Investor Letters

Bill Ackman: The Fund Manager’s Dilemma

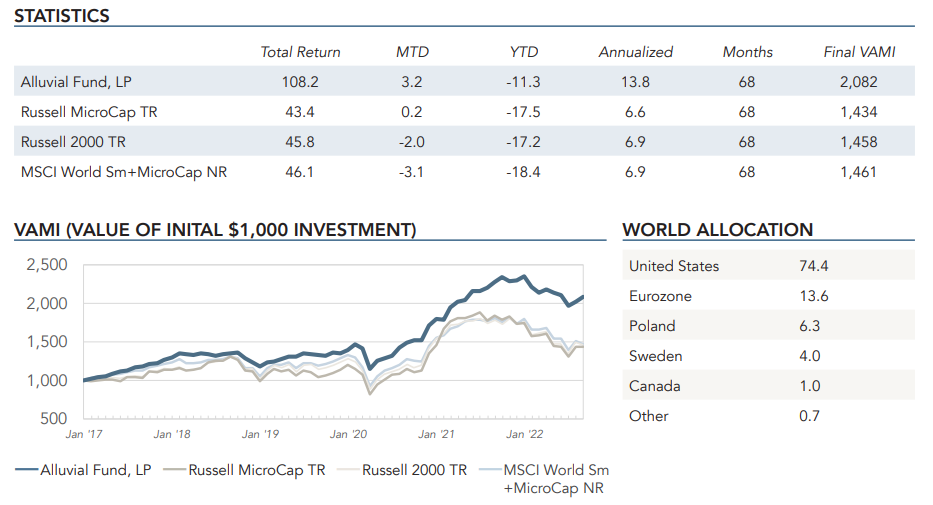

Alluvial Fund August 2022 Performance Update

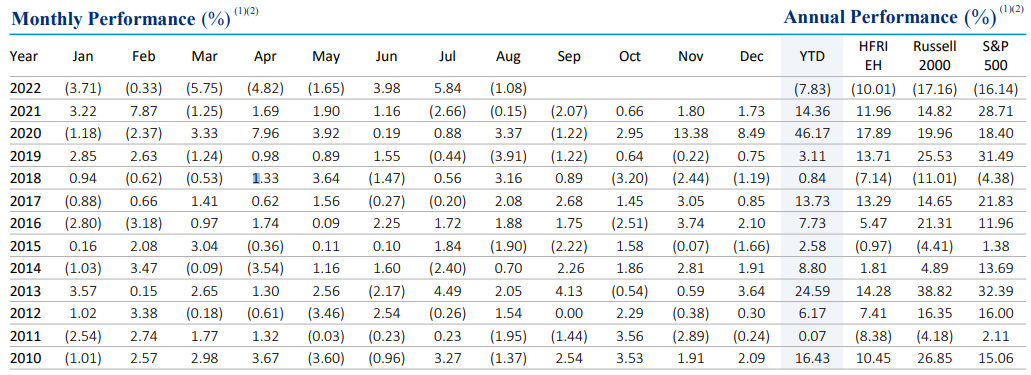

Roubaix Fund Composite August 2022 Performance Update

Black Bear Value Fund August 2022 Update

Strubel Investment Management: September 2022 Newsletter

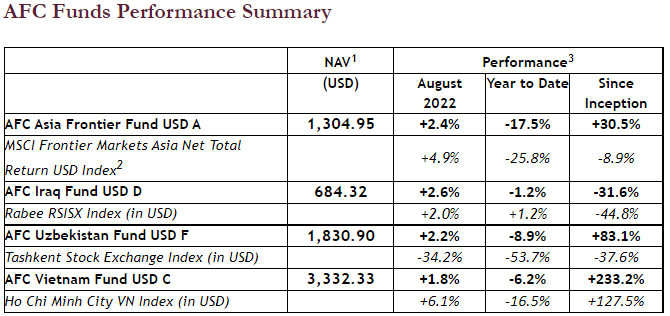

Asia Frontier Capital (AFC) – August 2022 Newsletter

New Memo from Howard Marks: The Illusion of Knowledge

DG Value Finds Attractive Bargains In The Rubble [Exclusive]

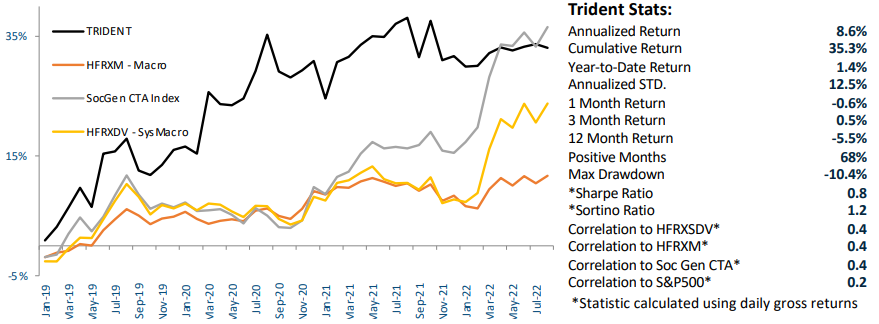

Trident Fund LP August 2022 Performance Update

This Odey Fund Is Tapping Multiple Dislocations Around The Energy Crisis And Winning Big [Exclusive]

Odey’s Special Situations Fund hit a home run with energy stocks in August [Exclusive]

Arquitos Capital Management 2Q22 Commentary

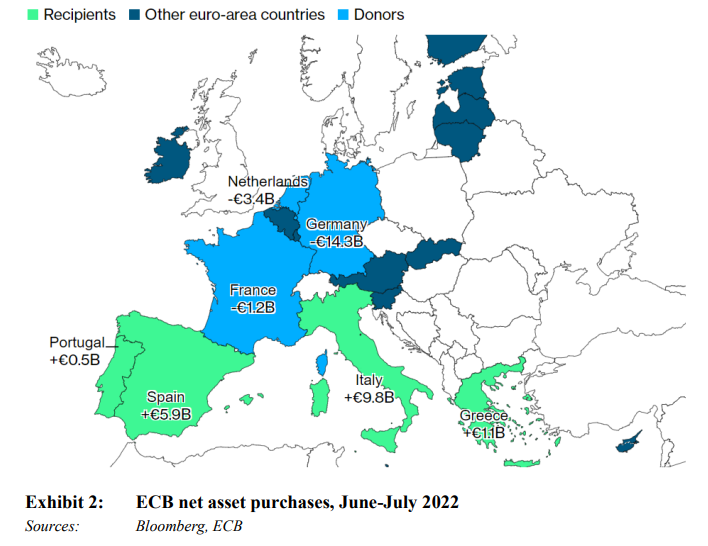

Absolute Return Partners September 2022: The House of Cards

GreenWood Investors 2Q22 Letter: The Use Of Adversity

GreenHaven Road Partners Fund 2Q22 Commentary

Greenhaven Road Capital 2Q22 Commentary

Hedge Fund Alpha’s September 2022 Hedge Fund Update: Tiger Global Reshuffles Team After Tech Losses

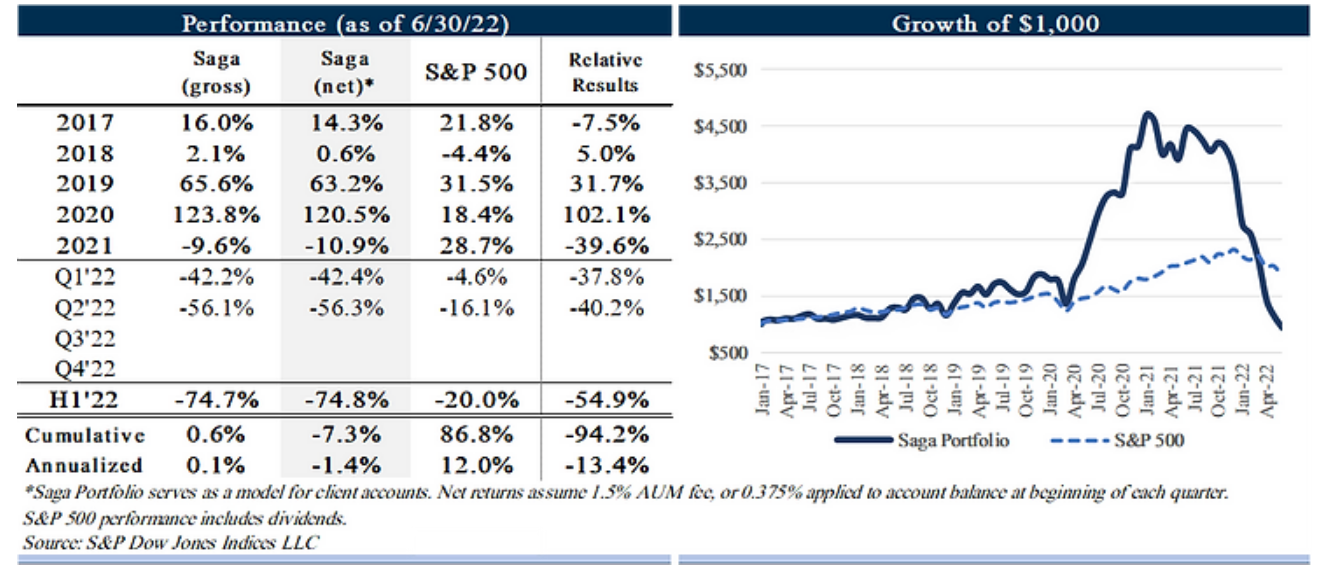

Saga Partners 2Q22 Performance Update