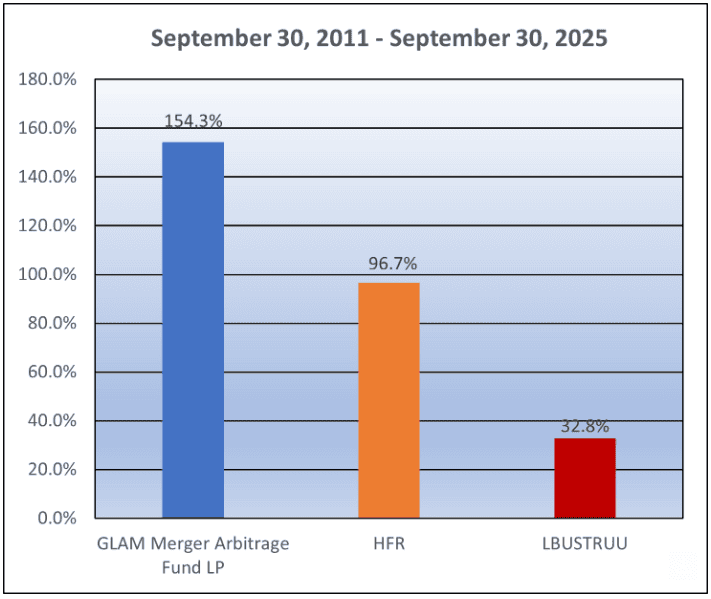

In the latest letter to investors, Gardner Lewis Asset Management released its year-to-date performance for the Merger Arbitrage Fund, which stands at +13.0%. It topped both the HFRI ED Merger Arbitrage Index and the Bloomberg Barclays US Aggregate Bond Index, which rose +8.2% and +6.1% respectively.

The core values of the Merger Arbitrage Fund are that it has low correlation to traditional asset classes, low volatility, and that it exclusively invests in M&A deals. Every deal is viewed from several angles, including strategic, regulatory, financial, and stakeholder perspectives.

In a letter obtained by Hedge Fund Alpha, Gardner Lewis discussed the current trends in the M&A market. In the letter, Gardner Lewis questions whether this surge is temporary or a multi-year shift. Several viewpoints from Goldman Sachs, Morgan Stanley, and Citigroup executives are also discussed. Below, we analyze Gardner Lewis's specific take on why regulatory shifts in 2025 have created a 'restart opportunity' for M&A arbitrage.