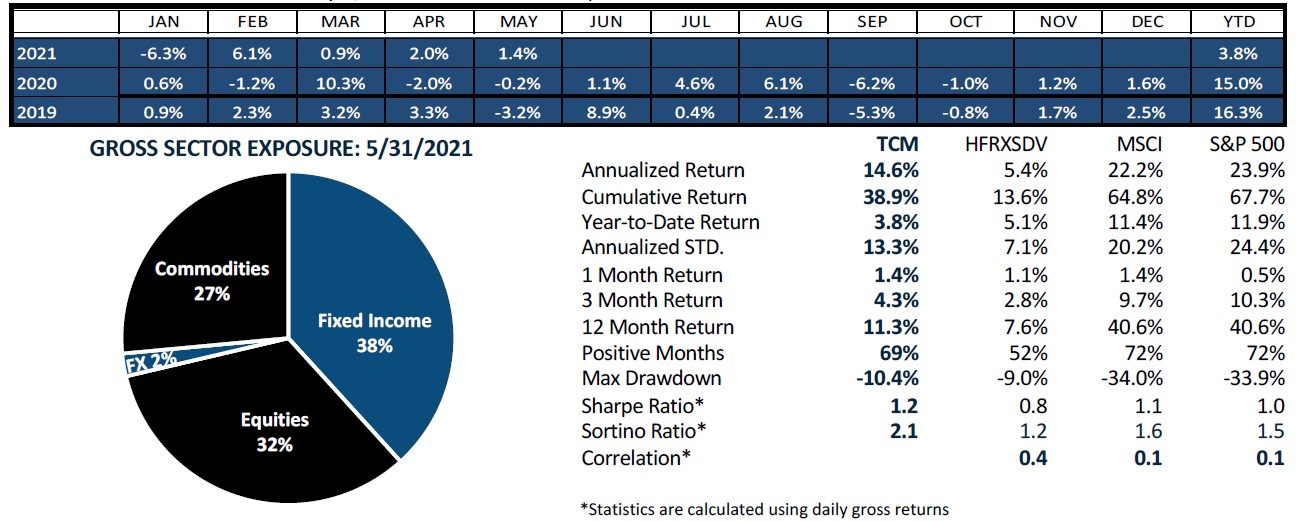

This mining and metals fund is having a strong year so far

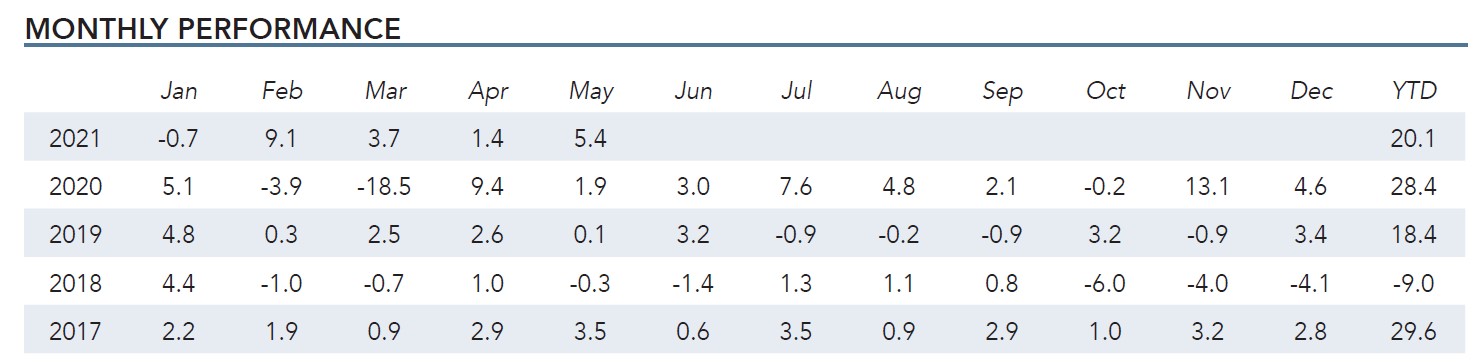

Alluvial Fund May 2021 Performance Update

Michael Burry: The Deleterious Effect Of Permanent Capital Loss On Portfolio Returns Cannot Be Overstated

Odey Special Situations Buys Distell Ahead Of Bidding War

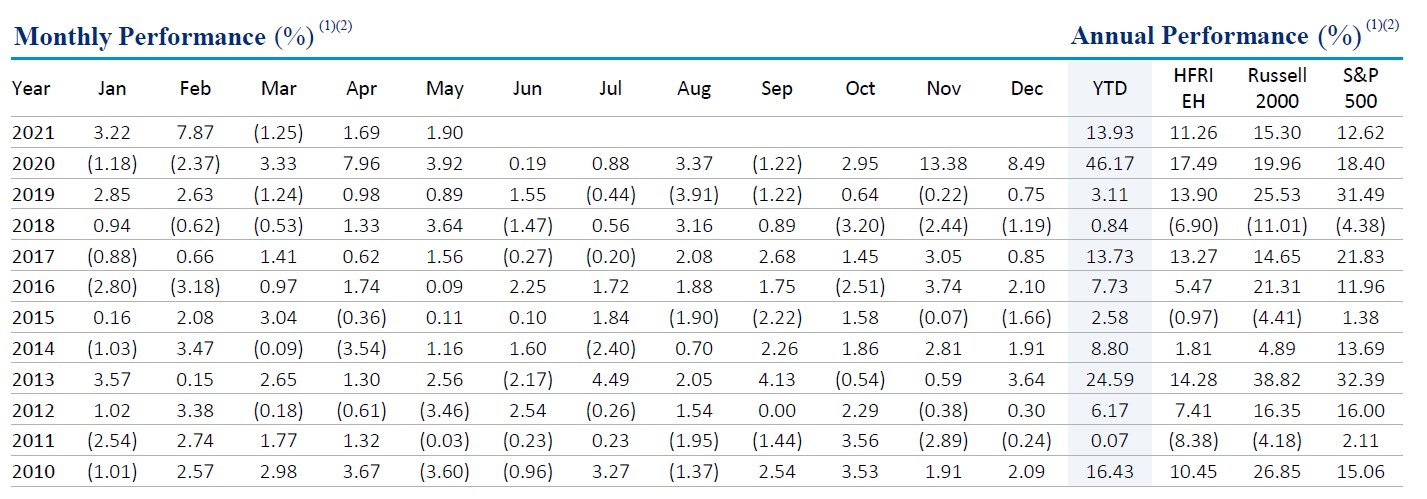

Roubaix Performance Update; YTD Net Return +13.93%

Trident Fund LP May 2020 Commentary

Blue Eagle Struggled in Q1 but expects fundamentals to start mattering

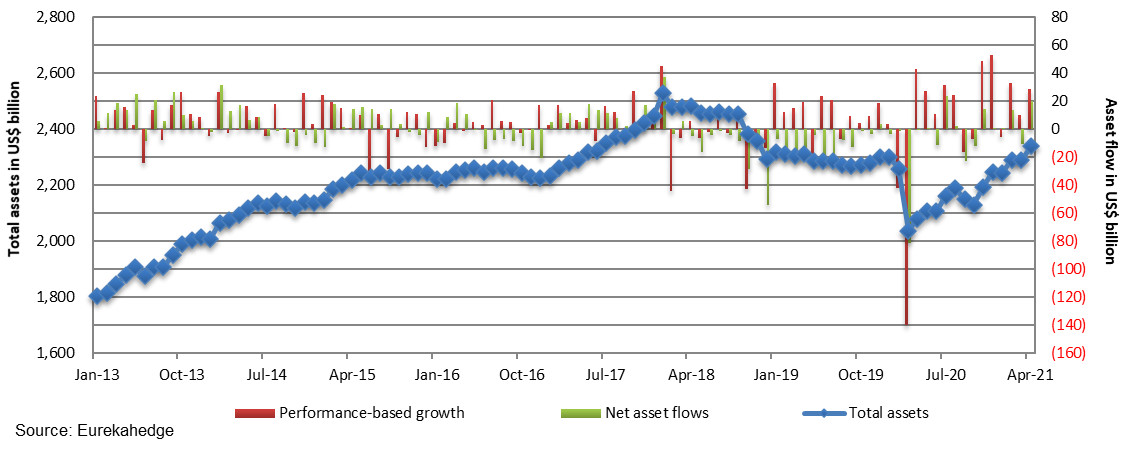

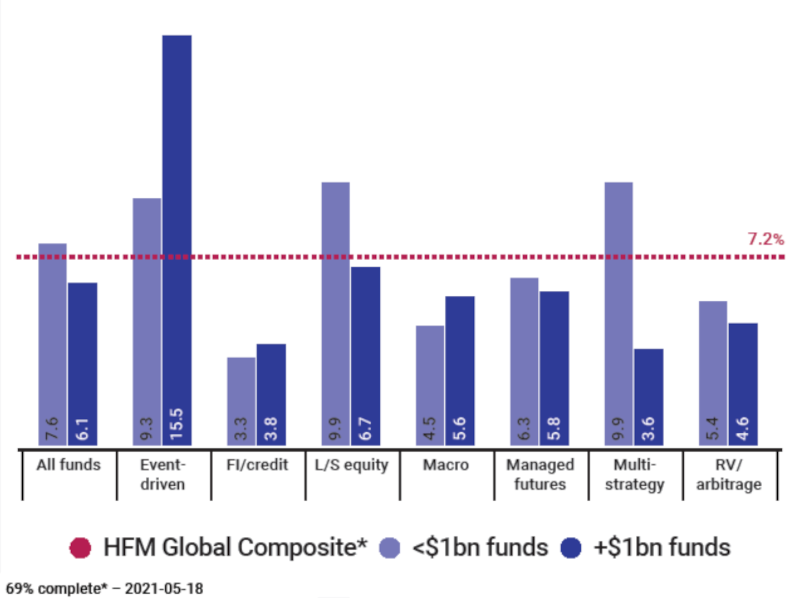

Hedge Fund Managers Were Up 2.16% In April

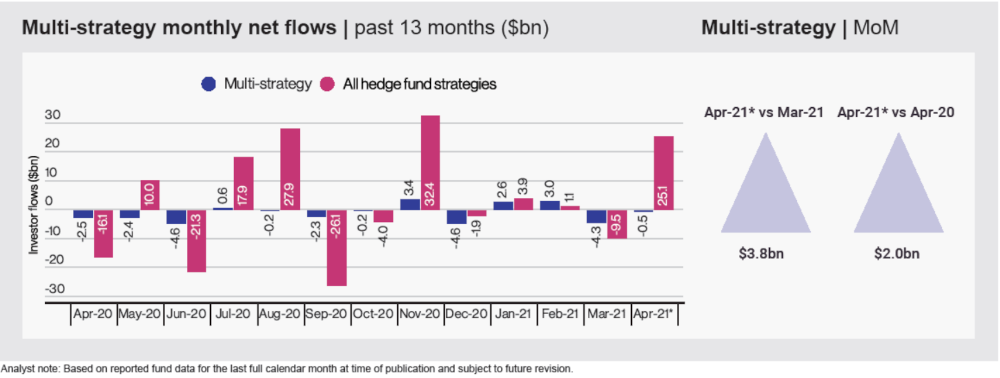

April Gains Fortify A Strong Six Months For Multi-Strategy Hedge Funds

Yost presents its long thesis for this airport food operator [Q1 Letter]

This 20 year old value fund likes gold miners despite the falling gold price

Event-Driven Billion Dollar Hedge Funds Lead Industry Gains Through April

Carlson’s Double Black Diamond fund is winning with these event-driven positions