ETFGI reports global ETFs industry gathered net inflows of 42.46 billion US dollars during July 2022.

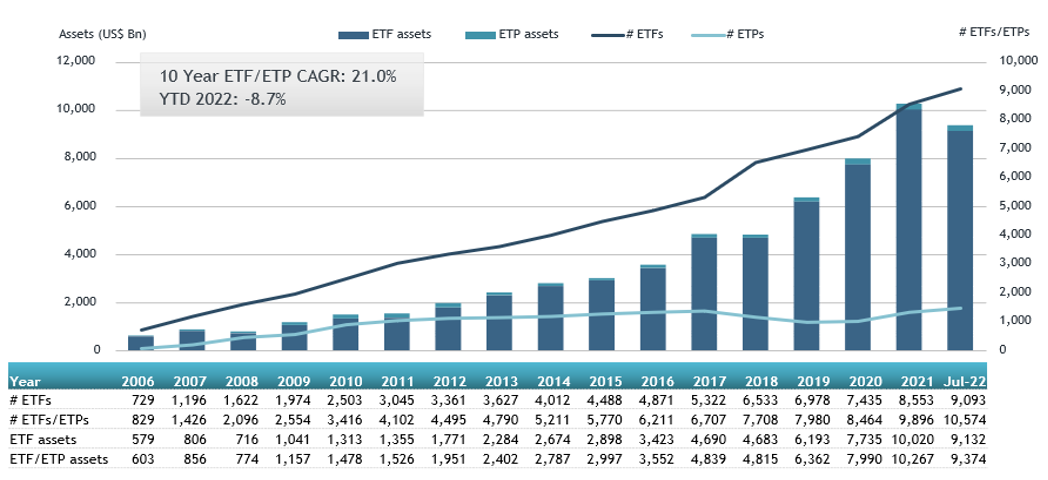

LONDON —August 15, 2022 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today global ETFs industry gathered net inflows of US$42.46 billion during July, bringing year-to-date net inflows to US$505.79 billion. During July 2022, assets invested globally in the ETF/ETP industry increased by 5.9%, from US$8.86 trillion at the end of June to US$9.37 trillion, according to ETFGI’s July 2022 global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Q2 2022 hedge fund letters, conferences and more

Highlights

- Net inflows of $42.46 Bn into the global ETFs industry during July.

- YTD net inflows of $505.79 Bn are the second highest on record, after YTD net inflows in 2021 of $739.57 Bn.

- 38th month of consecutive net inflows.

- Assets of $9.37 Tn invested in global ETFs industry at the end of July 2022.

- Fixed Income ETFs and ETPs listed globally saw $31.22 Bn in net inflows in July 2022.

“The S&P 500 increased by 9.22% in July but is down 12.58% YTD 2022. Developed markets excluding the US increased by 5.32% in July but are down 15.84% YTD 2022. Sweden (up 12.13%) and Netherlands (up 9.64%) saw the largest increases amongst the developed markets in July. Emerging markets decreased by 0.40% during July and are down 16.46% YTD in 2022. Pakistan (down 16.59%) and China (down 8.77%) saw the largest decreases amongst emerging markets in July, while Chile (up 12.24%) and India (up 9.14%) saw the largest increases.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of July 2022

Global ETFs industry had 10,574 products, with 21,818 listings, assets of $9.37 Tn, from 644 providers listed on 80 exchanges in 63 countries at the end of July.

During July, ETFs/ETPs gathered net inflows of $42.46 Bn. Equity ETFs/ETPs gathered net inflows of $11.83 Bn during July, bringing YTD net inflows to $289.81 Bn, lower than the $511.79 Bn in net inflows equity products had attracted at this point in 2021. Fixed income ETFs/ETPs accumulated net inflows of $31.22 Bn during July, bringing net inflows for the year through July 2022 to $116.60 Bn, lower than the $133.15 Bn in net inflows fixed income products had attracted at the end of July 2021. Commodities ETFs/ETPs reported net outflows of $10.87 Bn during July, bringing YTD net inflows to $2.97 Bn, higher than the $6.13 Bn in net outflows commodities products had reported year to date in 2021. Active ETFs/ETPs attracted net inflows of $8.22 Bn over the month, gathering YTD net inflows of $71.41 Bn, lower than the $88.97 Bn in net inflows active products had reported YTD in 2021.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $41.23 Bn during July. iShares US Treasury Bond ETF (GOVT US) gathered $4.77 Bn, the largest individual net inflow.

Top 20 ETFs by net new inflows July 2022: Global

| Name |

Ticker |

Assets |

NNA |

NNA |

|

| iShares US Treasury Bond ETF |

23,041.64 |

8,154.68 |

4,772.77 |

||

| Vanguard S&P 500 ETF |

VOO US |

271,258.78 |

29,475.63 |

4,173.78 |

|

| iShares 20+ Year Treasury Bond ETF |

TLT US |

24,868.55 |

9,415.77 |

4,134.88 |

|

| iShares iBoxx $ Investment Grade Corporate Bond ETF |

LQD US |

35,754.83 |

1,938.26 |

3,318.00 |

|

| iShares Core S&P 500 ETF |

IVV US |

302,751.94 |

13,458.81 |

2,388.81 |

|

| iShares 10-20 Year Treasury Bond ETF |

TLH US |

4,667.80 |

3,471.37 |

2,203.05 |

|

| Hwabao WP Cash Tianyi Listed Money Market Fund |

511990 CH |

22,566.65 |

933.96 |

1,751.58 |

|

| Invesco QQQ Trust |

QQQ US |

174,303.63 |

2,141.07 |

1,722.92 |

|

| Vanguard Total Stock Market ETF |

VTI US |

267,116.66 |

14,364.86 |

1,671.58 |

|

| iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

15,392.31 |

(4,595.01) |

1,604.19 |

|

| SPDR Bloomberg Barclays High Yield Bond ETF |

JNK US |

8,080.98 |

(624.56) |

1,530.23 |

|

| iShares 7-10 Year Treasury Bond ETF |

IEF US |

21,616.61 |

5,487.47 |

1,463.38 |

|

| iShares MSCI EAFE Growth ETF |

EFG US |

10,133.05 |

(756.29) |

1,415.23 |

|

| iShares MSCI USA Min Vol Factor ETF |

USMV US |

28,645.33 |

830.55 |

1,357.72 |

|

| ProShares UltraPro Short QQQ |

SQQQ US |

4,225.73 |

2,209.87 |

1,348.66 |

|

| Vanguard Growth ETF |

VUG US |

77,124.52 |

6,166.44 |

1,318.22 |

|

| iShares Broad USD High Yield Corporate Bond ETF |

USHY US |

8,300.99 |

365.91 |

1,316.47 |

|

| China Southern CSI 1000 ETF – Acc |

512100 CH |

1,542.10 |

1,424.85 |

1,310.23 |

|

| iShares Core S&P Small-Cap ETF |

IJR US |

67,819.42 |

1,123.55 |

1,304.23 |

|

| JPMorgan Equity Premium Income ETF |

JEPI US |

11,690.54 |

6,510.80 |

1,127.84 |

The top 10 ETPs by net new assets collectively gathered $2.05 Bn over July. ProShares Ultra VIX Short-Term Futures (UVXY US) gathered $694 Mn, the largest individual net inflow.

Top 10 ETPs by net new inflows July 2022: Global

Investors have tended to invest in Fixed Income ETFs/ETPs during July.