Don’t trust analysis from managers that shows they have outperformed an appropriately selected, passive benchmark. That is true for mutual funds, and new research shows it is equally accurate when it comes to endowments and pension funds.

Q3 2022 hedge fund letters, conferences and more

My October 22, 2021, article for Advisor Perspectives, “How Mutual Funds Mislead Investors,” provided the evidence demonstrating that mutual funds routinely select benchmarks that provide them with the greatest degree of performance, even to the extent of switching benchmarks if a different one will boost their performance. Kevin Mullally and Andrea Rossi, authors of the July 2021 study, “Benchmark Backdating in Mutual Funds,” on which the article was based, analyzed whether fund sponsors took advantage of this flexibility to mislead investors. Their data sample covered actively managed funds over the 13-year period 2006-2018. Their findings led them to conclude that “the information some funds present to investors about their relative performance does not appear to be reliable.” Sadly, demonstrating their naivete, investors rewarded funds for backdating their past performance – funds that changed their benchmarks received positive abnormal flows in the next five years.

Unfortunately, mutual funds are not the only institutions that mislead investors via their choice of benchmark. Just like mutual funds, public pension plans and endowments are allowed to use benchmarks of their own choosing, typically referred to as custom or strategic benchmarks. This freedom allows them to exhibit significant benchmark bias – they do not have to choose a passive benchmark (such as an index or index fund) that best presents the exposures and risk characteristics of their actual investments. Instead, they can choose benchmarks that are more easily outperformed.

Richard Ennis, author of the October 2022 paper “Lies, Damn Lies and Performance Benchmarks: An Injunction for Trustees,” demonstrated that “most institutional investors, such as public pension funds and endowments, report their performance using biased benchmarks. The benchmarks are biased downwardly, meaning their returns tend to be less than a fair one for the market exposures and risk exhibited by the institutions’ portfolios.”

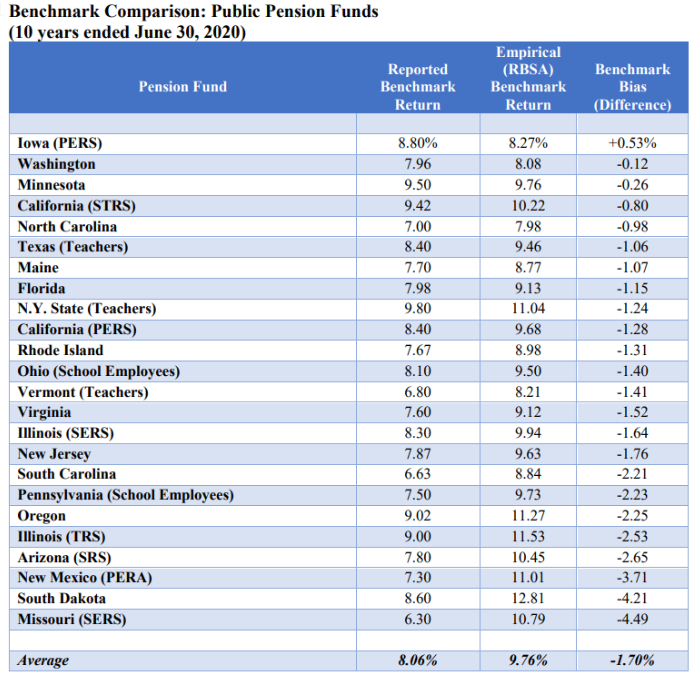

Benchmark bias of public pension plans

Using returns-based style analysis, Ennis found that while the 24 public pension plans he studied reported outperforming their custom benchmarks by an average of 0.4 percentage points per year for the decade, 19 of the 24 exhibited bias of greater than 1 percentage point, and one exhibited benchmark bias of nearly 4.5 percentage points. The average bias was 1.7 percentage points per year. This bias enabled a sizable majority to report outperforming their chosen benchmarks when, in fact, most underperformed an appropriate passive-management benchmark by a wide margin. Ennis noted: “Benchmark bias is significant and pervasive.”

Read the full article here by Larry Swedroe, Advisor Perspectives.