Black Bear Value Fund performance update for the month ended August 31, 2019.

Q2 hedge fund letters, conference, scoops etc

Dear Partners and Friends,

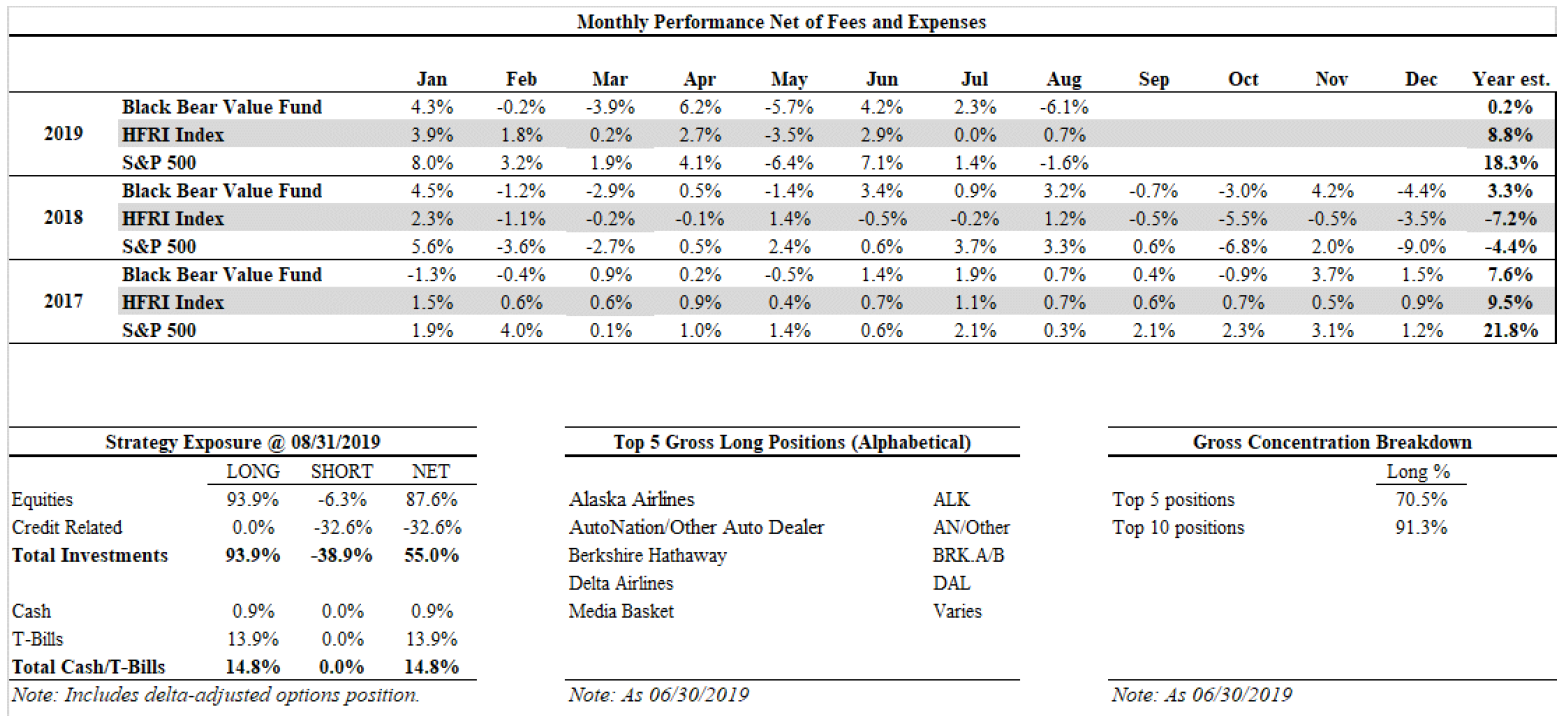

- The Fund returned -6.1%, net, in August. YTD +0.2%, net.

- The S&P 500 returned -1.6% in August. YTD +18.3%.

- The HFRI index returned +0.7% in July. YTD +8.8%.

Some of our central themes (namely media) dramatically under-performed various indices. As prices dropped, the risk/reward became favorable so I bought a lot more. This means we are increasingly concentrated in some prior mentioned themes. Short-term fear/gyrations are our friend despite the short term mark-to-market pain. Q3 letter will discuss more. Your CIO (me) has added to our existing investment in Black Bear...