Investor Letters

The Absolute Return October 2021 Commentary: Why Much Wealth Must Be Confiscated

ExodusPoint Warns Investors: Europe Could Be At Its Peak Growth Rate [Exclusive]

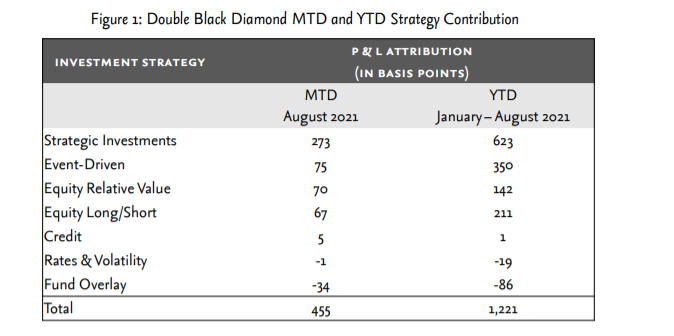

Carlson Capital’s Double Black Diamond Adds 3.3% In August

David Einhorn Top 10 Holdings (Q2 2021)

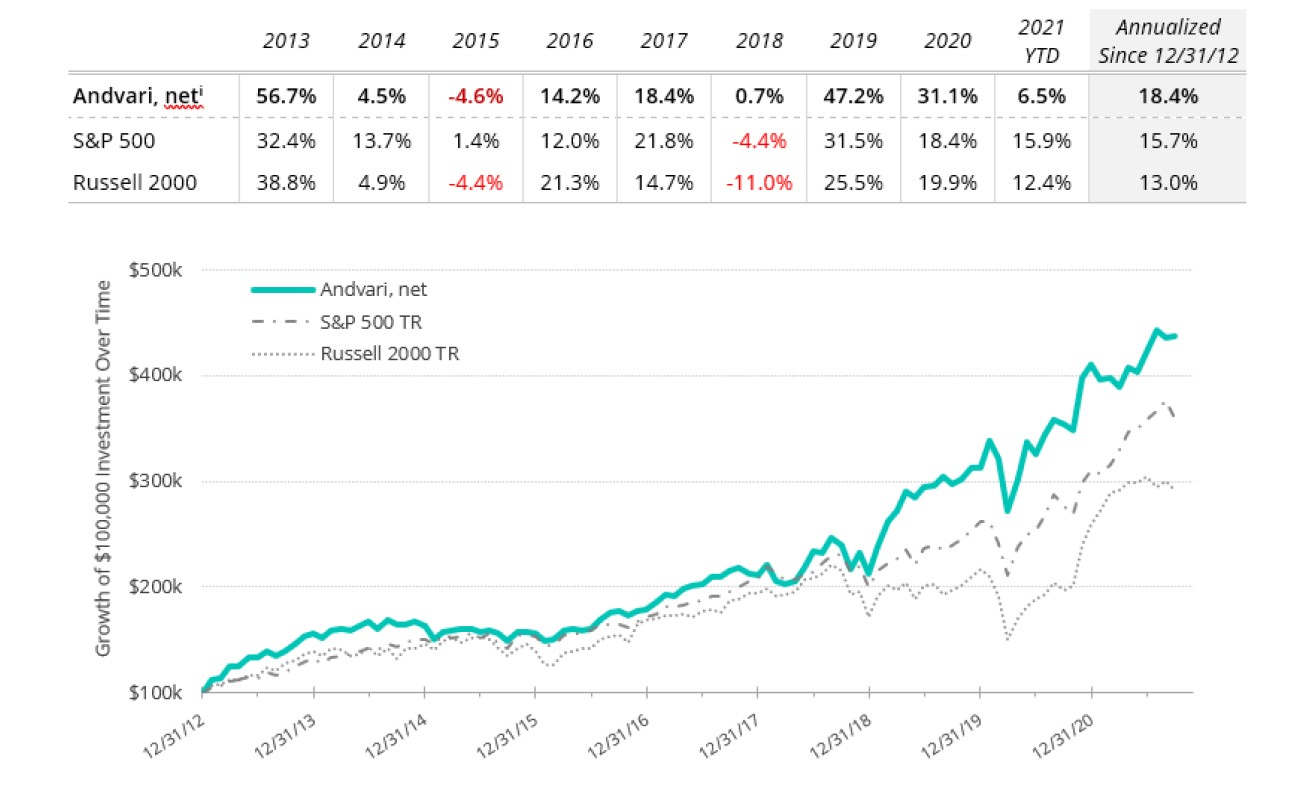

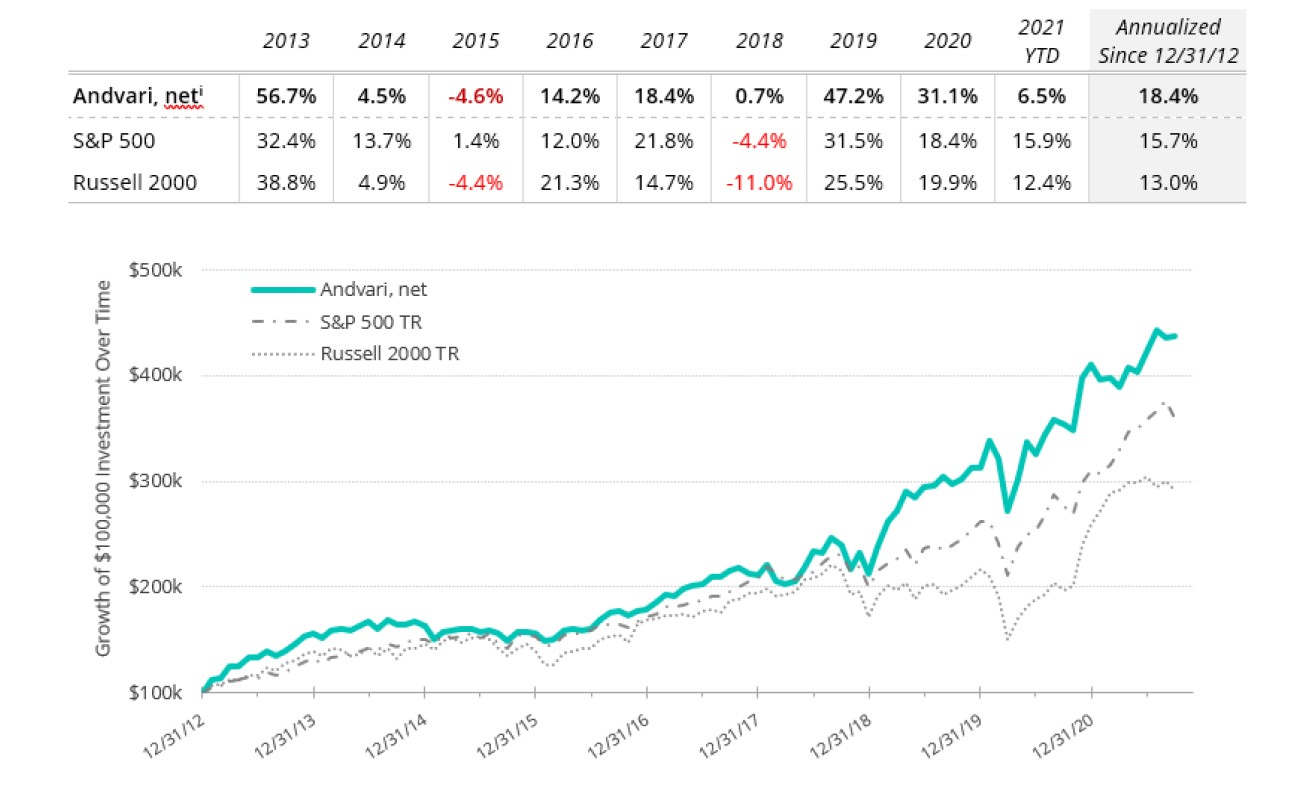

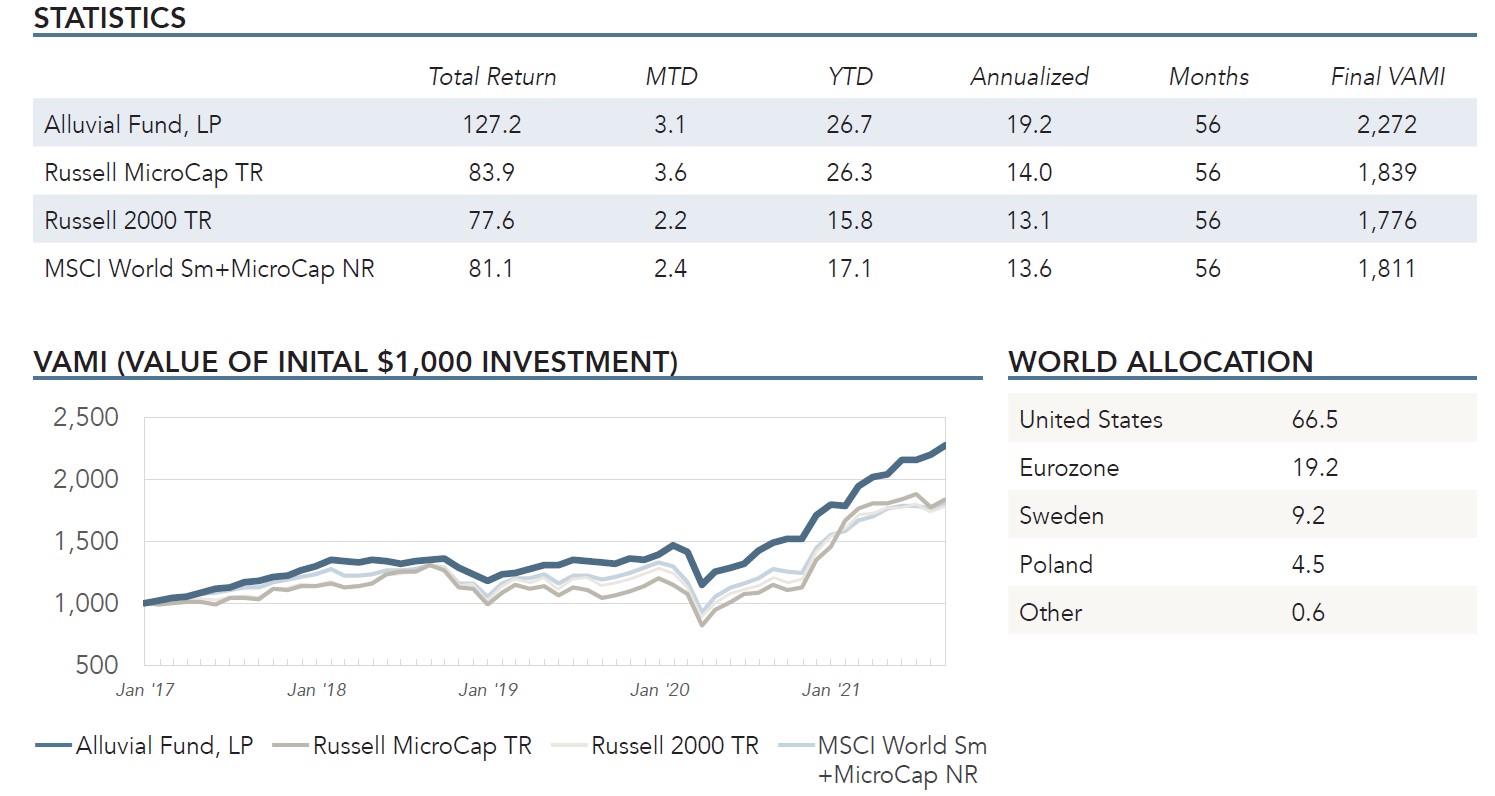

Alluvial Fund August 2021 Performance Update

Terry Smith: Investing In Bitcoin Is Greater Fool Theory

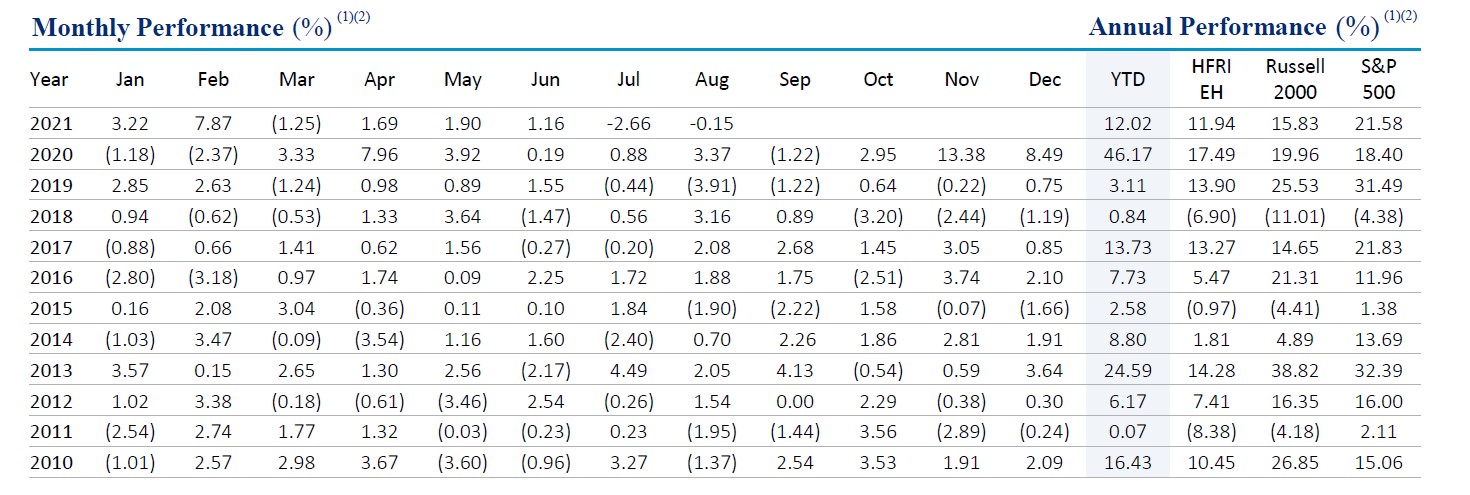

Roubaix August 2021 Update; YTD Net Return +12.02%

Chilton Updates Outlook On Healthcare REITs

Black Bear Value Fund August Performance Update

Odey’s Adrian Courtenay Explains Why Merger Arbitrage Is Such A Good Strategy

This Event-Driven Fund Won In August With The Largest U.S. Cannabis REIT

Giano Capital Adds Cyclical Stocks A “Barometer” Shows Rising Inflation

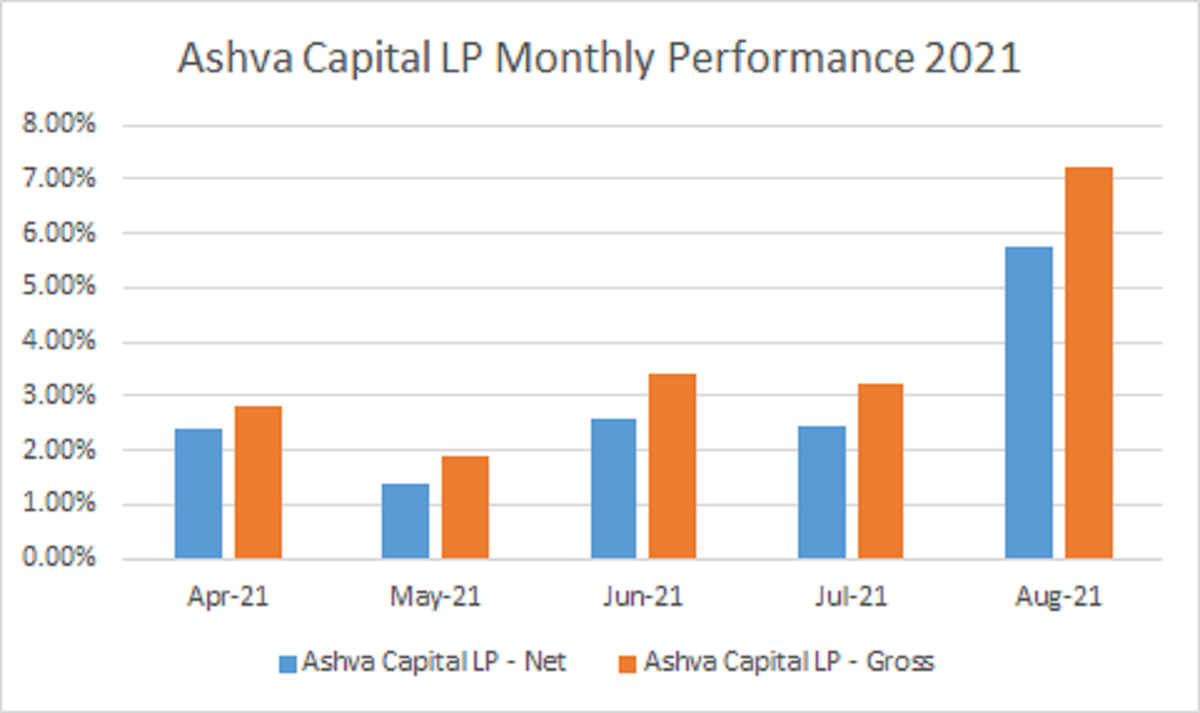

Ashva Capital August 2021 Commentary

Cornwall Capital: The Patient Fat Tail Approach

Value Briefs

Value Briefs

Thomas Russo: Berkshire Has The Least Amount Of Agency Cost Of Any Company I Follow

Liberty Park Capital Up 8.1% With Market-Neutral Strategy; Shorting These Cyclical Stocks

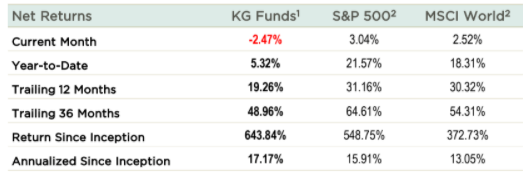

KG Investments Underperforms As Alibaba Drags [Exclusive]

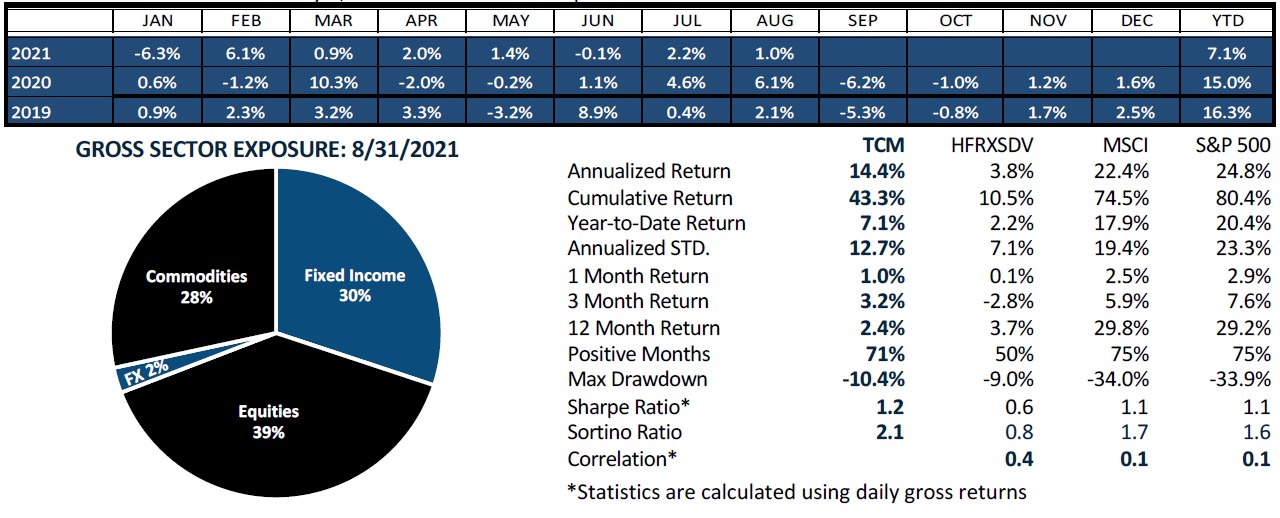

Trident Fund LP August 2021 Performance Update