Investor Letters

This Value Fund Had Some Robust Long Returns But Got Hit By Shorts

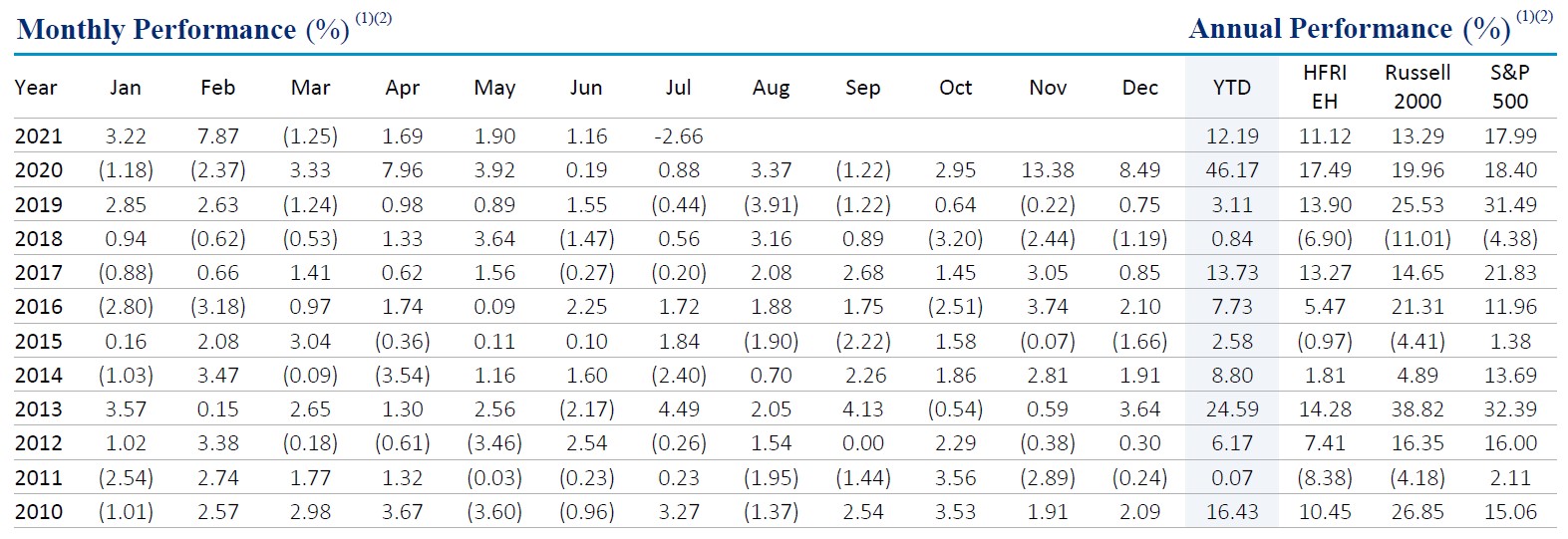

Roubaix Performance Update; YTD Net Return +12.19%

Exclusive: Lee Ainslie’s Maverick Details Thesis For Biotech Sector

This Long/ Short Equity Fund Presents Its Thesis For Ferroglobe

South Point Capital Is Prepared For The End Of Speculative Behavior: Q2 Letter

Hawk Ridge Adds 3.1% In Q2 Sees Value In This Cement Company

EXCLUSIVE: Lee Ainslie’s Maverick Had A Challenging 2Q

This Tiger grand-cub was flat during Q2 but is ready for the return of volatility

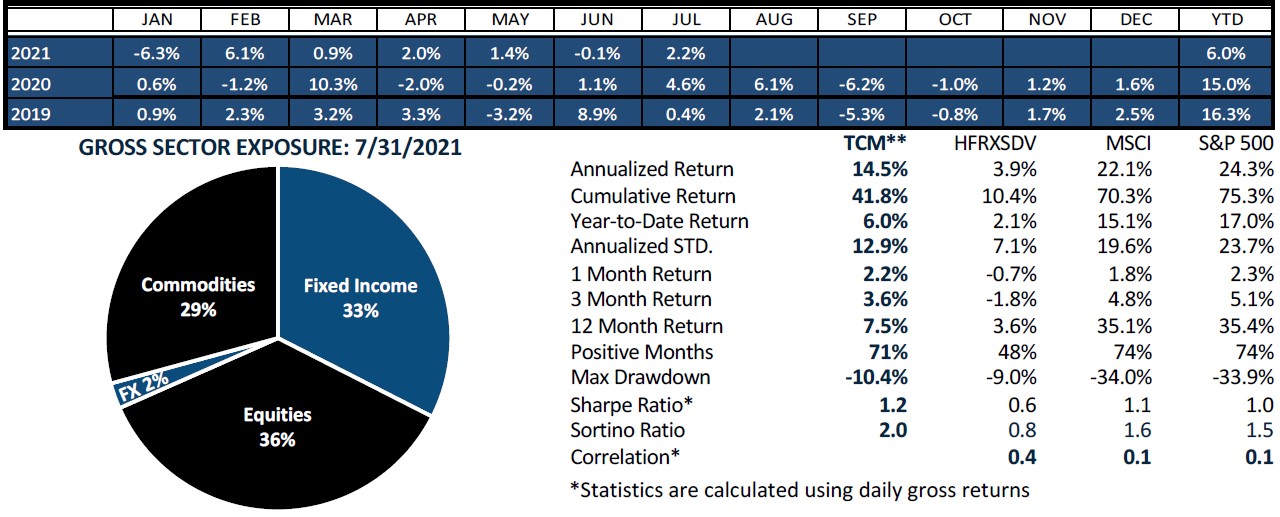

Trident Fund LP July 2021 Commentary

Odey Falls -2.5% In Q2, Bets On Economic Recovery

Michael Burry: Markets Are Anything But Random

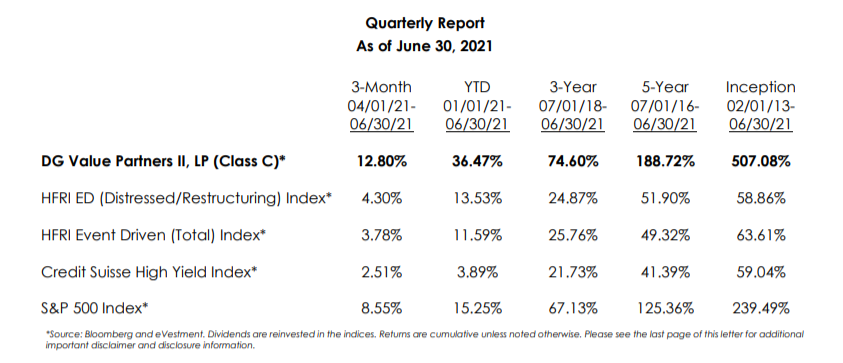

DG Value Adds 36.4% YTD As Distressed Stocks Surge

Carlson Capital’s Double Black Diamond Strategy Gains 5.3% On Jewelry Play

Alkeon: Big Tech Is Only Just Getting Started

Marathon Partners: There Is A “Compelling Opportunity” In US Cannabis

Very Dangerous…

Greenlight Capital Full Q2 2021 Letter: Einhorn Thinks Inflation Is Here To Stay

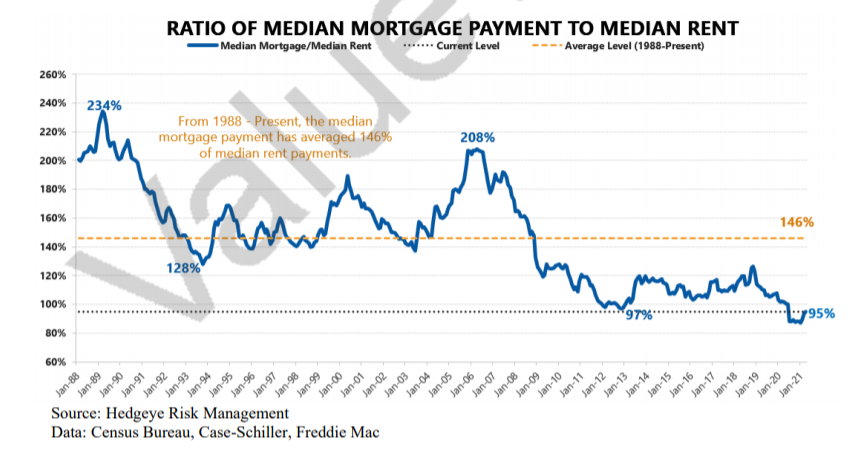

Voss Capital is tapping into the affordable housing shortage