We often get questions about China’s foreign reserves. The fear is that China’s massive “pile” of foreign exchange reserves is a risk factor for U.S. markets. In the first part of this report, we will discuss the evolution of foreign reserves from gold to the dollar, with a historical focus. In Part II, we will use the macroeconomic saving identity to analyze the economic relationship between China and the U.S. In Part III, using this analysis, we will discuss the likelihood that China will “dump” its Treasuries and potential repercussions if it were to do so. From there, we will examine the impact of such a decision by China to reallocate its reserves. Finally, as always, we will conclude with market ramifications.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

Foreign Reserves

Until August 15, 1971, the foreign financial system rested, to varying degrees, on gold. However, the gold standard had been eroding since the end of WWI. Political philosophers such as David Hume noted the “price-specie” relationship; essentially, wealth didn’t necessarily reside in the accumulation of gold. In nations that acquired gold from American colonies, the end result was mostly higher prices. As the money supply rose, if there wasn’t a commensurate rise in the supply of goods, the end result was inflation.

Early classical economists used this line of thought to attack the dominant trade theory of the day, mercantilism. Mercantilism rested on the idea that the accumulation of money (specie) was an unalloyed good. Mercantilism argued that the strength of the nation was determined by the amount of money (specie or precious metals) it had. Thus, the country should try to run a trade surplus to accumulate specie.

The theory suffers from the “error of composition” logic. This error assumes that what is correct on a small scale is equally correct on a larger scale. For example, accumulating cash is a good outcome for a household or business. But for the economy as a whole, accumulating cash when the economy’s productive capacity is fully engaged merely leads to higher prices.

Instead, in practice, the gold standard for international trade was mostly self-regulating. As a country ran a trade surplus, it accumulated gold; assuming it was operating under full employment of resources, prices would rise. As prices rose, goods for export would become less competitive and thus less attractive for foreigners. At the same time, in the deficit nation, the lack of specie would cause the opposite effect. Prices would decline, making export goods more attractive to foreign buyers. The combined effect would lead to a reversal in trade flows and an eventual reversal in specie flows as well. As the deficit nation moved toward surplus, gold would flow to that nation, lifting prices. And, as gold left the surplus nation, prices would begin to fall. Essentially, under the gold standard, foreign trade became self-regulating.

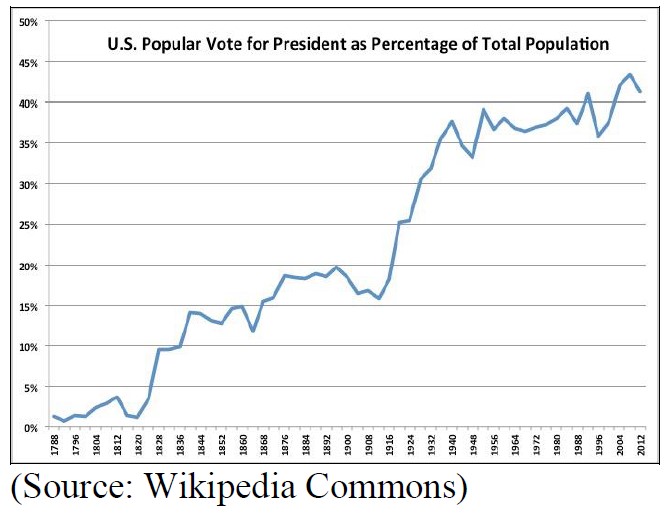

So, if it worked, why didn’t the gold standard continue? The spread of democracy was the primary reason. Although many Western nations considered themselves democracies, in reality, suffrage was restricted well into the early 20th century. In reading the thoughts of the Founders of the American Republic (Federalist and Anti-Federalist papers, for example), there was great concern over unrestricted democracy. The Founders worried about “mob rule” and constructed mechanisms to reduce the impact of direct democracy. The Electoral College remains as a vestige of these concerns. Senators were selected by state legislators until the passage of the 17th Amendment in 1912; after the passage of this amendment, voters elected senators. Women were not allowed to vote across the country until the 19th Amendment was passed in 1920. Although the 15th Amendment made it illegal to restrict the right to vote based on race, color or creed, the ability of African-Americans to vote in the U.S. was not fully resolved until the 1965 Voting Rights Act.

This chart shows the number Americans voting for president as a percentage of the total population. Until 1820, under 5% of the population elected the president. Even into WWI, the percentage was under 20%. It appears the gold standard became difficult to maintain once that 20% threshold was broken.

For the gold standard to function, the costs of adjustment generally fall on labor and debtors. Deflation usually leads to falling wages and raises the real cost of debt service. Until the end of WWI, Western nations tended to use the gold standard because the political power of those adversely affected by it was limited.1 Once suffrage expanded, the groups adversely affected by the gold standard would no longer support politicians who fostered such policies.

Even the Bretton Woods system was not a pure gold standard. Instead, it was a “dollar/gold” standard. The world used the dollar for trade but could redeem those dollars for gold at a rate of $35 per ounce. This gave foreigners comfort that the U.S. had some constraints on policy that would protect the value of their reserves. However, the link wasn’t as rigid as a pure gold standard because exchange rates were fixed. So, a nation with excess dollars had few alternatives other than gold, which offered no interest payments, unlike dollar assets.

The reserve currency problem was best defined by Robert Triffin, a Belgian-American economist who noted that the reserve currency nation had to run trade deficits in order to foster global growth. But, if the trade deficits become large enough, foreigners may lose faith in the reserve currency. If the reserve currency nation takes steps to reduce the trade deficit, usually through austerity measures, the global economy will suffer from a contraction of the money supply. Eventually, according to Triffin, either the reserve currency will become suspect due to excessive supply or taking steps to bolster confidence in the currency will lead to weaker global growth.

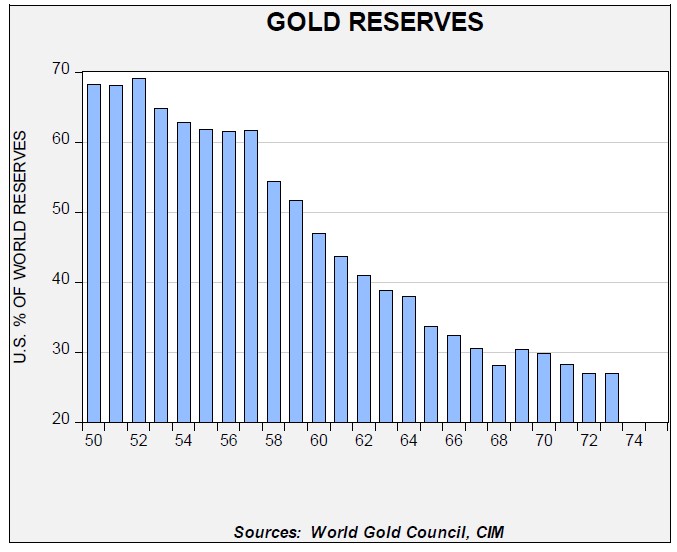

Triffin’s prediction became evident by the early 1970s. France was demanding gold in lieu of dollars and the gold supply was shrinking rapidly.

This chart shows U.S. official gold reserves as a percentage of global reserves. In the early 1950s, U.S. gold reserves represented about 70% of the world total. By 1971, it was down to 28% and the trend was declining.

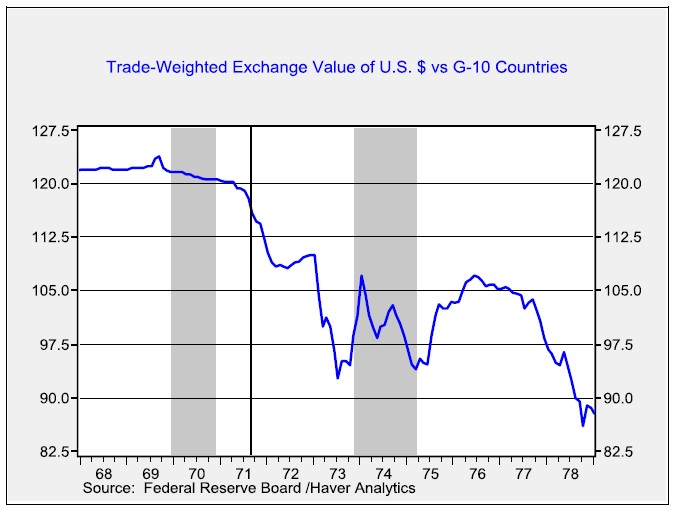

By 1971, President Nixon was faced with a difficult choice. To maintain the Bretton Woods system, he needed to implement austerity—increase taxes, lower spending and/or support tight monetary policy from the Federal Reserve. Such policies are never politically popular and Nixon was in the process of trying to win re-election. So, instead of austerity Nixon opted to close the gold window. No longer would dollar holders be able to swap for gold at $35 per ounce.

Nixon also allowed the dollar to float; it rapidly depreciated. The chart below shows the dollar index, trade weighted, against the G-10 currencies. The date of the “Nixon shock” is shown by a vertical line on the chart. From that point until the trough in mid-1973, the dollar depreciated by 21.4%.2

Despite the policy shift and subsequent depreciation, no other currency was a strong contender for reserve currency status. Instead, the world financial system shifted from a “dollar/gold” system to a “dollar/Treasury” system. In other words, nations held U.S. government debt instead of gold.

Why did foreign nations continue to use the dollar for reserve purposes after the link with gold was broken? There were probably two reasons. The world was in the throes of the Cold War and the U.S. was not only the leading economy, but it was the guarantor of security for the free world. Second, no other nation had a large enough economy to rival the U.S. In the absence of a competitor, the world continued to use the dollar for reserve purposes.

The shift means that the international finance system is no longer self-regulating. Although floating exchange rates should create some degree of adjustment, in practice, nations intervened in exchange rates for stability. Consequently, as long as foreigners prefer to use dollars for trade and reserve purposes and the U.S. can continuously run fiscal deficits, then foreign reserves, mostly denominated in U.S. dollars,3 can expand without limit. But…that assumes the U.S. can tolerate running persistent trade deficits without economic or political repercussions. In one sense, the description of the dollar’s reserve status as an “exorbitant privilege” is correct; the U.S. gets goods and services from the world in return for Treasury obligations, denominated in the currency the U.S. Mint prints. At the same time, this means the U.S. faces relentless foreign competition that can reduce employment in those affected industries. It also means that the U.S. has to have a very large financial system in order to manage the inflows. Like most factors in economics, there are costs and benefits to a policy and, politically, there are winners and losers.

Part II

Next week, we will continue this report with a discussion of the macroeconomic identities.

Article by Bill O’Grady of Confluence Investment Management