Investor Letters

McIntyre Partnerships: Hedging Inflation While Looking For The “Fat Pitch”

Clint Carlson Is “Definitely Bearish” On Stocks, Says “Don’t Fight The Fed” [Exclusive]

David Einhorn’s Greenlight Capital Outperforms As Inflation Bets Pay Off [Full Letter]

Performing Capital Profits From Small Caps Creating Value

Carl Icahn’s Open Letter To Southwest Gas Stockholders

Why Does Volatility React So Differently To Crises? This Fund Manager Has An Answer

Carlson Fund Benefits From Robust M&A Activity Despite Other Event-Driven Weakness [Exclusive]

Exodus Point Tells Investors How It Will Profit Off Rising Inflation [Exclusive]

Carlson Capital Believes Rising Rates Present A Severe Challenge For Investors [Exclusive]

Cliff Asness: FOMO Means Investors Can’t Tell You About Their Losers

Where Do Returns Really Come From?

Prem Watsa: How To Find Companies That Can Survive For 100 Years

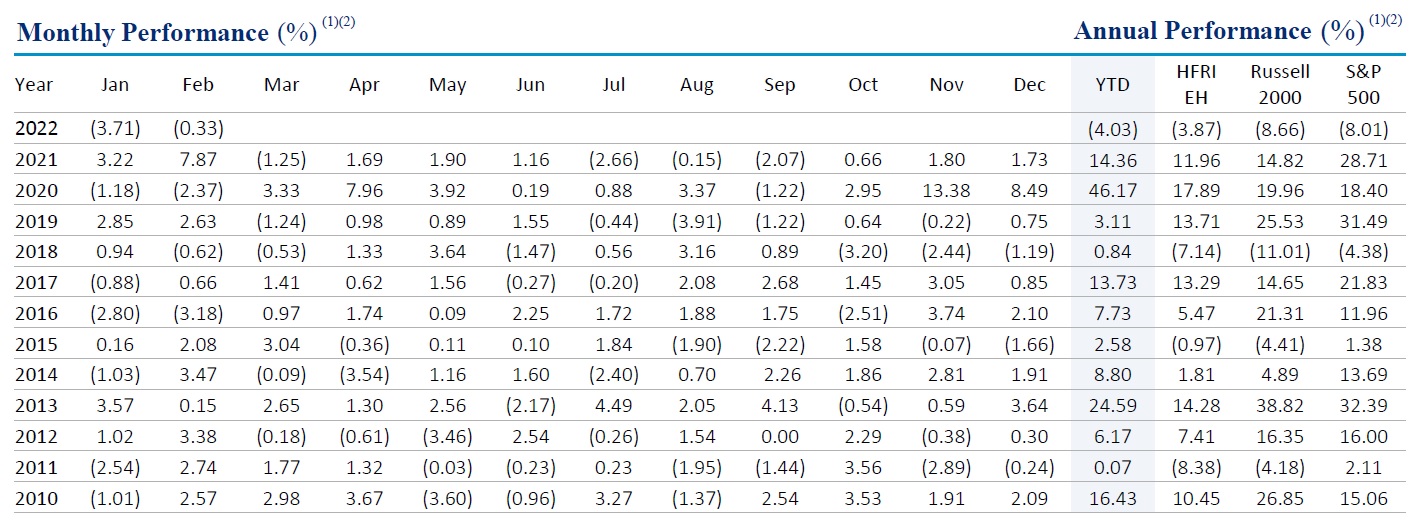

Roubaix Fund Composite February 2022 Performance Update

This Options-Focused Fund Developed A New Strategy That Performs Well In Multiple Rotations

Warren Buffett: We Find Little That Excites Us!

Odey Special Situations Fund Outperforms In Tough Month For Equities

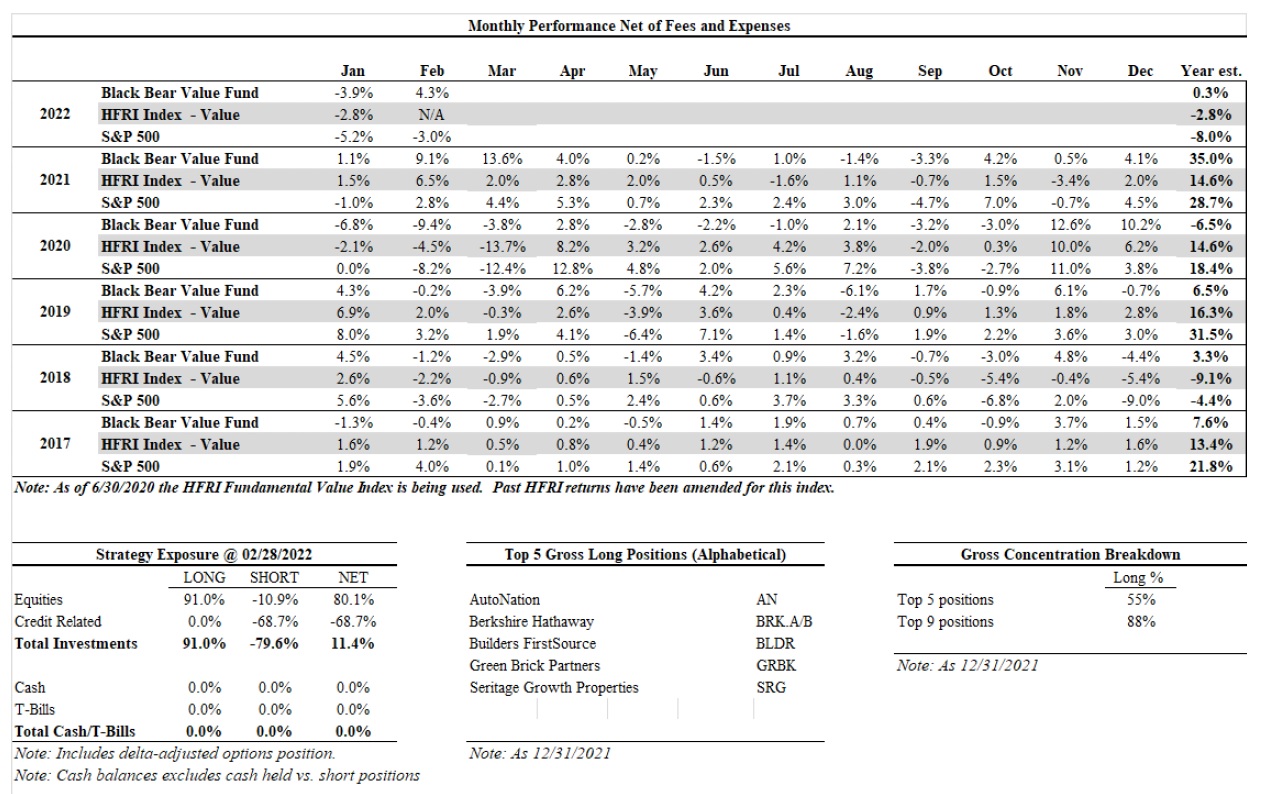

Black Bear Value Partners February 2022 Update

Howard Marks: Find An Asset, Or An Asset Class, That Looks Scary From The Outside