Investor Letters

Sandon Capital Activist Fund March 2025 Commentary

Vltava Fund Q1 2025 Commentary: Is The Stock Market A Casino?

Today’s Sell-Off – Global Return Value Investments

GDS Investments February 2025 Client Note

Silver Beech Capital Q4 2024 Commentary

Exclusive Insights

Exclusive Insights

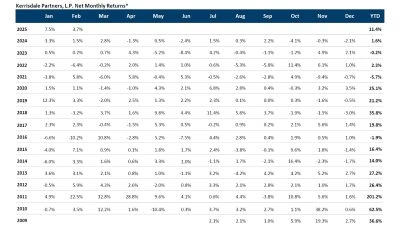

Kerrisdale Capital Continues Their Winning Streak In February

Exclusive Insights

Exclusive Insights

‘The Big Short’ Greg Lippmann Agrees With Scott Bessent’s That Wall Street’s Reign Is Ending [Exclusive]

Semper Augustus Investments Q4 2024 Commentary

Exclusive Insights

Exclusive Insights

Fifth Hill Capital: Trump Return Didn’t Boost Small-Caps; Value Underperformed to Growth Stocks

Exclusive Insights

Exclusive Insights

Up 12 Percent in 2024, ‘The Big Short’ Greg Lippmann Still Likes Solar PPAs [Exclusive]

Auscap Asset Management February 2025 Commentary

Exclusive Insights

Exclusive Insights

DG Capital Rides High in 2025 With Gains In Anterix And Burford Capital

Exclusive Insights

Exclusive Insights

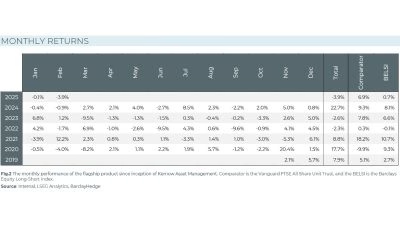

Svelland Capital Delivered 11.12% in 2024; Keeping Strong in January With 0.79% Gain [January Commentary]

Broyhill Asset Management Q1 2025 Commentary

Exclusive Insights

Exclusive Insights

Hedge Funds Are Snapping Up Shares of this “BadCo” Howard Hughes Spinoff

TMR Capital Q4 2024 Commentary

Exclusive Insights

Exclusive Insights

Third Point Sold Its Full Stakes Danaher, Thermo Fisher, Tesla and Cinemark in February [Exclusive]

Exclusive Insights

Exclusive Insights

Kerrisdale Capital Wins Big in January