Alluvial Fund commentary for the month ended February 29, 2020, providing a company profile on Detroit Legal News.

Dear Partners and Colleagues,

Q4 2019 hedge fund letters, conferences and more

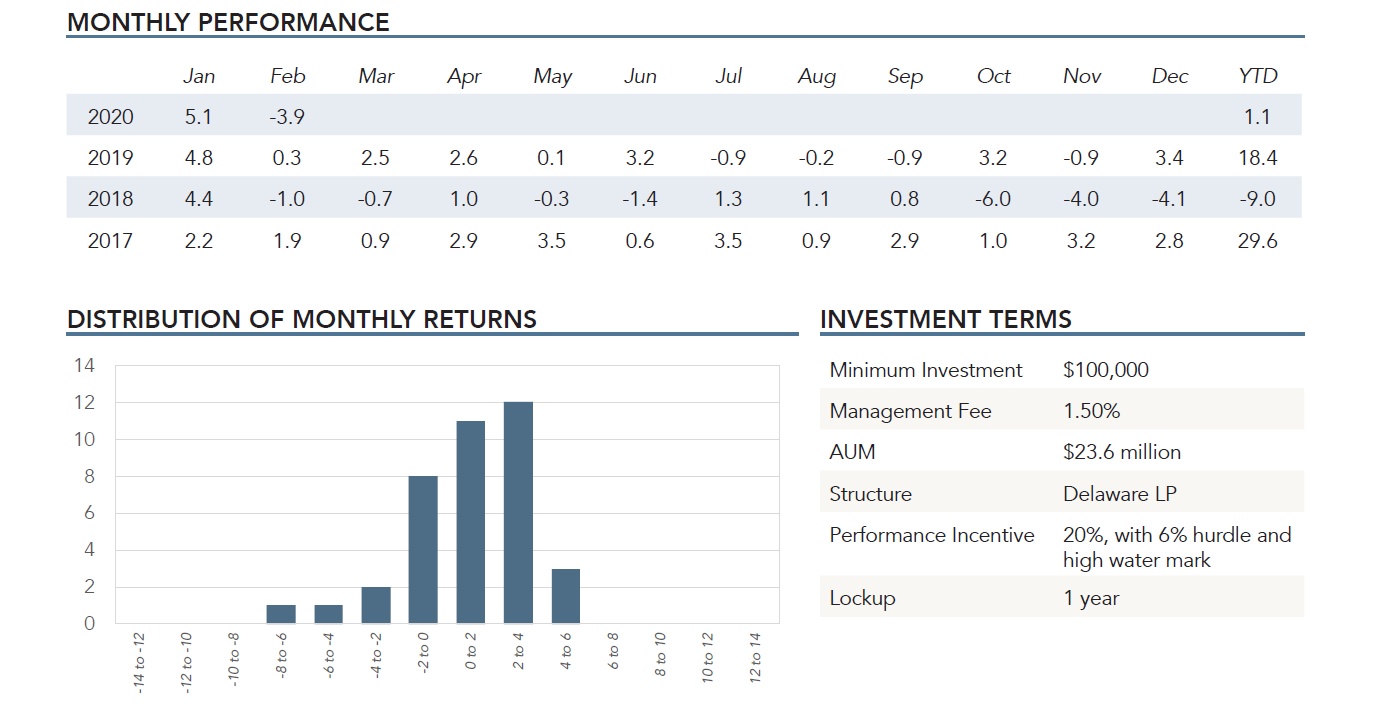

Alluvial Fund, LP returned -3.9% in February, compared to -8.2% for the S&P 500 and -8.4% for the Russell 2000. Year-to-date, Alluvial has returned 1.1% versus -8.3% for the S&P 500 and -11.4% for the Russell 2000. Since inception, Alluvial Fund, LP has returned 41.2% compared to 40.5% for the S&P 500 and 13.3% for the Russell 2000.

Alluvial Fund, LP is a value investing partnership with a focus on small companies and obscure securities, both domestic and international.