Investor Letters

Wondering what the smart money is up to? These hedge fund investor letters will point you in the right direction. We’ve got investor letters from leading and emerging managers around the globe, so you’ll always be up to date on what the smart money is doing. Some of the top hedge managers whose investor letters we cover include big name funds such as Dan Loeb, David Einhorn, “The Big Short” Greg Lippmann, Jeffrey Ubben’s ValueAct Capital, Marc Azer’s Two Sigma; as well as top emerging managers such as Alluvial Fund, Grey Owl Capital, Arquitos Capital, L1 Capital, Khrom Capital, Black Bear Value Fund, Kernow Asset Management, Gator Capital.

NOTE: We are not affiliated with nor do we endorse any funds listed. Stay on top of the latest in hedge fund commentary below. If you would like to see your fund covered please email us at info(@)hedgefundalpha.com. All inquires are confidential. We do not charge any money to cover funds nor do we accept compensation to be listed. We only cover those funds who we think are interesting or enhance the data (although we do not endorse any fund or investing they do). All emails are confidential and your investors will not know you sent us your letter. While we prefer prominent fund managers and top emerging fund managers we will accept other genres. However, your vehicle must be legally registered with FINRA (and if applicable the SEC) or your local equivalent (like the FCA in the UK_ to be considered. Also see our hedge fund database tool here.

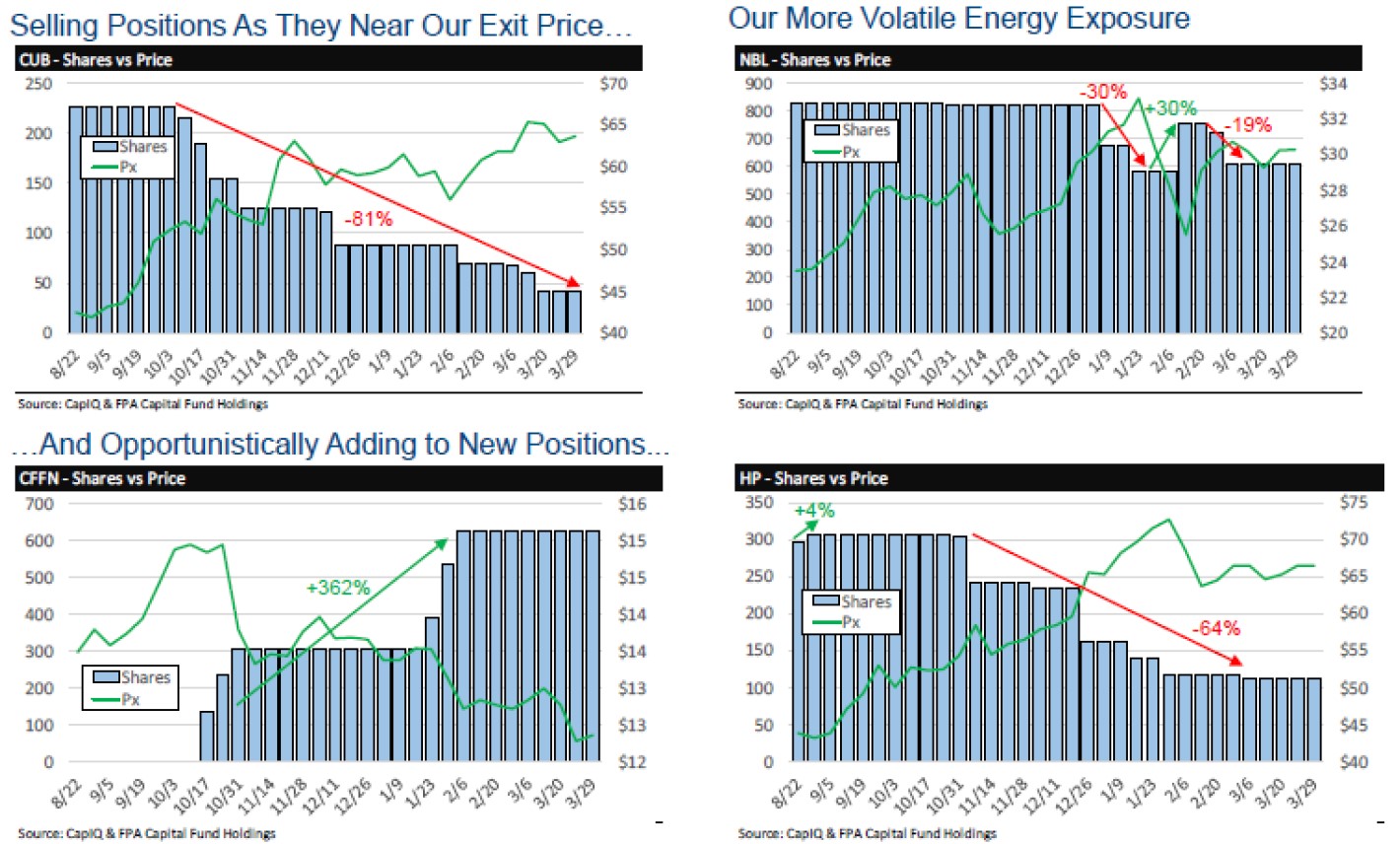

FPA Capital Fund 1Q18 Commentary – Be more nimble, avoid position inertia, Differentiate between long-term and opportunistic investments

Corsair Capital Management Exits Colony Northstar After Difficult Q1

James Montier: “Finance Has Turned The Art Of Transforming The Simple Into The Perplexing Into An Industry”

Old School Value Nugget Fest (Apr 25th Edition)

Value Briefs

Value Briefs

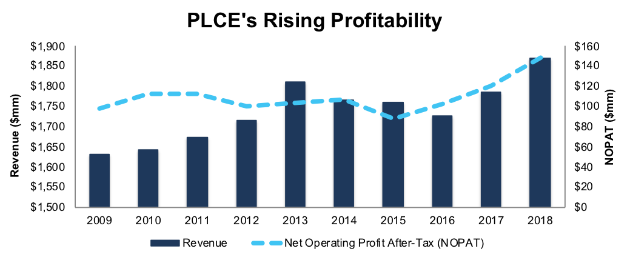

Childrens Place Inc (PLCE) Analysis

Value Briefs

Value Briefs

Top 10 Managed Futures Programs In March

Lakewood Capital’s Shorts JOBS Act IPO

Lakewood Capital Shorts Include Ligand, iRhythm, Tesla, Celltrion, Aurora Cannabis, PRA Group and Canopy Growth

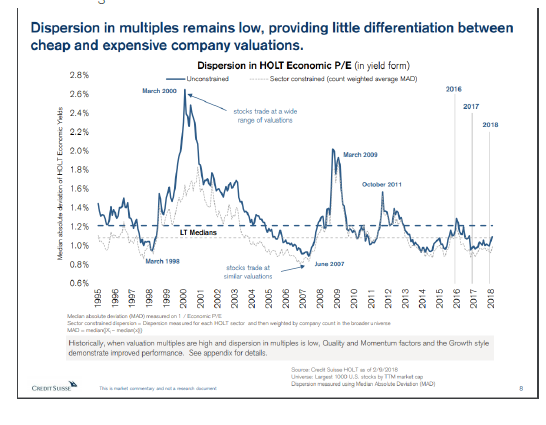

Gator Capital On Where To Find Alpha Right Now

Crispin Odey “At Last” Profiting As Market Drops; Details Bank Short

Seth Klarman On FAANG, Leverage, Discipline, Value Investing, Bitcoin, Disruption, Softbank, Reading And More

Farnam Street Q1: Lobsters, Buddhism, and Warren Buffett

Madera Main Fund Up 55% In 17, Gains 73% In Q1’18 – Details The Tech Revolution

Locust Wood Is Loving This Market Volatility

Seth Klarman Warns About Accelerating Disruption

Gator Financial: Uncovering Value In Financials

David Einhorn FULL Q1 Letter

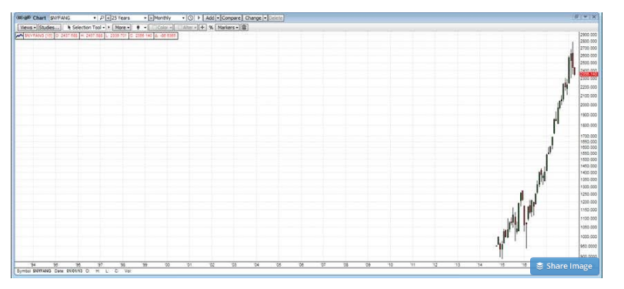

FANG vs The Market

Value Briefs

Value Briefs