After years of the some of worst asset classes going up nonstop, do fundamentals matter now?

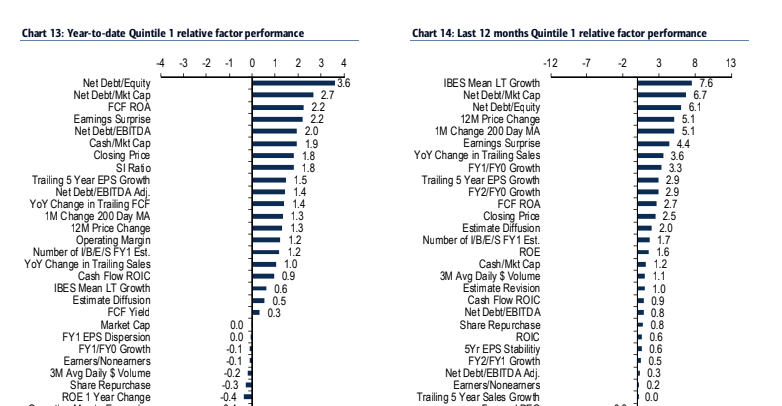

March was an up and down market for small-cap stocks. The Russell 2000, for instance, started the month near 1507, quickly climbed to 1601 in 12 days, then gave it all back to start April near 1492. In this type of maniacal market, how did small cap factors perform?

Amid heightened if not historical volatility, the place for small-cap investors to find at least a degree of comfort in March was Quality stocks, the best performing factor group within the small-cap universe.

Quality has been traditionally one of the more complicated factors to define. A