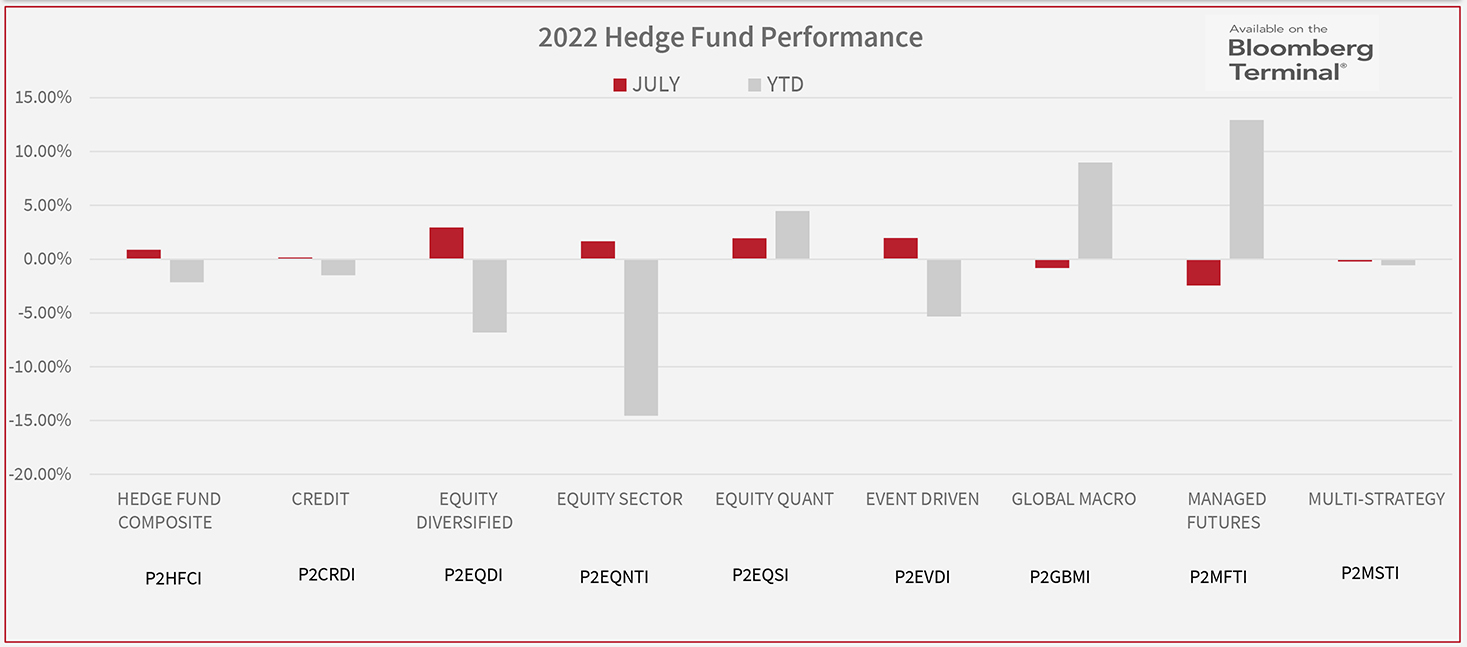

PivotalPath has released their monthly report, the Pivotal Point Of View, which measures performance among more than 2,500 institutionally-relevant hedge funds, as well as 40+ different hedge fund strategies and $2.5T in total industry assets. The big takeaway as we head into late summer: a reverse in growth, which has lagged the value sector throughout this year.

Read more hedge fund letters here

Below are a few quick highlights.

- While Value has outperformed Growth this year, July saw the reverse with a recovery of growth sectors. PivotalPath’s FAANG, Mobile Payments and Food Delivery baskets were among the strongest performers in July: +16%, +19%, and +15%, respectively. Additionally, volatility also declined in July as the VIX was down 25% to 23.87.

- Cryptocurrencies recovered in June with the Bloomberg Galaxy Crypto Index rising 44%. The index is now down 54% for the year.

- Internationally, China declined with the CSI 300 giving back its June gains, declining 7%. The Hang Seng declined 10% and is now down 16% for the year. Euro Stoxx 50 gained 7.3% and is now down 13.7% for the year.