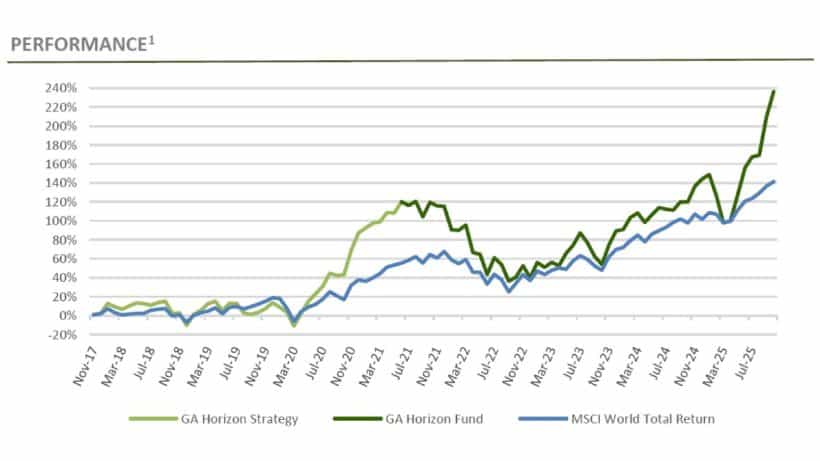

Green Ash Horizon Fund reported an 8.77% return in October, significantly outperforming the MSCI World's 2% return. As a result, the fund’s year-to-date return reached 37.86%.

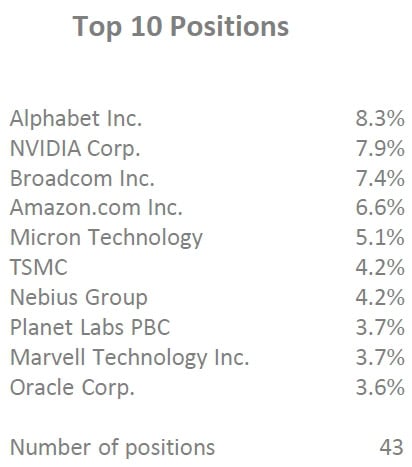

Тop performing themes, according to portfolio manager James Sanders, included AI Semis & Equipment, AI Foundries, Electrification, and AI Beneficiaries. On the detracting side was the Digital Consumer theme.

According to the firm's website Green Ash is a boutique asset manager based in London. We offer liquid strategies in credit, equity, multi asset and alternatives through fund based and managed account solutions

As for the Horizon Fund manager, the website states:

James is a portfolio manager and research analyst at Green Ash Partners. Over his 10+ years at the firm, James has overseen the fundamental analysis underpinning single stock and corporate bond holdings within Green Ash.

October Commentary

Also see: Brummer Multi-Strategy Delivers Up 4% In October As Long/Short Equity Defies Headwinds

The fund's exposure to the 'Magnificent Seven' and its AI-oriented focus drove the majority of upside during October. While the recent announcement of the scale of AI infrastructure plans did cause concern, the manager believes that the capex deployment for 2026 is already planned. Consequently, the manager sees no reason for immediate concern over overweight exposure to this sector.