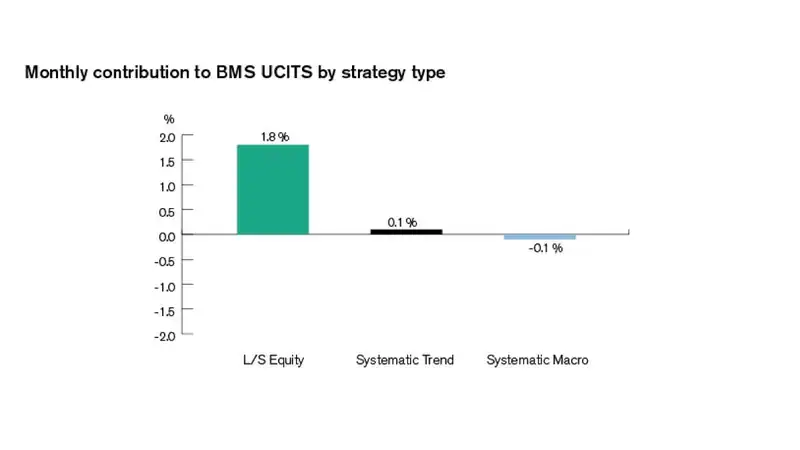

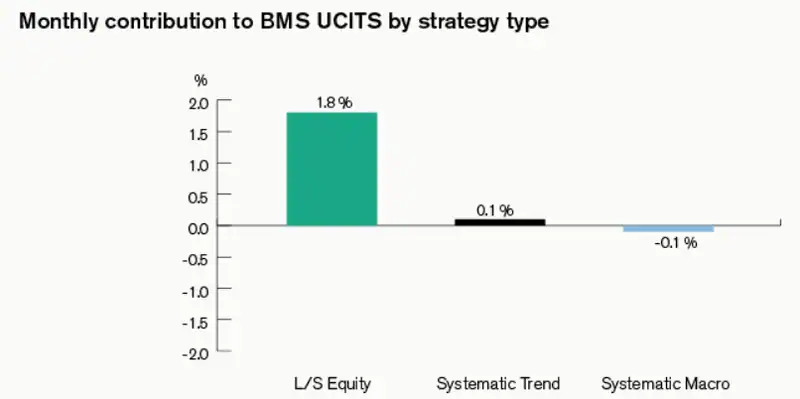

In its December report, the Multi-Strategy fund from Brummer reported a 1.5% gain, bringing the yearly performance to 13.2%. Currently, the strategy has $3.1 billion in assets under management, and it has generated a 7.94% annualized return since inception in 2020.

Monthly Market Commentary

With the year ending, every major market had a theme that came to the forefront. In the US, investors expected an equity market rally, which was at the beginning pushed by large tech names. In mid-month, the trend halted. AI companies reported significant expenditures and low margins. Large US indices stayed mostly flat despite a sell-off. Lower inflation and interest rate cuts supported this trend.

On the other hand, the manager noted a more positive discourse in the equity markets in Europe. Both continental Europe and the UK reported strong figures. The expanding banking sector and underinvestment in the AI theme drove the trend. Hand in hand came strong capital positions and interest rates higher than in the US.

Also see: Brummer Multi-Strategy Delivers Up 4% In October As Long/Short Equity Defies Headwinds

Equity markets in Asia had a mixed performance during the month. Conversely, Japan and its market struggled with increased volatility, which caused a downturn. However, by the end of the month, with announcements of rate increases, the market rebounded. It finished the year almost flat. In contrast, the Chinese market underperformed. Deflationary producer prices and falling demand drove the decline.