Investor Letters

Wondering what the smart money is up to? These hedge fund investor letters will point you in the right direction. We’ve got investor letters from leading and emerging managers around the globe, so you’ll always be up to date on what the smart money is doing. Some of the top hedge managers whose investor letters we cover include big name funds such as Dan Loeb, David Einhorn, “The Big Short” Greg Lippmann, Jeffrey Ubben’s ValueAct Capital, Marc Azer’s Two Sigma; as well as top emerging managers such as Alluvial Fund, Grey Owl Capital, Arquitos Capital, L1 Capital, Khrom Capital, Black Bear Value Fund, Kernow Asset Management, Gator Capital.

NOTE: We are not affiliated with nor do we endorse any funds listed. Stay on top of the latest in hedge fund commentary below. If you would like to see your fund covered please email us at info(@)hedgefundalpha.com. All inquires are confidential. We do not charge any money to cover funds nor do we accept compensation to be listed. We only cover those funds who we think are interesting or enhance the data (although we do not endorse any fund or investing they do). All emails are confidential and your investors will not know you sent us your letter. While we prefer prominent fund managers and top emerging fund managers we will accept other genres. However, your vehicle must be legally registered with FINRA (and if applicable the SEC) or your local equivalent (like the FCA in the UK_ to be considered. Also see our hedge fund database tool here.

Investor satisfaction with Hedge fund fees is not improving and other stuff you need to know in the industry

McIntyre Partnerships 4Q18 Commentary: Long Small Cap Financials

Michael Burry – Top 10 Holdings Q42018

SAGA Partners 4Q18 Commentary: Long This Canadian Midcap

Coho Capital 2018 Letter: Netflix Is The “Cable Cowboy for the Streaming Age”

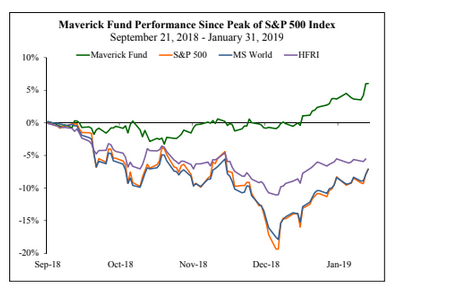

Maverick Capital Celebrates 25th Year With Investor Letter Discussing “When Preserving Capital Is Wiser Than Growing It”

Exclusive – Blue Mountain Doubles Down On Credit Exposure After Mixed 2018 And Insistence That PG&E Is “Solvent”

Left Brain Capital Appreciation Master Fund January 2019 Update Up 26% In January

Michael Mauboussin: Who Is On The Other Side?

This Fixed-Income Giant Was Flat In December But Outperformed In 2018

Hedge Fund 13F Round-Up For Q4 2018

Ray Dalio – Top 10 Holdings

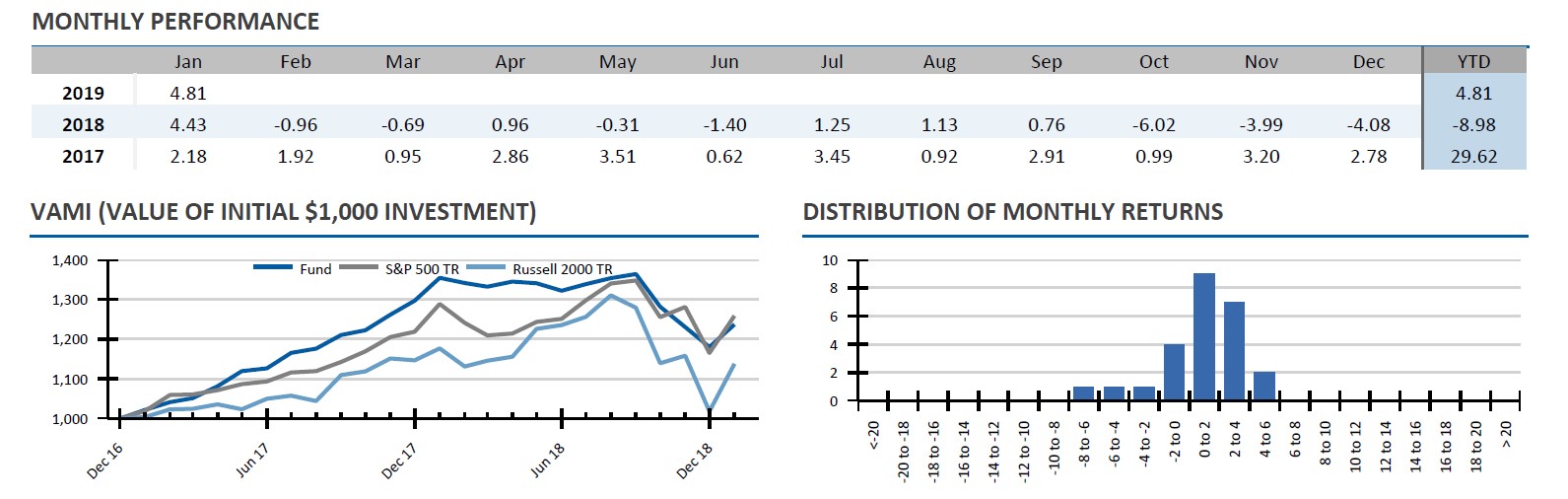

Alluvial Fund January 2019 Partnership Update

Nantahala Capital Comes Out On Top With 19% Return In 2018 Using Under The Radar Stocks

Pershing Square 2018 Annual Presentation “Creating Value Through Activism”

Royce Funds 2018 Annual Letter: Using The Downturn To Find Opportunities

Avenir Global Fund 4Q18 Commentary: Hong Kong Firm With Prior Audit Trouble Is Big Winner

Black Bear Value Fund January 2019 Update