Investor Letters

Wondering what the smart money is up to? These hedge fund investor letters will point you in the right direction. We’ve got investor letters from leading and emerging managers around the globe, so you’ll always be up to date on what the smart money is doing. Some of the top hedge managers whose investor letters we cover include big name funds such as Dan Loeb, David Einhorn, “The Big Short” Greg Lippmann, Jeffrey Ubben’s ValueAct Capital, Marc Azer’s Two Sigma; as well as top emerging managers such as Alluvial Fund, Grey Owl Capital, Arquitos Capital, L1 Capital, Khrom Capital, Black Bear Value Fund, Kernow Asset Management, Gator Capital.

NOTE: We are not affiliated with nor do we endorse any funds listed. Stay on top of the latest in hedge fund commentary below. If you would like to see your fund covered please email us at info(@)hedgefundalpha.com. All inquires are confidential. We do not charge any money to cover funds nor do we accept compensation to be listed. We only cover those funds who we think are interesting or enhance the data (although we do not endorse any fund or investing they do). All emails are confidential and your investors will not know you sent us your letter. While we prefer prominent fund managers and top emerging fund managers we will accept other genres. However, your vehicle must be legally registered with FINRA (and if applicable the SEC) or your local equivalent (like the FCA in the UK_ to be considered. Also see our hedge fund database tool here.

Hound Partners Short Book Helps Lift Fund To 23.4% Return In H1

Viking Global Wins On Illiquid Positions In Q2: Looks To Hire Analysts

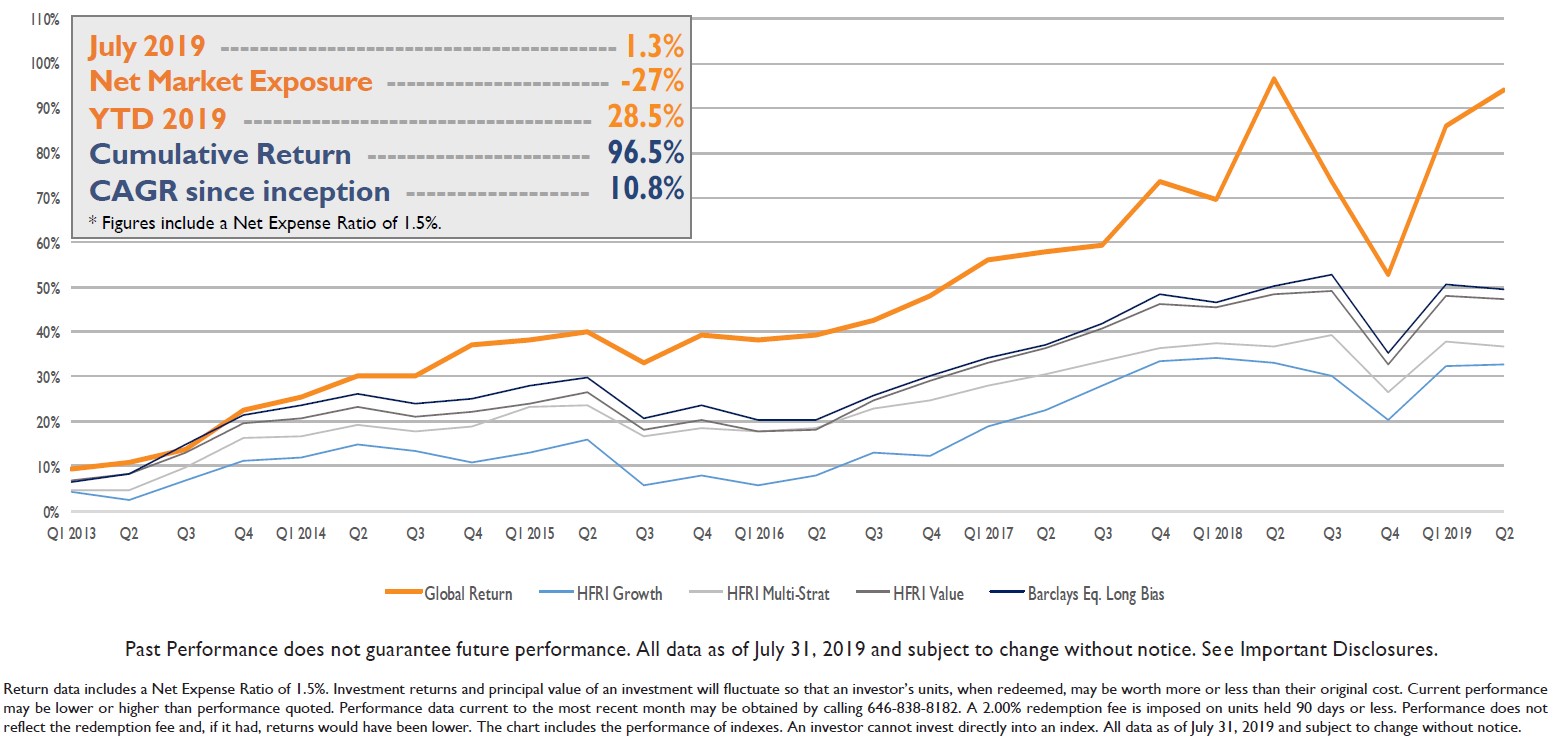

Global Return Asset Management July 2019 Commentary: Trade War Will Have Zero Impact On This Company

Carl Icahn Issues Open Letter To Occidental Petroleum Stockholders

We Went Through A Massive Amount Of Q2 Hedge Fund Letters Here Are The Most Notable Positions

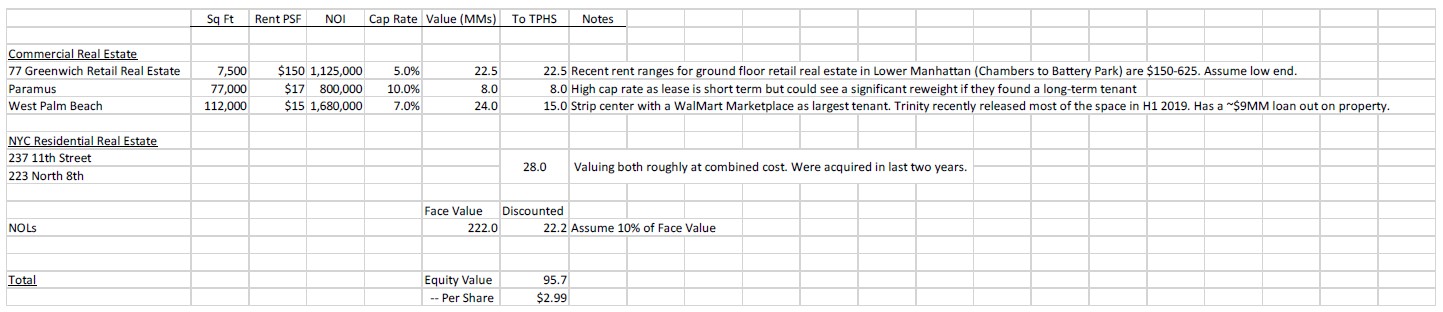

McIntyre Partnerships 2Q19 Commentary: Long This Micro-Cap Real Estate Stock

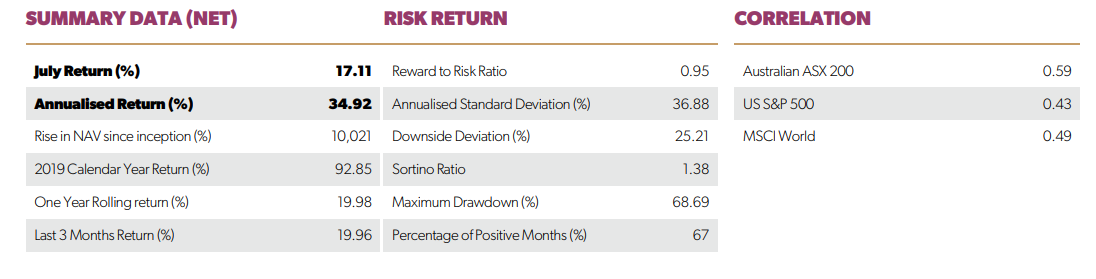

This Hedge Fund Is Up Nearly 100% YTD

Lee Ainslie’s Maverick Capital Outlines Indian Bank Longs

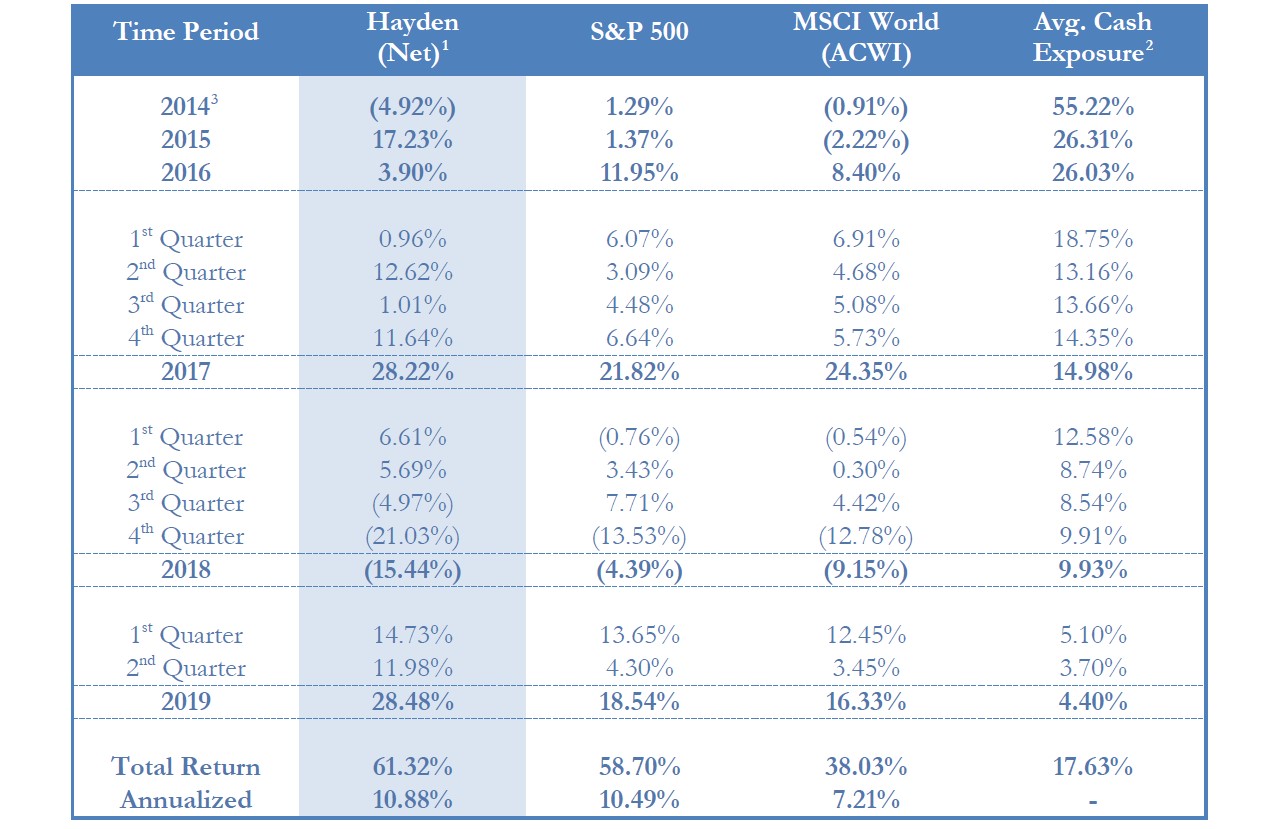

Hayden Capital 2Q19 Commentary: “Good” Vs “Bad” Business Model

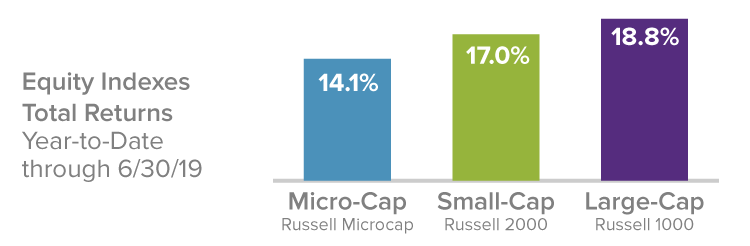

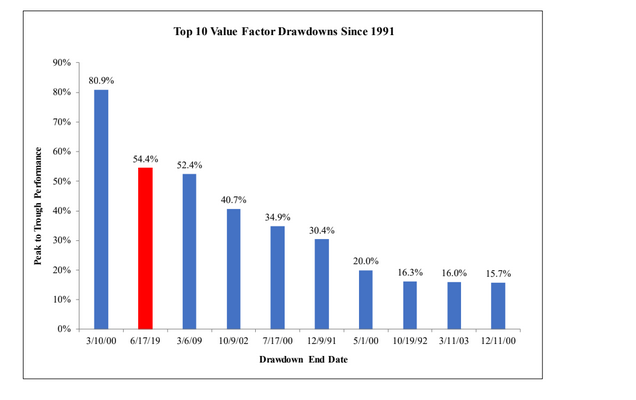

The Hidden Appeal Of Small-Caps And Cyclicals

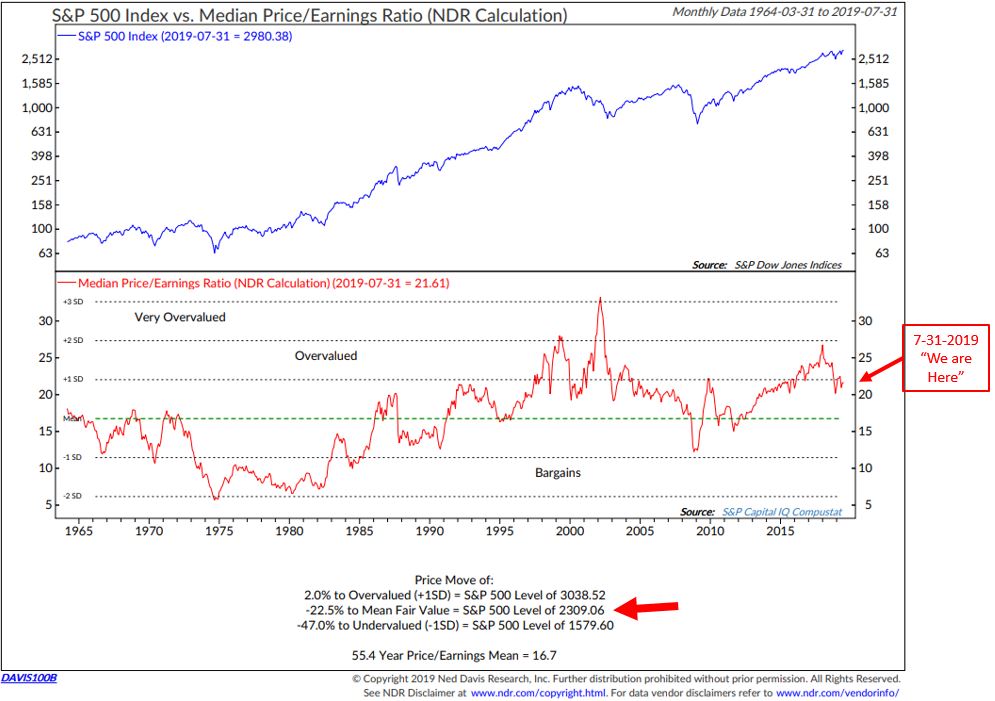

Valuation Dashboard Alarming Signs

Black Bear Value Fund July 2019 Performance Update

Maverick Capital’s Lee Ainslie’s Predicts The End Of The Cycle Soon As He Warns Of Major Crash

This Growth Hedge Fund Is Up An Impressive 31 Percent Through July

Hedge Fund With 2.56 Sharpe: Wall Street Has Gone Mad: “Bad News Cheered, Good News Makes Investors Nervous”

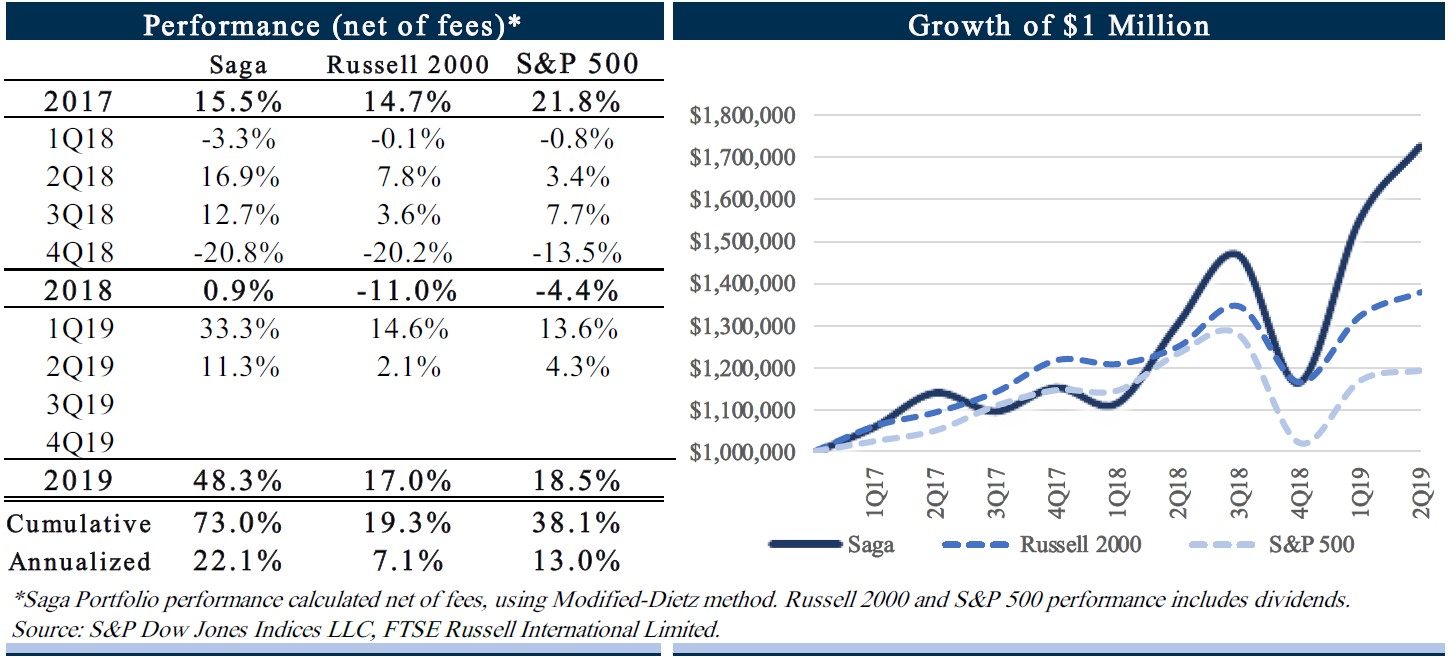

SAGA Partners 2Q19 Commentary: Long Trade Desk, Inc.

Greenhaven Road Capital 2Q19 Commentary

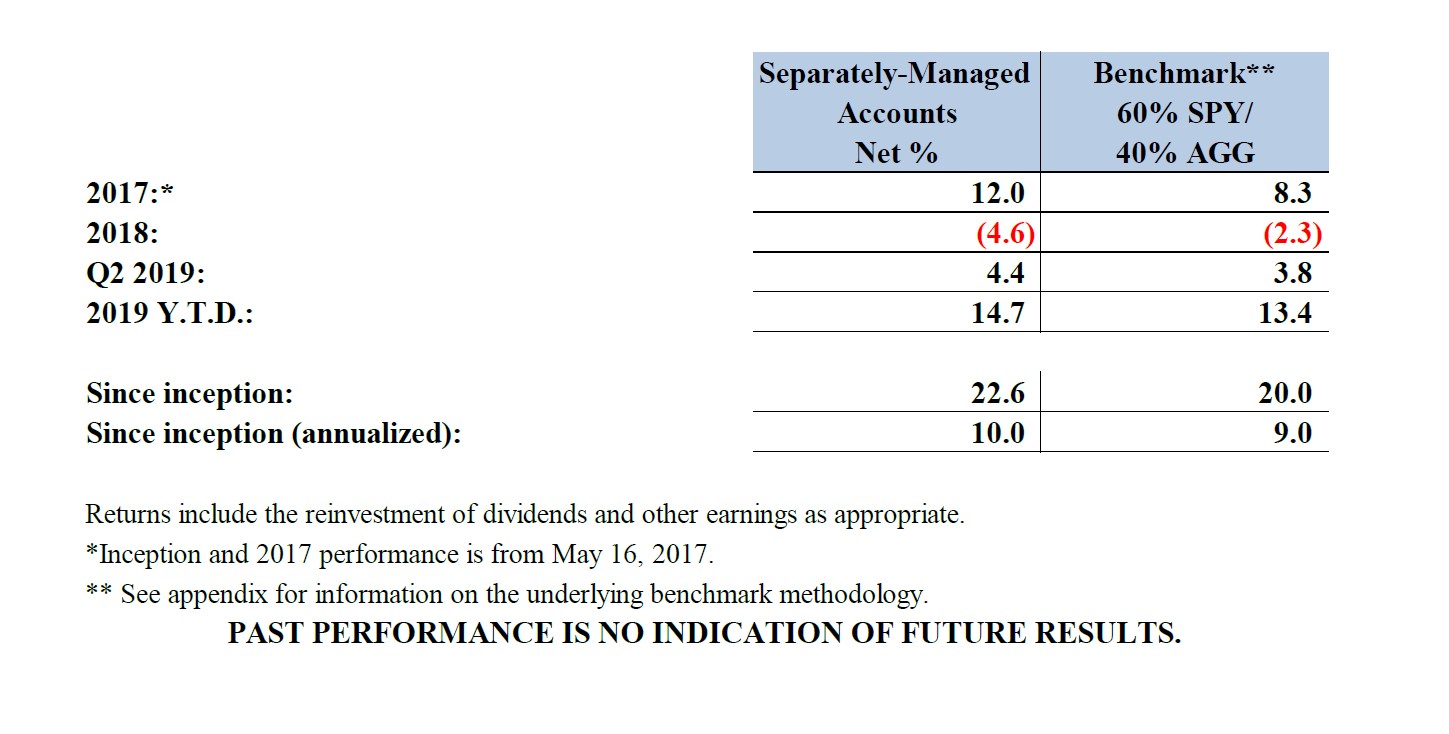

Barac Capital Management 2Q19 Commentary