Buying the S&P 500 is a perfectly acceptable investment strategy for the average investor, Mohnish Pabrai noted in his August 2020 presentation to investors reviewed by Valuewalk, of the Junoon Zero fee funds.

Q2 2020 hedge fund letters, conferences and more

However, he went on to state that at least one-third of the index is "presently overvalued" while as much as 20% "may be in bubble territory."

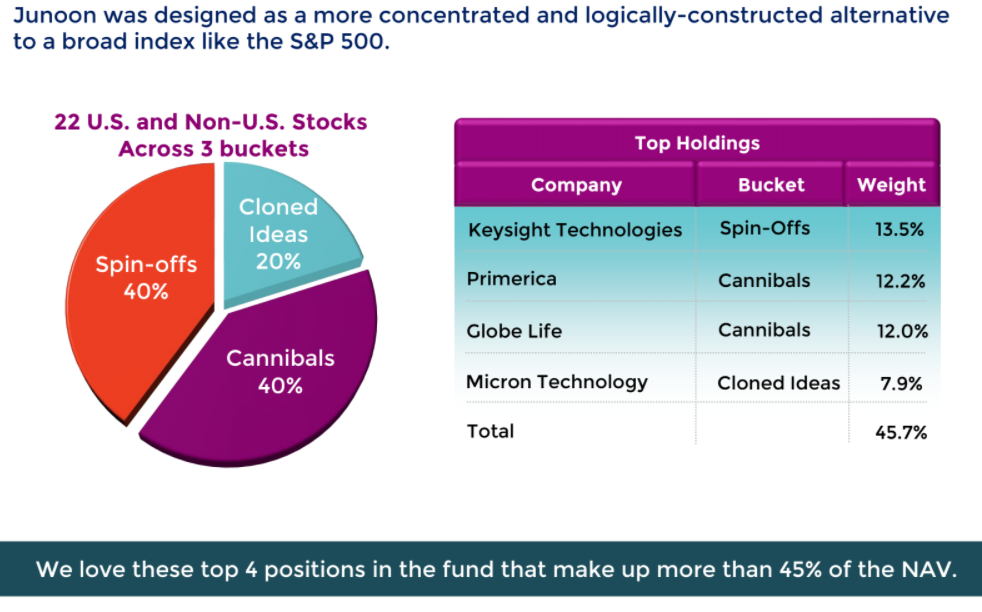

As a result, Pabrai declared in his presentation that the Junoon funds might be a "good alternative or supplement" to the S&P 500.

A "Good Alternative or Supplement"

Pabrai has tried to replicate the Buffett partnerships of the 1950s fee structure to reduce costs and improve performance for investors of the Junoon funds. 25% of...