DoubleLine Capital LP’s next pair of exchange-traded funds are setting sail into a rocky real estate market.

The DoubleLine Commercial Real Estate ETF (ticker DCMB) and the DoubleLine Mortgage ETF (DMBS) launched Tuesday, according to a press release. DCMB invests in investment-grade commercial mortgage-backed securities, while DMBS — whose management team includes DoubleLine founder Jeffrey Gundlach — holds high-quality residential mortgage-backed securities.

Q1 2023 hedge fund letters, conferences and more

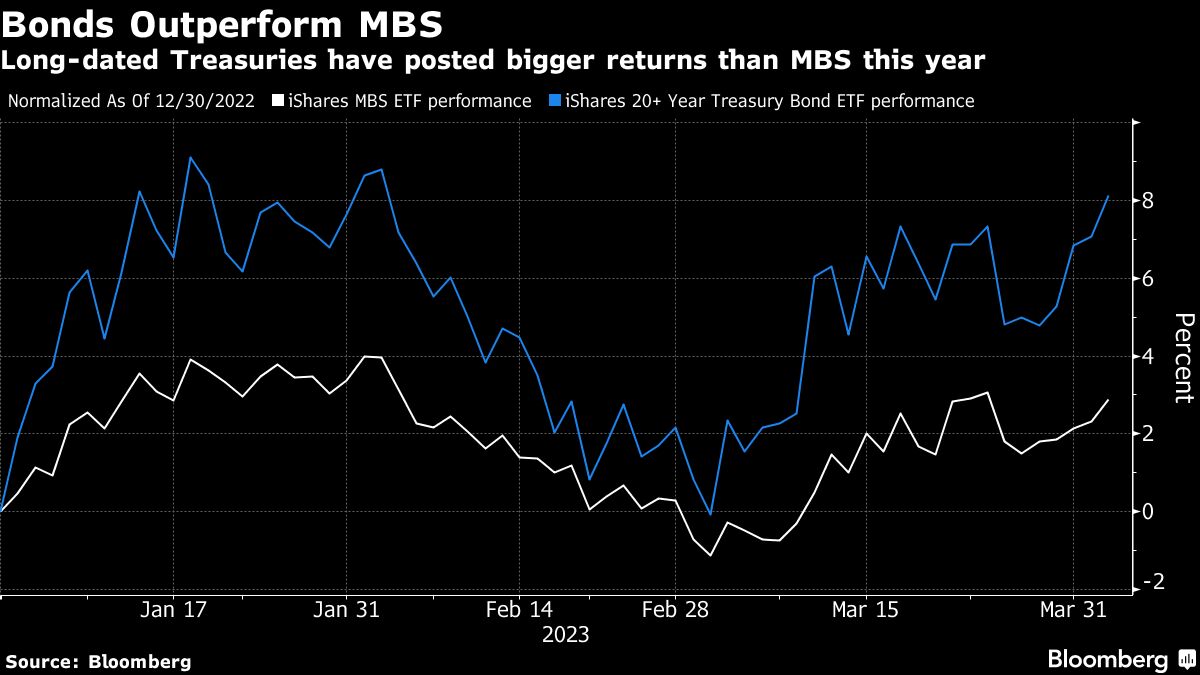

The new funds land at a potentially perilous time. The outlook for commercial real estate has darkened as remote work boosts office vacancies and higher borrowing costs loom for those looking to refinance in the coming year. Meanwhile, though still sitting on gains for the year, MBS underperformed long-dated Treasuries over the past month amid the banking sector turmoil that erupted with the collapse of Silicon Valley Bank and Signature Bank early last month.

Read the full article here by Katie Greifeld, Advisor Perspectives.