Alluvial Fund's commentary for the fourth quarter ended December 31, 2025.

Dear Partners,

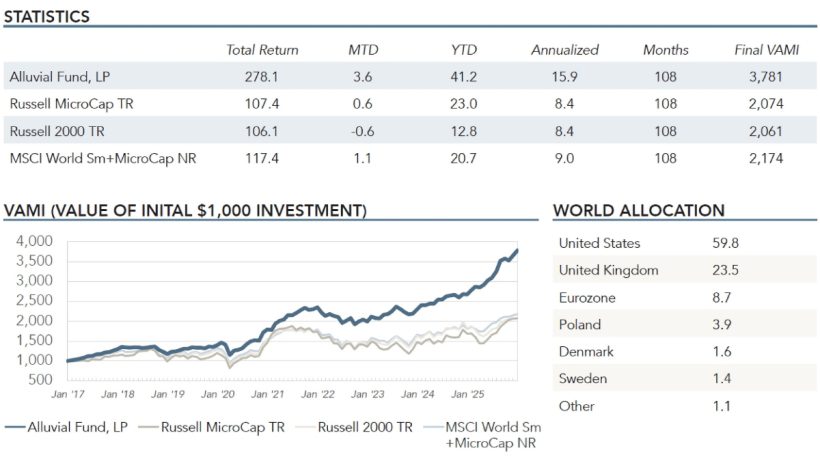

What a year. I am pleased to report that after a strong fourth quarter, Alluvial Fund finished up 41.2%, making 2025 the best year in our fund’s nine-year existence. It was one of those rare years in which nearly everything we owned did well. The market backdrop was supportive with most indexes producing healthy gains. However, these gains were heavily concentrated in a small set of companies: big tech, artificial intelligence plays, and anything in the AI value chain. The sources of Alluvial Fund’s returns could not be more different. We earned our money in laundry soap, canned corn, mid-tier shopping malls, air conditioning, useful rocks (limestone and cement), and widget distribution. Oh, and by selling mobile and internet service in Spain. More on that one in a bit.

On one hand, returns are returns. On the other, I like that our returns came largely from boring companies in defensive industries. It is still possible to make money using plain vanilla value investing principles and ignoring the market’s shiny objects. There is a lot of discussion on the topic of whether the AI industry is in a bubble. I don’t have a particular view, believing the answer depends greatly on the time horizon in question, but I do sleep well knowing that if the answer is “yes,” the ensuing washout will likely have limited impact on our portfolio besides the general effects any broad economic slowdown would have.

I cannot promise that this year’s returns will look anything like the last, but I do commit to spending each day looking for opportunities. I am confident that our portfolio represents a collection of good quality, deeply undervalued companies. I greatly appreciate your willingness to entrust your capital to Alluvial, and I will do all I can to deliver in 2026 and beyond.